The BoC chief, Stephen Poloz, left interest rates at 1.75% this month and at the highest among advanced economies, refraining to follow the dove camp that most of its major counterparts joined to countermeasure the negative spillovers from the US-China trade war. While higher rates keep Canadian bond yields relatively more attractive to investors, Canada’s heavy reliance on exports and commodity prices suggests that the economy could easily take a downturn if the US and China fail to find a common ground in the so-called phase one of their trade deal and instead keep playing the tit-for-tat game.

Inflation and retail sales may not be disappointing after all

Since the trade war is out of Canada’s control, which means that the Canadian economy may be increasingly tested, the central bank will be closely monitoring changes in consumption that remains a source of strength in the economy as fears are growing that weakness in manufacturing and construction activities could spread to domestic demand.

Disappointingly, employment figures released earlier this month signaled that the economy is not on a one-way trip north and that the labor market may be nearing a peak. Even though the unemployment rate remained steady and wages held up, employment growth missed forecasts by a wide margin, declining by 1.8k versus expectations of a 15k increase.

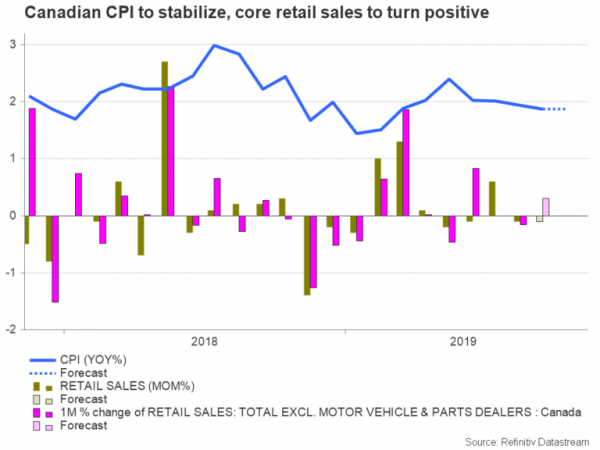

Inflation data on Wednesday could calm these worries if the monthly headline consumer price index returns to the positive area and particularly to 0.3% in October after retreating by 0.4% in September. In yearly terms, the gauge is projected to stabilize at 1.9% and near the 2.0% midpoint of the BoC 1-3% range inflation target, with the core measures (trimmed, common CPI) which exclude volatile items and thus better explain the inflation trend attracting extra attention.

Turning to Friday’s retail sales, projections are for a 0.1% decrease in total. However, with the core component, which excludes motor vehicles and auto parts, projected to post a positive growth of 0.1% m/m after falling by 0.2% previously, the report may not appear so discouraging after all.

Interest rate differentials may challenge central bank

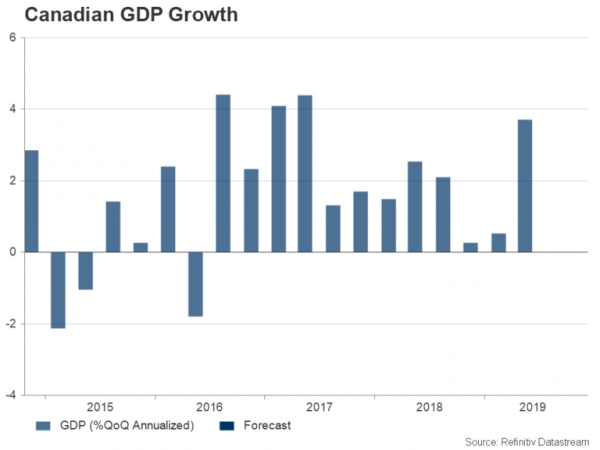

Unless a significant downside surprise occurs, the above data may not call for an immediate rate cut but may still keep alive some expectations for such an action at the next policy meeting on December 4, especially if the rebound in the Q2 GDP growth fails to stretch to Q3 at the end of November. Policymakers, though, are mindful that any delay in rate cuts may add extra footing to the Canadian currency that outperforms its G10 peers year-to-date at a time when other central banks have already triggered the monetary easing process. An appreciation in the loonie would make Canadian exports more expensive in foreign markets and thus harm the export-oriented economy.

Besides the data, remarks by Deputy Governor Carolyn Wilkins this Tuesday and a speech by the BoC chief Stephen Poloz on Thursday are expected to update markets about how willing the central bank is to cut interest rates ahead of the Q3 GDP release and amid the confusing headlines regarding the completion of a phase one trade agreement.

Big surprises in data could only move loonie

As regards the outlook for loonie this week, the Canadian currency is trying to gain ground against the US dollar and only a big surprise in the data could adjust rate expectations and therefore trigger fresh volatility in the market. So markets may be more interesting to hear comments by the BoC chairman this Thursday, while by the end of the month, GDP growth figures could be more informative before December’s policy meeting takes place.

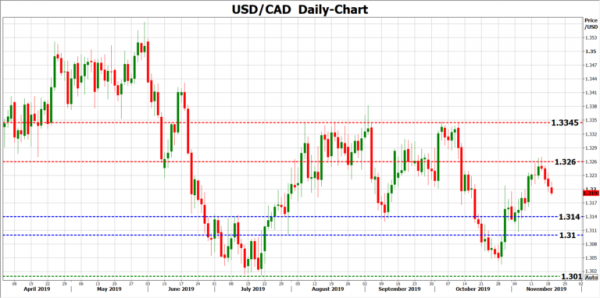

Anyhow, a softer-than-expected inflation rate and a smaller growth in retail sales would flag a bleak start to the fourth quarter, increasing the minimal odds for a rate cut in December. Such a result could help USDCAD to challenge the 1.3260-1.3345 restrictive area. Otherwise

On the other hand, a stronger outcome would reduce the need for monetary easing, with USDCAD probably extending losses towards the 1.3140-1.3100 area.