First, a review of last week’s events:

EUR/USD. Holidays are for people to get distracted for a while from daily problems, plunging into the magic atmosphere of miracle expectation. And miracles happen, and financial markets are no exception, as we have already warned our readers.

In normal times, investors look either towards the riskier stock market, or seek to hide their capital in safe havens, preferring government bonds, gold and safe-haven currencies. But Christmas and New Year are unusual times, and the market is so thin these days that it can be managed even on small volumes. As a result, in the last decade of December, both the S&P500 stock index continues to update historical highs, and gold, along with the yen and the franc, show an impressive growth. And treasury debt obligations are not going to retreat from the won positions. New Year’s miracles, that is! But, as you know, there are much less holidays in the year than working days. And the market returns to its normal state this week.

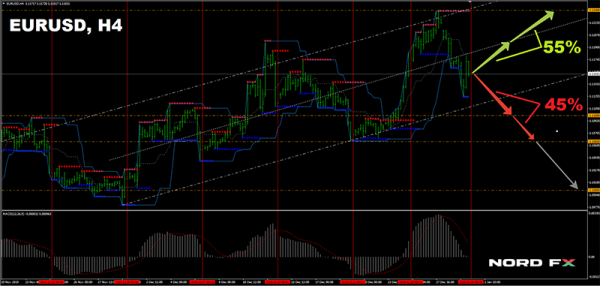

As for EUR/USD, starting from November 29, the pair is slowly moving along the ascending channel. On December 31, it reached its upper limit at 1.1240, and then changed direction, opening the year, 2020, with a gap down. The pair almost got to the bottom of the channel on Friday afternoon January 03, and then the pair returned to the central zone of the channel on a fairly dismal statistics on business activity in the USA (index ISM in manufacturing sector was below expectations and failed to rise above $50) and ended the week in the area of strong support/resistance 1.1160;

GBP/USD. The week’s result of the British pound was close to zero. Starting at 1.3085, it ended the five-day period at 1.3075, losing just 10 points. However, due to its relatively high volatility, it did not deprive traders of the opportunity to profit: its range of fluctuations over these days amounted to more than 230 points;

USD/JPY. In contrast to the pound, which ended the five-day period with almost zero results, safe-haven currencies are growing rapidly against the dollar. Thus, the yen gained almost 135 points against the “American”: starting from the horizon of 109.45, it finished at 108.10;

Cryptocurrencies. The digital asset market, as well as the Forex market, continues to sum up the results of the past year. For example, the online portal ForkLog has compiled a list of the most prominent and influential crypto persons in 2019. The top 10 is headed by the head of the Bitcoin exchange Binance Changpeng Zhao, in the middle of the list is the head of Facebook Mark Zuckerberg and the Telegram creator Pavel Durov, and the top ten is completed by Chinese President Xí Jìnpíng and Ethereum developer Vitalik Buterin.

Bitcoin, despite all the rate hikes, rose by 110% in 12 months, the S&P500 index rose by 22.8%, and gold added 19% over the same period. The result for the reference cryptocurrency, in general, is quite good, but only for those investors who invested in the coin at the beginning of the year, and not in the mid summer. For the latter, a completely different, sad melody sounds.

Now let’s move on to the results of the last week. And here there is nothing to talk about: the same side trend. The pair BTC/USD grows to $7,550 on Dec 29, then drops to $6,900 by 03 January, and then returns to where it started the week in the area of $7,300. In general, it is a complete disappointment for investors. But as for active traders who trade on short timeframes, with a leverage of 1: 50, like with the broker NordFX, the jumps of $650 is a good opportunity to make a profit.

As for the top altcoins, things are also flat here: there is a movement in very narrow side channels with gradual consolidation for a third week running: Ripple (XRP/USD) is around $0.19, Ethereum (ETH/USD) – $130 and Litecoin (LTC/USD) – $42 per coin. The total capitalization of the crypto market has fallen to $190 billion, and Bitcoin Crypto Fear & Greed Index is gradually approaching its neutral position (now it is at 38), which, in fact, also indicates a stagnation in the market.

As for the forecast for the coming week, summarizing the opinions of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

EUR/USD. Last week, we summarized the forecasts given for 2020 by analysts at JPMorgan Chase, Goldman Sachs, Bank of America Merrill Lynch, Deutsche Bank and a number of other global banks. Recall that, in general, they reached a consensus, predicting the fall of the dollar against the euro and the growth of the pair to levels from 1.1400 to 1.2000. The main reason was a slowdown in global economic growth, which should increase demand for riskier assets. Especially so since the US Federal Reserve, on the eve of the presidential election, under pressure from Donald Trump, is likely to continue to reduce interest rates, or at least keep them at the existing level.

However, there is also an opposite opinion, which is again tied to the US presidential election. It is noted that it is during the election years that the US currency shows particularly good results. In such periods over the past 40 years, the USD index declined only twice. But the euro fell in 9 cases out of 11. So, if you focus on these statistics, the dollar should be bought, not sold. Moreover, for Central Banks, it is still the main reserve currency, far ahead of any other assets.

As for the near future, 55% of experts, supported by 85% of indicators on D1, expect the pair to grow to the upper limit of the ascending channel at the level of 1.1240. The next target is 1.1330. The strengthening of the euro over the dollar can be also facilitated by the macroeconomic data, which we will learn next week. So, on Tuesday, January 07, the December value of the ISM business activity index in the service sector will be known, and on Friday, data on the labor market in the United States will be released. And if the number of new jobs outside the agricultural sector (NFP) decreases, according to the forecast, by 40% (from 266K to 160K), this will have a negative impact on the dollar. However, often the market reacts in advance to such predictions, so that immediately at the time of the release of statistics there may not be strong jerks.

In addition to these 55% of bull supporters, there are also 45% of experts who support bearish sentiment. 85% of the indicators on H4 and graphical analysis on the same timeframe side with them. Support levels are 1.1100, 1.1065 and 1.1000;

GBP/USD. The situation with the pound is again confused and depends on how and what happens to the process of leaving the EU. The head of the European Commission, Ursula von der Leyen, expressed concern that there is little time left for negotiations on the UK’s relations with the European Union after Brexit. In her view, the 11-month transition period for negotiations is extremely short and may have to be extended. And her Deputy Frans Timmermans called on the British to immediately return to the bosom of the European family after the divorce.

GBP/USD. The situation with the pound is again confused and depends on how and what happens to the process of leaving the EU. The head of the European Commission, Ursula von der Leyen, expressed concern that there is little time left for negotiations on the UK’s relations with the European Union after Brexit. In her view, the 11-month transition period for negotiations is extremely short and may have to be extended. And her Deputy Frans Timmermans called on the British to immediately return to the bosom of the European family after the divorce.

In the meantime, 60% of experts expect the pair to grow to the upper limit of the channel 1.3050-1.3215. The goals in case of a breakout are 1.3285, 1.3425 and the December 13 high of 1.3515. Graphical analysis, 15% of trend indicators on D1 and the same number of oscillators that give signals about the pair being oversold agree with this development.

The remaining 40% of analysts and the vast majority of indicators vote for the fall of the pair. The nearest strong support is at 1.2975, the goal is to reach the 1.2825-1.2900 zone;

USD/JPY. Supported by graphical analysis on D1, 70% of analysts believe that the fall of the pair will stop at the level of 107.80, having fought off from which, the pair will first go to the resistance of 109.25, and then to the maximum values of last December in the area of 109.70.

30% expect that the strengthening of the yen will continue, so the pair will be able to fall to the support of 107.50, and then another 100 points lower.

As for the indicators, 100% of them are colored red on H4 and 85% on D1. Signals of the pair being oversold are given by 15% of oscillators on D1, which is often confirmed by the rapid change of trend;

Cryptocurrencies. Forecasts for the near future are as gray and boring as the charts of crypto pairs. However, the closer to the May halving of Bitcoin, the more green color and optimism of experts appear. 70% of them expect that the quotes will go up sharply. The picture is similar among investors. According to TradeBlock, only 30% of BTC coins were in motion in 2019. The remaining 70% are in wallets in a “frozen” state, in the hope of a future growth.

Of course, there are pessimists among analysts. According to their forecasts, the pair BTC/USD will soon have another fall. The new generation of mining equipment (ASIC S17 and T17) makes this process cost-effective, even if Bitcoin falls to the $3500-4400 zone, and this is where they believe the really strong support is located. But if the pair breaks through it, then we can talk about the end of the 10-year history of the world’s first digital currency.