The Japanese yen was little changed today after the market received weak economic data. Data from the Statistics Bureau showed that household spending in December dropped by -1.7%. This was lower than the estimates increase of 0.2% and November’s increase of 2.6%. It declined by 4.8% on YoY basis, which was lower than the expected decline of 1.7%. Meanwhile, overall income was unchanged in December while overtime pay dropped by -2.6%. Recently, even though Japan released weak economic data, there was hope that the country was turning itself around.

Asian stocks and US futures declined as the market worried about the impact of coronavirus. Many companies in China have either reduced work or shutdown their plants. The latest company to do so was Toyota, which extended the shutdown of its Chinese plants until February 16. This happened as the disease continued to spread. The death toll has risen to more than 600 people and the number of confirmed cases to 31,161. In a report, S&P Global said that it expects China’s GDP to grow by 5% this year after rising by 6.1% in 2019.

The biggest news of the day will be the US jobs numbers. The Bureau of Labour Statistics is expected to release the official jobs data for January. Nonfarm payrolls are expected to have increased by 160k. This will be better than December’s 145k. On Wednesday, data from ADP showed that the number rose by 290k. The unemployment rate is expected to have remained unchanged at 3.5% while private nonfarm payrolls are expected to have increased by 150k. Wages are expected to rise by 3.0% after rising by 2.9% in the previous month.

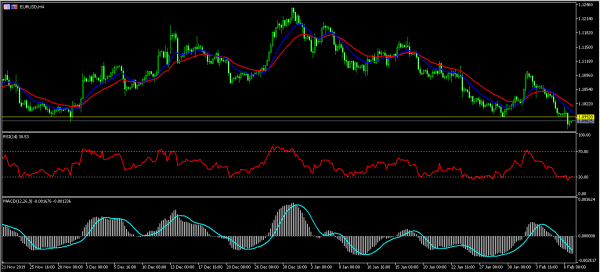

EUR/USD

The EUR/USD pair declined to a low of 1.0963 during the American session. This was the lowest level since October last year. The pair pared some of these losses during the Asian session. It is trading below the 14-day and 28-day exponential moving averages. The RSI is below the oversold level of 30. The signal and main line of the MACD are below the neutral level. The pair may remain at the current levels ahead of the NFP data.

USD/JPY

The USD/JPY pair was unchanged during the Asian session. The pair is trading at 109.90, which is slightly lower than the day’s high of 110.00. The pair has found some resistance around these levels and the price is along the 14-day and 28-day moving averages. The RSI has been moving downwards. The price is slightly below the Ichimoku cloud. The pair may move lower ahead of the NFP data.

XAU/USD

The XAU/USD pair rose to a high of 1568.50 as fears of the coronavirus disease rose. This is higher than Wednesday’s low of 1547.45. The price is above the 14-day and 28-day exponential moving averages. The price is slightly above the 38.2% Fibonacci Retracement level. The RSI has remained slightly below the oversold level. There is a possibility that the pair will move to test the 50% Fibonacci level of 1570.