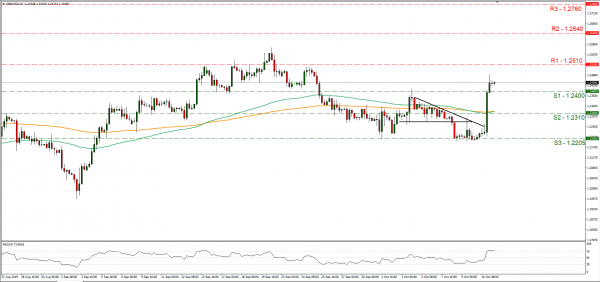

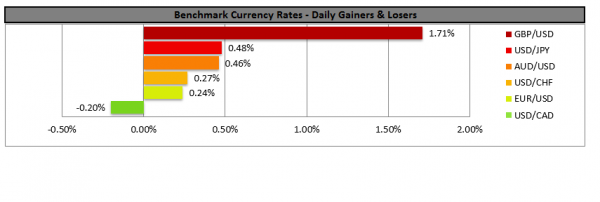

The pound rallied against the USD yesterday, posting one of its strongest daily movements in 7 months, reaching a two-week high. Irish Prime Minister Leo Varadkar stated yesterday, that a Brexit deal could be achieved by the end of October and characterized his meeting with UK Prime Minister Johnson as very positive. The joint statement made by the two Prime Ministers, stated that they had identified the potential pathway for a possible Brexit deal. It still remains unclear, what the possible terms of such an agreement may finally be and intense negotiations may be required, while the uncertainty of such negotiations falling through still exists. We maintain the view that should Irish objections be overcome, we could see Brexit actually finding its way to a solution, as Ireland is considered as a Brexit keyholder. We could see the GBP strengthening should there be further good news about Brexit, and we would not be surprised to see further positive comments coming from Brussels about the issue. Cable rallied yesterday and broke consecutively the 1.2310 (S2) and 1.2400 (S1) resistance lines, now turned to support. We could see the pair rising further today, however some signs of stabilisation started to show during the Asian session. Should the bulls maintain their control over the pair’s direction, we could see it breaking the 1.2510 (R1) resistance line and aim for higher grounds. Should the bears take over, we could see cable breaking the 1.2400 (S1) support line and aim for the 1.2310 (S2) support level. Please note that the RSI indicator in the 4 hour chart has surpassed the reading of 70, implying possibly a rather overcrowded long position.

JPY weakens further as US-Sino negotiations seem positive

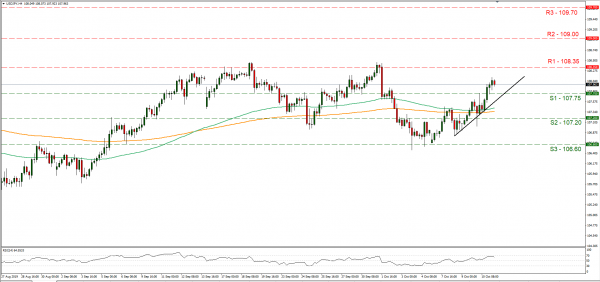

JPY weakened against the USD during today’s Asian session, as hopes for progress in the US-Sino negotiations are rising. US president Trump stated that the China trade talks are “going really well” increasing hopes for progress in the US-Sino negotiations. According to media, also US President Trump is to meet with Chinese Vice president Liu He on Friday, which boosted hopes even further. A White House official said that talks had gone “probably better than expected”, as per media. We could see the US-Sino negotiations ease the tensions between the two countries and possibly delay the planned US tariffs, even without the signing of an interim deal. Should there be more positive headlines about progress today, we could see JPY weakening further, or commodity currencies such as the Aussie strengthening. USD/JPY rose further, breaking the 107.75 (S1) resistance line, now turned to support. We maintain a bullish bias for the pair’s direction and for our bias to change, we would require the pair to break the upward trendline incepted since the 8th of the month. Should the pair find fresh buying orders along its path we could see it breaking the 108.35 (R1) resistance line. Please note that the prementioned resistance level served the pair well on the 17th and 18th of September, as well as the 1st of October, so some difficulties may lay ahead for the pair to actually break it. Should the pair come under the selling interest of the market, we could see it breaking the 107.75 (S1) support line and aim for the 107.20 (S2) support level.

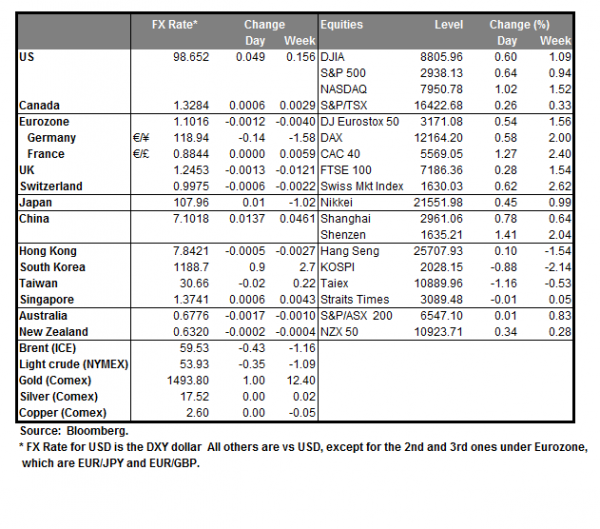

Other economic highlights today and early tomorrow

From today’s financial releases we tend to focus on Canada’s employment data for September and the US U. Michigan preliminary consumer sentiment indicator for October. As for Monday’s Asian session, please be cautious as the release of China’s trade data for September could create volatility in the markets. As for speakers please note that ECBs’ De Guindo’s, Minneapolis Fed President Neel Kashkari, Boston Fed President Eric Rosengren and Dallas Fed President Robert Kaplan are scheduled to speak.

Support: 1.2400 (S1), 1.2310 (S2), 1.2205 (S3)

Resistance: 1.2510 (R1), 1.2640 (R2), 1.2760 (R3)

Support: 107.75 (S1), 107.20 (S2), 106.60 (S3)

Resistance: 108.35 (R1), 109.00 (R2), 109.70 (R3)