The New Zealand dollar slumped after the RBNZ delivered its interest rate decision. The bank left interest rates unchanged at 0.25 per cent and expanded the quantitative easing program that was started in March this year. The bank will now buy assets worth more than $60 billion in the next 12 months. Also, it expanded the eligible assets to include inflation-indexed bonds. The rate decision came a day ahead of the country’s budget, which will be read tomorrow. Most importantly, it came at a time when the country is having conflicts with China on Taiwan issues.

The British pound was little changed today ahead of key data from the UK. The ONS will today release the preliminary reading of first quarter GDP data from the country. Analysts expect the economy to have declined by 2.5 per cent from the fourth quarter and 2.1 per cent on an annualized basis. Also, the manufacturing production is expected to have dropped by 6.0 per cent in March and by 10.4% from January to March. On the other hand, analysts expect industrial production to have contracted by 9.3%. Another report is expected to show that business investments and construction output declined sharply in March.

Traders will also be focusing on inflation data from the US. The Bureau of Labour Statistics will release the Producer Price Index (PP) today. Analysts polled by Reuters expect the headline PPI to drop by 0.5 per cent in April after another 0.2% decline in March. They expect the PPI to drop by 0.2 per cent on an annualised basis. Similarly, the core PPI, which excludes the volatile food and energy products is expected to have risen by just 0.9%. These numbers will come a day after we received weak CPI data from the country.

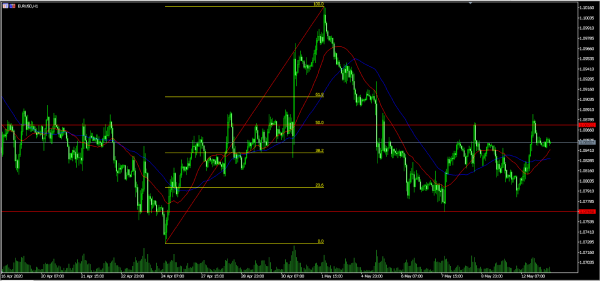

EUR/USD

The EUR/USD pair was little changed in the Asian session and is now trading at 1.0851, which is lower than yesterday’s high of 1.0885. On the hourly chart, this price is slightly above the 38.2% Fibonacci retracement level and above the 25-day and 50-day exponential moving averages. The pair will likely move to retest the 50% retracement level at 1.0872. This will depend on the PPI data from the US.

GBP/USD

The GBP/USD pair declined to an intraday low of 1.2248 ahead of the important GDP data from the UK. On the four-hour chart, this price is slightly below the 50% Fibonacci retracement level. It is also along the neckline of the head and shoulder pattern. Therefore, a move below the current level will mean that bears are in control. As such, they will attempt to move lower and test the 38.2% retracement level at 1.2090.

NZD/USD

The NZD/USD declined sharply as the market reacted on the RBNZ interest rate decision. The pair moved to a low of 0.6016, which is between the 50% and 61.8% Fibonacci retracement level. The price is also slightly below the 25-day and 50-day exponential moving average. Also, it is attempting to move below the pink trendline below. Therefore, a break past this support will mean that there are more sellers in the market who will want to push the pair lower.