Economic numbers continue to trickle in for the period most dramatically impacted by social/physical distancing measures. In an unusual step, Statistics Canada released a preliminary estimate of March and Q1 GDP in Canada, with both posting record declines despite virus-control measures really only ramping up significantly in the last couple of weeks of the month/quarter. A plunge in US retail sales and industrial production in March also confirmed that the US economy contracted in Q1. And the economic numbers will look dramatically worse in April with 22 million initial jobless claims having now been filed in the US since mid-March (representing a staggering 13.5% of the US labour force.)

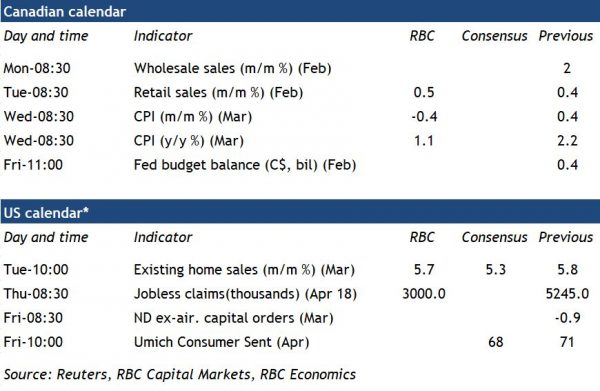

Near-term economic data will continue to look exceptionally ugly. We’re assuming the pace of new weekly US jobless claims will moderate to about 3 million from 5.2 million (recall the previous weekly record was 695 thousand). In Canada, February retail sales will probably be among the last benign-looking economic data releases before social/physical distancing measures kicked in more aggressively in the back half of March. Our own more-timely consumer spending tracker is already flagging a dramatic pullback in spending in March. And reports are that a total of 6.4 million people have applied for the government’s new CERB income support program in Canada, suggesting April’s employment decline will be multiples of the million jobs lost in March.

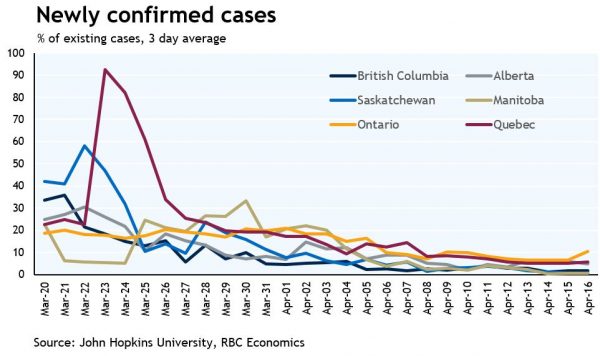

But the night is darkest before the dawn, and there have also been glimmers of the light on the horizon. Social distancing measures appear to be working to slow the spread of the virus. Countries/regions have begun to think more seriously about how to begin to ease restrictions. There is clearly a risk in moving too quickly, but some countries in Europe have already begun to take steps in that direction, reopening some shops, in some cases allowing students to return to school. In Canada there have been signs that the virus curve is indeed flattening. That is happening more clearly in the Western provinces than in Central/Eastern Canada, suggesting that the economy’s reopening may be staggered by region. That said, the toll of the outbreak is still growing with a rising number of deaths from the illness. But even in Ontario/Quebec, where the number of confirmed cases has continued to increase at a higher rate, the pace of increase in hospitalizations has slowed. In Ontario, the net number of patients in intensive care has actually declined slightly over the last week according to official data. And the pace of testing has picked up. Even with these tentative signs it is very likely that some form of significant social distancing restrictions are going to be needed for months. But the conversation has at least begun to shift to what that ‘new normal’ will look like.