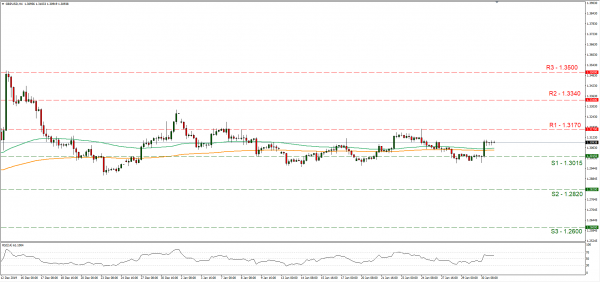

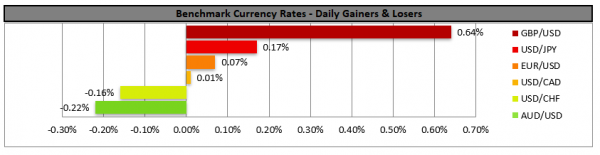

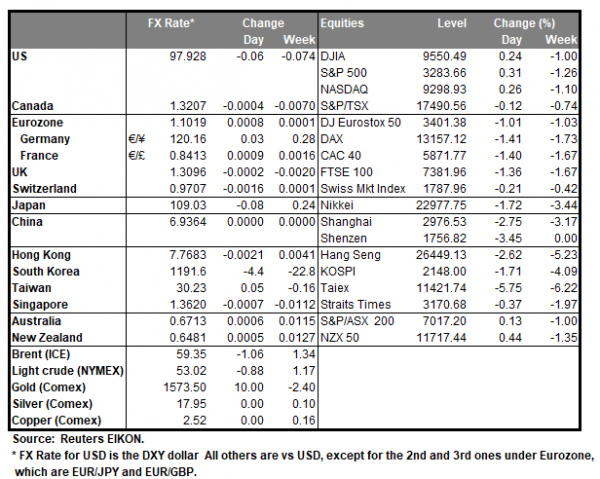

The pound got a modest boost yesterday as BoE decided to remain on hold at +0.75%, in a 7-2 vote count. The accompanying statement seemed well balanced and struck a more decisive tone for the bank to act in order to achieve its inflation target of 2%. Also, some slightly dovish hints were included as the bank stated that monetary policy may need to reinforce “the expected recovery in UK GDP growth”, under certain circumstances including a weak CPI rate. On the flip side the bank states that some modest tightening may be needed should the economy recover broadly in line with MPC’s projections. Overall the bank seems to remain strongly data driven, with emphasis being placed, primarily on the CPI rate and the GDP growth rate. In his last press conference as Governor of the BoE, Mark Carney highlighted some signs of a pick-up in the UK economy and at the same time maintained a rather wait and see position for the signs to be translated into hard data. We could see the pound being more data driven with indicators for inflation, drawing more attention in the future. GBP/USD jumped during the decision aiming for the 1.3170 (R1) resistance line yet stabilised after the decision maintaining a tight range bound movement. We could see the pair continuing a sideways movement today yet there may be some bullish tendencies for the pair. Should the pair come under the selling interest of the market, we could see it breaking the 1.3170 (R1) resistance line and aim for the 1.3340 (R2) resistance level. On the flip side, should the pair’s long positions be favoured by the market, we could see it breaking the 1.3015 (S1) support line and aim for the 1.2820 (S2) support level.

Coronavirus worries create volatility for JPY

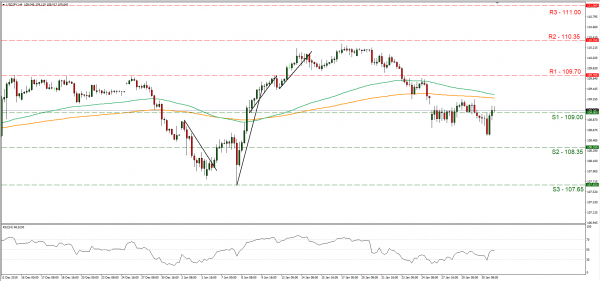

Worries about the new Coronavirus created volatility for JPY, while at the same time the Aussie seems to continue to weaken. The World Health Organization declared the new Coronavirus a public health emergency yet also stated that this should not be considered as a vote of no confidence for China. At the same time the organization praised China’s efforts to limit the spread of the virus to other countries. After WHO’s press conference market worries seemed to ease somewhat, yet it should be noted that the US and Japan warn citizens to avoid travelling to China, while Japan also announced drastic measures from Saturday on. We maintain the view that the situation remains fragile, hence market volatility may turn safe havens such as the JPY to either direction. USD/JPY initially dropped yesterday yet was able to recover any lost ground and trade higher breaking the 109.00 (S1) resistance line, now turned to support. We could see the pair maintaining a sideways motion, yet as mentioned in the fundamental analysis, the market’s risk on/off sentiment could send the pair to either direction. Should the pair come under the control of the bulls, we could see it aiming if not breaking the 109.70 (R1) resistance line. Should the bears be in charge, we could see the pair breaking the 109.00 (S1) support line and aim for the 108.35 (S2) support level.

Other economic highlights today and early tomorrow

During the morning European session, we get from France the preliminary GDP growth rate for Q4 and the preliminary CPI (EU Normalized) rate for January as well as the respective rates for the Eurozone. In the American session, we get the US consumption rate for December, Canada’s GDP growth rate for November, and the final US University of Michigan consumer sentiment indicator for January. During Monday’s Asian session, we get Japan’s Jibun manufacturing PMI for January, Australia’s building approval growth rate and China’s Caixin Manufacturing PMI.

Support: 109.00 (S1), 108.35 (S2), 107.65 (S3)

Resistance: 109.70 (R1), 110.35 (R2), 111.00 (R3)

Support: 1.3015 (S1), 1.2820 (S2), 1.2600 (S3)

Resistance: 1.3170 (R1), 1.3340 (R2), 1.3500 (R3)