The Eurozone’s preliminary PMIs for April will be released on Thursday at 08:00 GMT, and the numbers could be scary. However, investors don’t pay much attention to economic data nowadays, so the euro might be driven by risk sentiment and politics instead. The meeting of EU leaders – also on Thursday – is an asymmetric upside risk, but the currency’s broader outlook still seems negative.

Too little, too late

The European Union’s weak institutional framework has come back to bite the euro in this crisis as well. The stimulus measures by policymakers on a European level have left investors deeply disappointed, both by being too slow and too small. Once again, European leaders were late to agree a rescue package, and when they did, its size was quite small at half a trillion euros, or 3% of EU GDP.

In fact, the EU’s Economics Commissioner said that a total of €1.5 trillion in fiscal stimulus might be needed to tackle the fallout from this crisis. While that may ultimately come, it will probably take months of bitter infighting, reducing its effectiveness by being late and by having uncertainty around whether it will arrive at all.

The real issue is how to pay for all this. The Eurozone doesn’t have a common fiscal policy, so when a crisis hits, highly-indebted economies like Italy and Spain want everyone to share the burden – for example by creating Eurobonds – while creditor nations like Germany oppose the whole idea.

Ironically, this half-baked institutional setup generates a lot of uncertainty, limits growth in the currency bloc, and adds a risk premium on euro-denominated assets, including on the currency itself.

Data don’t matter, but EU meeting might

This week, all eyes will be on Thursday’s events. The preliminary PMIs for April will reveal just how much economic damage the pandemic has inflicted, with forecasts pointing to another drop deeper into contraction territory for both the manufacturing and services indexes.

Admittedly though, economic data don’t mean much right now. While investors could pay some attention to the PMIs since they also contain a forward-looking component, most of the price action in the euro might be driven by the meeting of EU leaders.

They will be discussing more stimulus measures, including the prospect of some risk-sharing mechanism like Eurobonds. If agreed, this could be a game changer for the euro. It would imply a quicker recovery in the most virus-ravaged economies like Italy and Spain, and remove some of the political risk premium.

However, despite some recent signs of flexibility, such an agreement remains very unlikely given the scale of opposition from Germany and the Netherlands. Therefore, the risks surrounding the euro’s reaction seem asymmetric. With nobody really expecting a deal, a surprise Eurobond agreement would likely push the euro much higher, whereas another disappointment might only generate minor losses.

But bigger picture still negative

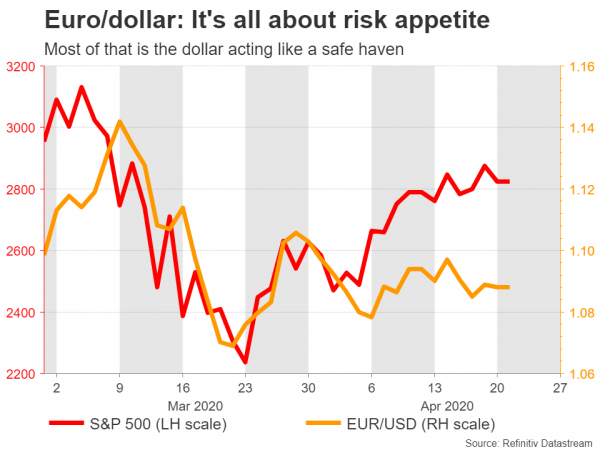

Overall, it’s difficult to be optimistic on the euro. The currency has been mostly at the hands of risk sentiment lately, rising and falling with stock markets. That has a lot to do with the dollar, which has been trading like a safe haven in this crisis. As such, euro/dollar tends to move in a direction similar to that of stocks nowadays.

In that sense, the risk of another decline in stocks – and therefore another leg lower in euro/dollar – looks elevated. The current level of equity prices implies a V-shaped recovery, which is quite unlikely given how quickly unemployment is soaring and the marks this crisis might leave on consumer behavior. Additionally, there’s the risk of second waves of infections if the lockdowns end prematurely.

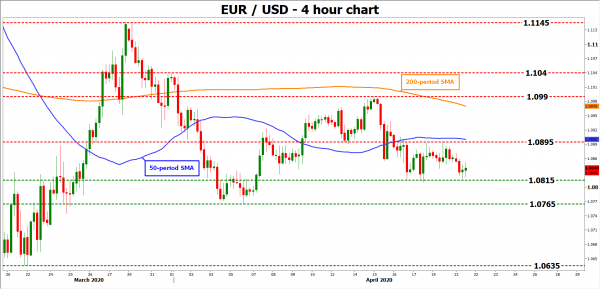

Taking a technical look at euro/dollar, if the bears stay in control and pierce below 1.0815, their next target might be the 1.0765 zone.

On the upside, a move above 1.0895 could open the door for a test of 1.0990.

Finally note that the S&P ratings agency will review Italy’s bond rating on Friday, and there’s a high risk of a euro-negative downgrade unless EU leaders agree to something substantial the previous day.