The dollar index rose after the market received positive economic data from the United States. According to ADP, the economy added more than 291k private sector jobs in January. This was higher than the consensus estimates of 156k. This data came ahead of the official jobs numbers, which will be released tomorrow. Meanwhile, the ISM non-manufacturing PMI rose to 55.5 in January. This was higher than the expected 55.0. It was also the highest level since August last year. Non-manufacturing business activity rose to 60.9 from the previous 57.0. On trade, exports from the US rose from $208.10 billion to $209.60 while imports rose from $251 billion to $258 billion.

The price of crude oil rose as the market hoped that OPEC and its allies will intervene. This is after the price declined to the lowest level since last year. The price has dropped by more than 20% from its January high. Yesterday, data from the EIA showed that oil inventories declined from 3.548 million barrels to 3.355 million. This was higher than the expected 2.831 million barrels. The market hopes that the new coronavirus disease will not have a major impact on the price of oil.

The Australian dollar rose today after the country released mixed retail sales and trade numbers. The country’s exports rose by 1% in December. This was lower than the previous 2%. Imports rose by 2% in December after falling by 3% in the previous month. As a result, the country’s trade surplus declined from $5.51 billion to $5.22 billion. Meanwhile, retail sales rose by 0.5% in the fourth quarter after falling by 0.1% in the third quarter. However, on a MoM basis, retail sales declined by 0.5% in December after rising by 1% in the previous month. The director of Australia’s statistics office attributed the drop to the strong Black Friday sales in the previous month. He also attributed it to the bushfires. These numbers came two days after the RBA left interest rates unchanged.

EUR/USD

The EUR/USD pair declined to a low of 1.0993, which was the lowest level it has been since January 29. The pair started the week at 1.1095. It is now trading below the 14-day and 28-day exponential moving averages. This price is below the 14-day and 28-day exponential moving averages. This is near the important support of 1.0992. The RSI remains at the oversold level of 30. The pair may remain in a holding pattern ahead of the official NFP data tomorrow.

XBR/USD

The XBR/USD pair rose to an intraday high of 56.58. The pair has been moving upwards after it formed a double bottom at 53.70. The 28-day and 14-day exponential moving averages have made a bullish crossover. The RSI has been moving upwards while the momentum indicator is above 100. The pair may continue to rise as sentiment improves.

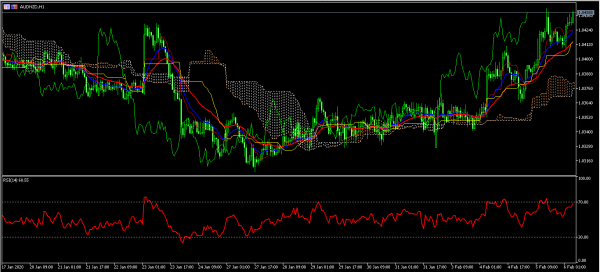

AUD/NZD

The AUD/NZD pair rose to a high of 1.0440 after mixed data. The pair has been on an upward trend since January 27, when the pair was trading at 1.0306. The price is above the 14-day and 28-day exponential moving averages while the RSI is close to the overbought level of 70. The price is above the Ichimoku cloud. The pair may continue to rise today.