The CAD surged after the Bank of Canada (BoC) hiked rates

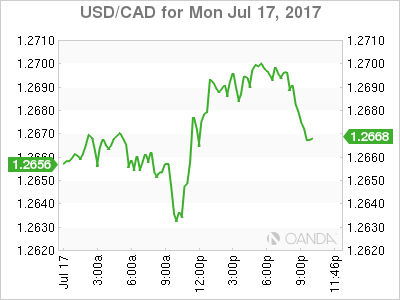

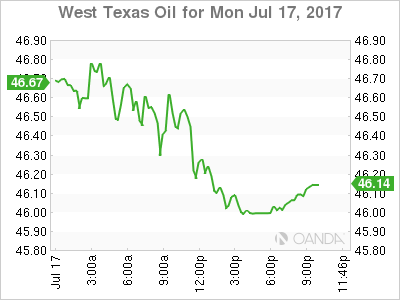

The Canadian dollar is lower against the US dollar on Monday after the release of lower than expected existing home sales and the release of the US NAFTA renegotiation objectives by the Trump Administration. Oil prices are in decline after the Energy Information Administration (EIA) reported higher US production this year and growing scepticism about the Organization of the Petroleum Exporting Countries (OPEC) production cut deal is actually working offering little support to the loonie.

The CAD will have to wait until Friday to get a major indicator release when the Canadian retail sales and inflation data will be published. For now US political uncertainty and the “America First” objectives of the NAFTA renegotiation could have a negative effect on the Canadian currency.

The loonie had a strong performance last week as the USD retreated as US data disappointed with slow inflation and falling retail sales. The Bank of Canada (BoC) hiked rates for the first time in 7 years after switching the rhetoric in the past month. The market is still pricing in a second rate hike this year, but Canadian inflation and high levels of household debt could change the mind of the central bank.

The USD/CAD gained 0.364 percent in the last 24 hours. The currency is trading at 1.2693 and regained some of the losses from last week. The economic calendar will provide little excitement for trading the pair as few opportunities are scheduled. The loonie got a huge boost last week with a telegraphed rate hike coming to pass in Canada and soft data in the US. Next up for the pair will be more details on the US NAFTA renegotiation objectives and Canadian inflation and retail sales data later in the week.

The Bank of Canada joins the U.S. Federal Reserve as the only two central banks in the G7 to hike rates but also in dismissing the lack of inflation as temporary. The BoC is also moving to a more data dependant rhetoric but markets still price in another rate hike before the end of the year.

A big obstacle for the loonie before the end of the year will be the NAFTA renegotiations slated to begin in late August. The Trump administration would rather tear the agreement and forge a new one, but at the moment is willing to go ahead at the request of Canada and Mexico. If the hard ball tactics of tariffs are any indication it will be a tough negotiation. Mexico has already said that it could walk out if tariffs are part of the new agreement. Regarding timing Mexican officials have said that they expect the negotiations to be done by before the end of 2017 and not drag on for a long time.

US Trade Representative Robert Lighthizer published the NAFTA renegotiation objectives as part of the process to start talks between the three nations in the next 30 days. The US has taken the lead with both Canada and Mexico willing to seat down and review any updates to the trade agreement. The NAFTA pairs will be sensitive to combative comments from the Trump administration head of the start of talks in mid August.

The price of oil lost 1.091 percent on Monday. West Texas Intermediate is trading at $46.15 and Brent at $48.36 after the Energy Information Administration (EIA) published a forecast that the total shale regions oil output in August would rise by 113,000 barrels per day. Total output in the month could reach 5.59 million barrels per day compared with 5.5 in June. Oil prices retreated at the start of the week after gaining more than 5 percent last week.

Energy prices have been dictated by weekly changes in US crude inventories and reports from the Organization of the Petroleum Exporting Countries (OPEC) led production cut agreement. Oil rigs have increased production in the United States taking advantage of the stability provided by the production cut deal. Demand specially in China is giving optimistic signals to producers and could be the tie breaker between the two opposing forces. Oil producers that are part of the agreement will meet in Russia on July 24 to discuss the current market situation and review the compliance levels.

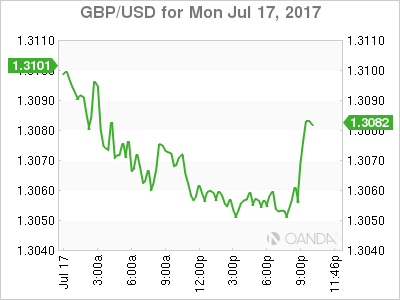

The GBP/USD lost 0.344 in the last 24 hours. Cable is trading at 1.3055 ahead of the release of the British consumer price index. BoE doves have thrown cold water to the idea of a rate hike even as inflation continues to heat up, but the pound has gotten support from a softer more conciliatory approach to Brexit from PM May. Acknowledging there will be a bill to settle after the UK leaves the EU could result in a more amicable divorce reducing the probabilities of the worst case scenario outcomes.

Investor surveys point to a 81 percent expectation of a rate hike within 12 months with the market pricing in around 50 percent in the next six months.

Brexit negotiations kicked off in Brussels as the UK Secretary of State in charge of steering Britain out of the European Union pledged to get down to work. The pound has lost ground ever since the outcome of the referendum was announced and the full economic reality of leaving the EU has not been totally priced in as March 2019 is a more concrete deadline. After securing a majority the cabinet of David Cameron followed through on a campaign promise and put forth the decision to remain or exit at the hands to the people. The outcome of that decision not only terminated his political career, but has put in jeopardy his successor as Theresa May misjudged the electorate when seeking to build on that majority only to see it reduced by calling a snap election. The results leave a less than unified front when negotiations kicked off in Brussels with various rumours of infighting in the cabinet and the fate of the British economy in the air.

Market events to watch this week:

Tuesday, July 18

4:30 am GBP CPI y/y

Wednesday, July 19

8:30 am USD Building Permits

10:30 am USD Crude Oil Inventories

9:30 pm AUD Employment Change

Tentative JPY Monetary Policy Statement

Thursday, July 20

Tentative JPY BOJ Outlook Report

Tentative JPY BOJ Policy Rate

2:30 am JPY BOJ Press Conference

4:30 am GBP Retail Sales m/m

7:45 am EUR Minimum Bid Rate

8:30 am EUR ECB Press Conference

8:30 am USD Unemployment Claims

Friday, July 21

8:30 am CAD CPI m/m

8:30 am CAD Core Retail Sales m/m