U.S. Review

Wait and See

- The re-opening of the country is getting underway, with all 50 states starting to roll back restrictions.

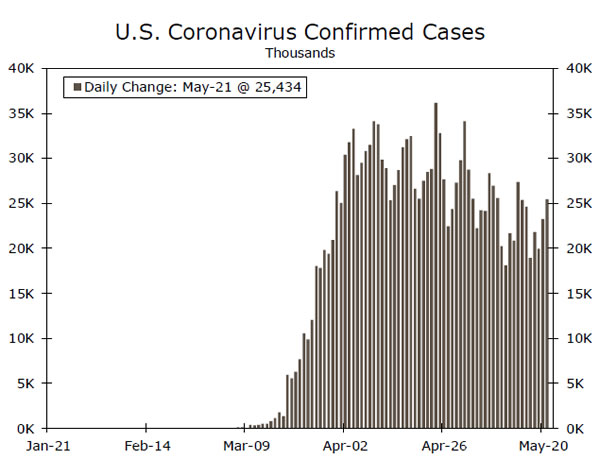

- It remains too early to assess the effect of the re-opening on coronavirus case growth, which continues to slow in a fairly broad-based manner, despite an impressive—albeit late-inthe- game—ramp-up in testing.

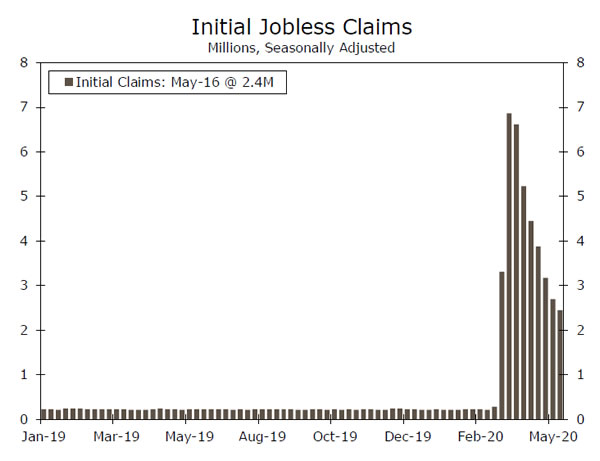

- Nearly 2.5 million Americans filed initial unemployment claims the week ended May 16, bringing the cumulative total over the past nine weeks to more than 38 million.

Wait and See

The re-opening of the country is getting underway, with all 50 states starting to roll back restrictions. It remains too early to assess the effect of the re-opening on coronavirus case growth, which continues to decline in a fairly broad-based manner, despite an impressive—albeit late-in-the-game—ramp-up in testing. The theme this week therefore seemed to be wait and see, among governors and economic policymakers.

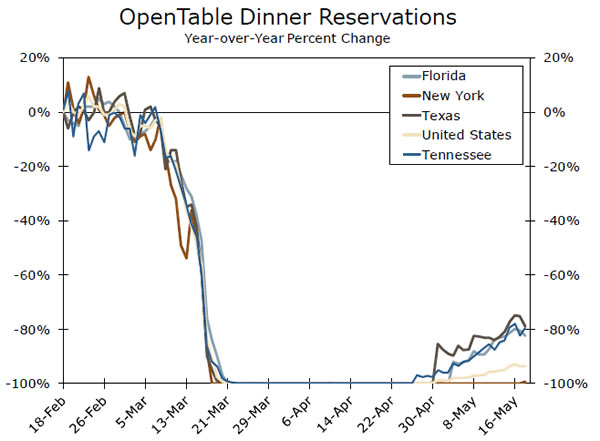

First, governors are anxiously watching the health data to detect signs of a rebound in case growth. The earliest states to re-open— Tennessee, South Carolina and Florida, among others—have not seen a surge, but any conclusions beyond that would be premature.

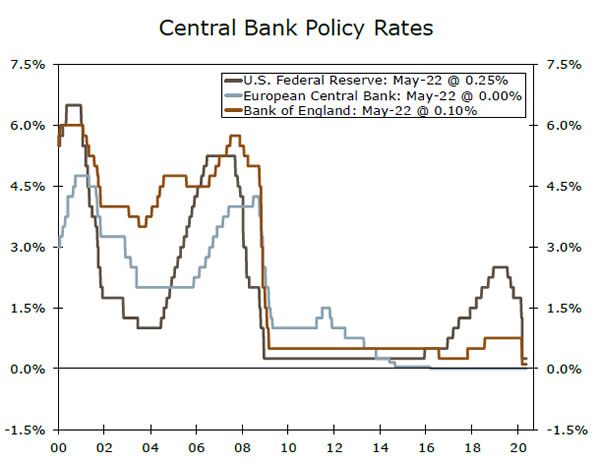

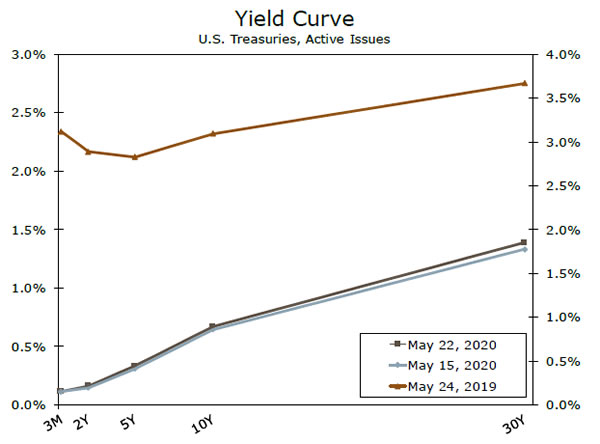

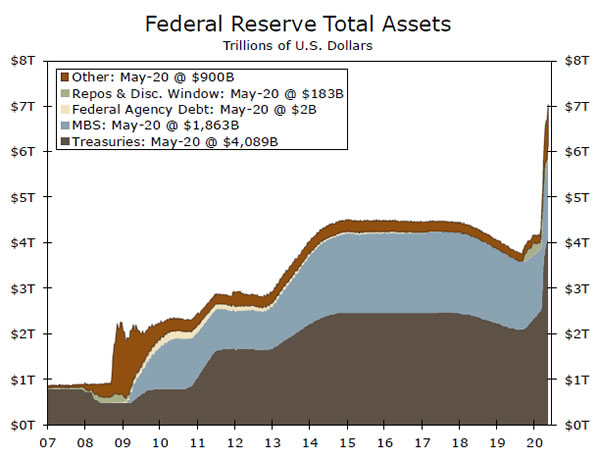

Second, the week passed without any major news out of Capitol Hill, with GOP lawmakers expressing their desire to wait and see how the enacted fiscal relief measures play out. The Fed has also been on pause in terms of new policy announcements (large-scale asset purchases are of course continuing), not so much because it does not want to do anything, but rather because Fed officials would like to see more action on the fiscal front. On 60 Minutes last Sunday, Chair Powell emphasized that there is “no limit” to what the Fed can do, but also stressed that worries about deficits should be subordinate to worries about the long-term damage from recessions. He made similar grave remarks during Congressional testimony and again hinted at the need for more fiscal action. The minutes of the last FOMC meeting were also published this week, and the discussions were bleak. The committee discussed the “substantial likelihood of additional waves of outbreak in the near or medium term” and that “such developments could lead to a protracted period of severely reduced economic activity.” In an effort to prevent long-term economic scars, the committee discussed additional novel monetary policy actions—it “could make its forward guidance for the path for the federal funds rate more explicit,” by linking it either to a date or to a key macroeconomic variable, such as the unemployment rate. It also discussed explicit yield curve control.

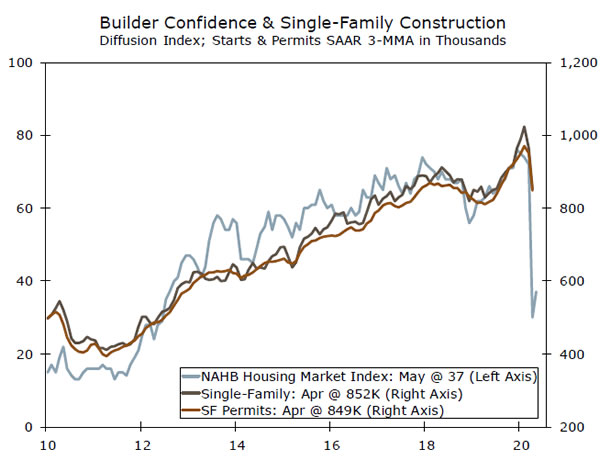

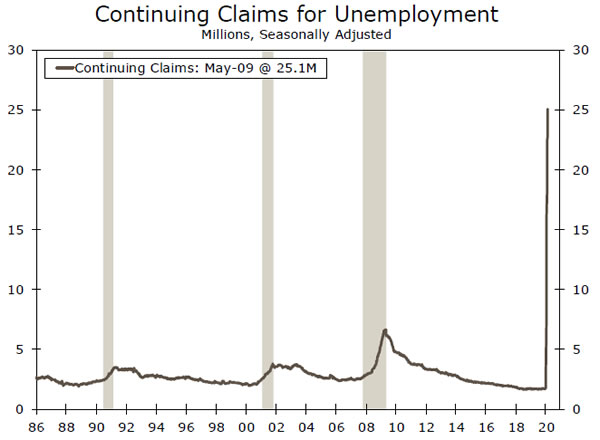

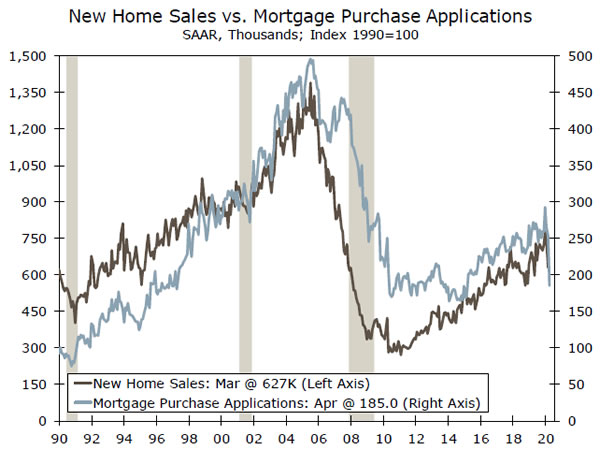

The backdrop to these wait-and-see approaches is further carnage in the labor market. Nearly 2.5 million Americans filed initial unemployment claims the week ended May 16, bringing the cumulative total over the past nine weeks to more than 38 million. Some of these no doubt have found new jobs, but the continuing claims data indicate more than 25 million were out of work the week ended May 9. Despite this, housing continues to be a bright spot. In some sense, it’s the theory of low expectations that makes the prior statement true. Indeed, many have begun to celebrate upticks—in restaurant reservations, TSA screenings, hotel occupancy—that still leave the level of activity down nearly 90% year-over-year. Housing is really the only example where activity is fairly strong even without comparison to its March and April low points. Mortgage purchase applications are down just 2% yearover- year, and the NAHB homebuilder confidence index rose seven points in May. Whether other sectors can follow housing’s trajectory will come down to the public health situation. For now we wait and see.

U.S. Outlook

New Home Sales • Tuesday

Almost every economic indicator has seemed to follow the same pattern as of late: large declines in March followed by even bigger declines in April. New home sales, which fell 15.4% in March and are expected to fall 21.5% in April, are no exception. That said, there is some indication that the pullback in the housing sector will not be as severe as other parts of the economy.

Housing had a lot of momentum heading into the COVID-19 crisis. Even with the March drop, new home sales are running 6.7% ahead of their year-ago pace. While shutdown orders and social distancing have brought challenges for builders and buyers, it is possible that the housing market could pick back up as states begin to re-open. It seems relatively few of those who lost their job over the past few weeks were prospective home buyers. Mortgage applications for purchase and search trends for ‘new home’ have bounced back sharply from the first two weeks in May.

Previous: 627K Wells Fargo: 566K Consensus: 493K (SAAR)

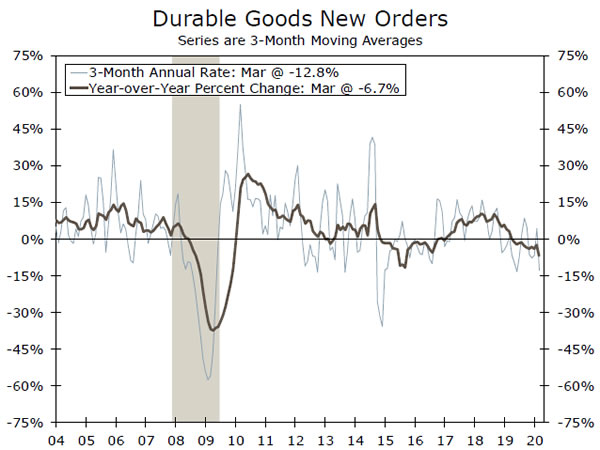

Durable Goods • Thursday

While durable goods orders suffered their second largest decline on record in March, the drop was due almost entirely to cancellations at Boeing. Nondefense capital goods orders ex aircraft fell only a scant 0.1% in March, but it is unlikely that this resilience was repeated in April.

According to the industrial production report, activity in the manufacturing sector fell at a record pace in April. While this may not be surprising given that many factories shut down last month to prevent the spread of COVID-19, it does not bode well for next week’s durable goods report. We expect orders fell 14.2% last month. Beyond April’s number, the outlook for spending in the manufacturing space is fairly bleak. While consumer spending has the potential to bounce back as shutdown orders are lifted, the trend in capital goods orders was weak going into the COVID-19 crisis.

Previous: -14.7% Wells Fargo: -14.2% Consensus: -18.0% (Month-over-Month)

Personal Income & Spending • Friday

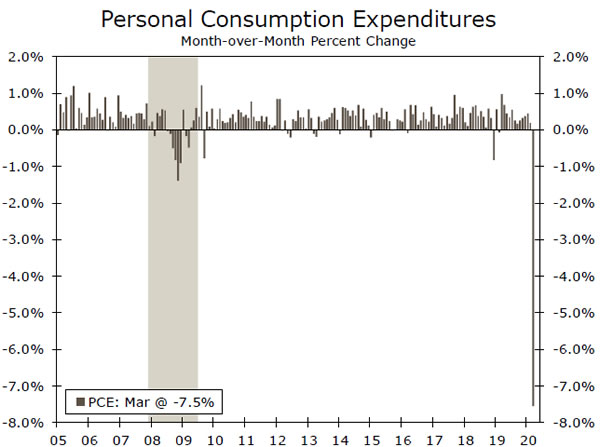

Personal income fell 2% in March—bigger than any one-month decline registered during the Great Recession—but April is likely to be much worse. More than 20 million people lost their jobs according to the April employment report, which the BEA uses to tabulate wages & salaries, likely leading to a record drop in personal income. That said, compensation from unemployment helped offset some of the decline in March and should do so again in April.

While the declines in income were likely steep in April, the spending declines were even more dramatic. With lockdowns only in place for half of March, spending fell a record 7.5%. Last week’s retail sales report gave us a hint of what spending looked like when nonessential businesses were closed for the whole month, and it was not pretty. Retail sales fell a record 16.4% in April, as control group sales, which serves as a proxy for goods personal consumption expenditures, fell 15.3%. Except unprecedented weakness from services consumption as well.

Previous: -2.0%;-7.5% Wells Fargo: -4.4%; -10.8% Consensus: -6.5% Inc.;-12.8% Spend. (Month-over-Month)

Global Review

U.S.-China Tensions Building; EM Central Banks Easing

- Along with the intensification of COVID-19, U.S.-China relations have started to intensify again as well. Heightened rhetoric from the U.S. administration has recently turned to action, and while we are not yet ready to build any material escalations or additional tariffs into our forecasts, we acknowledge U.S.-China trade tensions could be deteriorating.

- Multiple central banks in emerging markets met this week to assess monetary policy with rate cuts occurring across Asia and EMEA. With inflation on a downward trajectory, additional monetary policy space to cut rates has been created and as of now, we believe EM central banks will continue to ease policy.

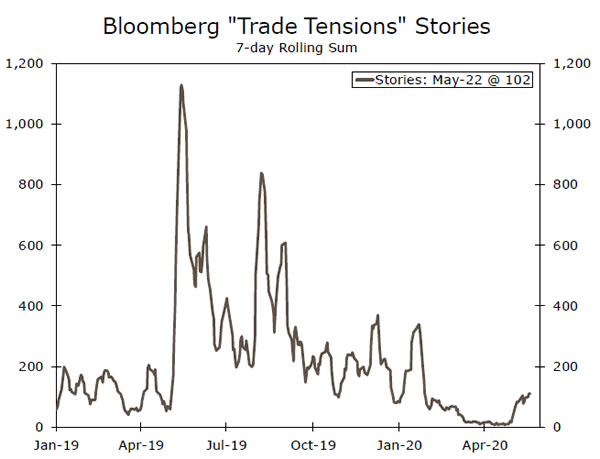

U.S.-China Tensions Heating Back Up

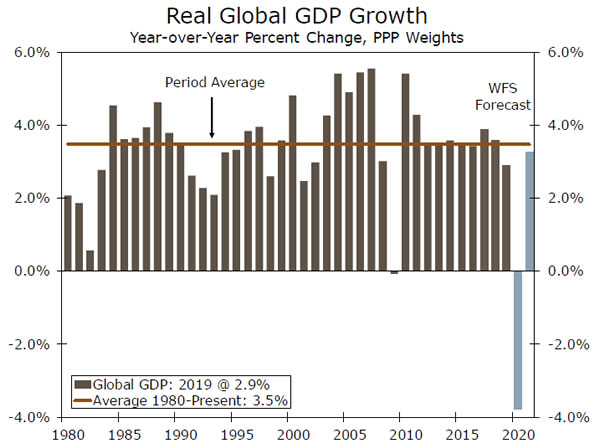

Following a Phase I trade deal toward the end of last year, U.S.-China relations seemed to be improving or at least steady. As COVID-19 has intensified and economies around the world have been disrupted, the U.S. administration has pointed the finger at China for failing to prevent the spread of the virus. In this context, the U.S. administration as well as Chinese authorities have traded hostile rhetoric toward each other leading market participants to believe tensions between the two countries may be starting to escalate once again. Over the past few weeks, this rhetoric has turned to action as the U.S. administration prevented a large government pension fund from allocating capital toward Chinese equities and the Senate approved legislation that could lead to Chinese companies being barred from publically listing on U.S. stock exchanges. It is unclear if the U.S. administration is resuming its tough stance on China as a way of political jockeying ahead of the presidential election in November. If trade tensions pick up meaningfully over the next few weeks and months, however, additional downward pressure could be placed on the Chinese economy as well as global growth at a time where significant contractions are already being forecasted. As of now, we are not building in any escalations or additional tariff assumptions into our forecasts, but we do recognize that U.S.-China relations may be on the path toward further deterioration.

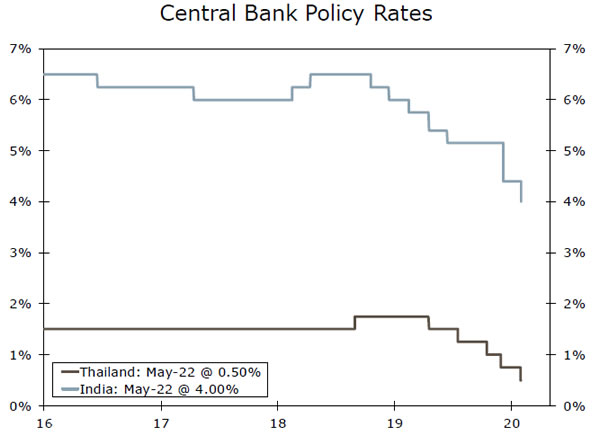

Emerging Markets Central Banks Keep Cutting Rates

This week, central banks across the emerging markets met to assess monetary policy. Starting in Asia, the Central Bank of Thailand lowered its main interest rate 25 bps to 0.50%. Despite the cut, the baht strengthened this week as sentiment towards emerging currencies improved and optimism around a global recovery increased. The Reserve Bank of India (RBI) also opted to cut interest rates in an off-cycle, unscheduled decision. RBI policymakers lowered interest rates 40 bps, marking a cumulative reduction of 115 bps this year. In addition, RBI governor Das signaled easier monetary policy is likely to continue and further rate cuts should be expected as the Indian economy is on pace for a contraction this year. As of now, we expect the RBI to act in similar fashion, lowering its repurchase rates in scheduled and unscheduled fashion and will continue to seek additional options for easing monetary policy going forward.

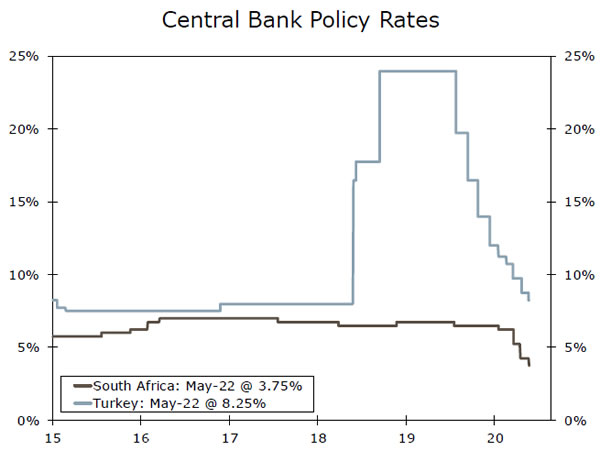

Central banks in the EMEA region also convened this week, with the Central Bank of Turkey and South African Reserve Bank each choosing to lower interest rates 50 bps. With inflation on a downward trajectory as a result of COVID-19, both central banks likely have a bit more room to ease monetary policy. In addition, lower policy rates should help offset at least some of the economic effects from the virus. However, going forward, we believe both central banks need to be cautious. Each of their respective currencies are highly vulnerable to changes in sentiment and lower policy rates during times of uncertainty could fuel large currency depreciations. As of now, we are particularly worried about a large sell-off in Turkey as FX reserves are low and the central bank’s ability to support the currency is limited.

Global Outlook

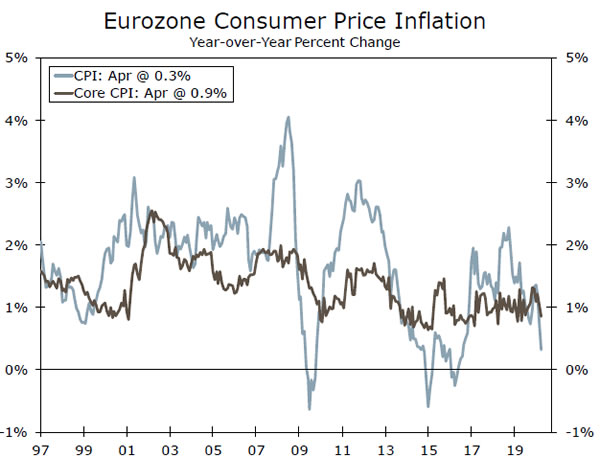

Eurozone Inflation • Friday

Across the globe, COVID-19 has placed downward pressure on inflation, with the Eurozone being no exception. In fact, prices in the Eurozone have decelerated significantly over the course of the first few months of the year. At the beginning of 2020, CPI inflation was 1.4% year-over-year, and as the effects of COVID-19 continue, inflation slowed to 0.3% year-over-year in April. Going forward, we expect inflation to continue to soften and forecast prices to rise only 0.2% year-over-year in May. In addition, we forecast multiple months of disinflation later this year and for annual inflation to be only 0.3% in 2020. The ECB’s asset purchase programs should eventually help Eurozone growth and inflation dynamics, although we believe quantitative easing will take some time to filter down to the real economy. In addition, the European Union is exploring the issuance of bonds, with the proceeds going directly to countries that need it the most, which could aid in a recovery.

Previous: 0.3% Wells Fargo: 0.2% Consensus: 0.4% (Year-over-Year)

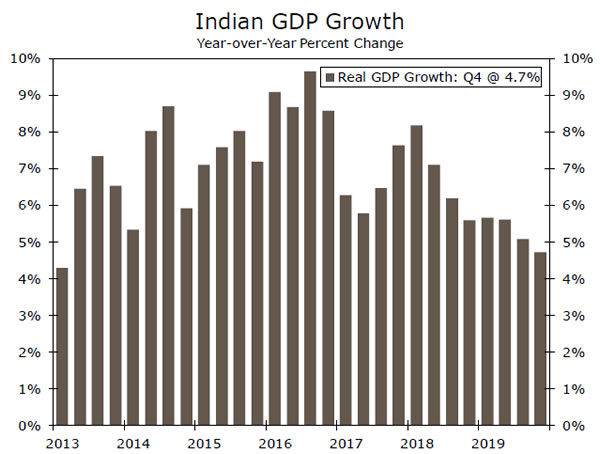

India GDP • Friday

Indian economic growth has been on a downward trajectory for some time now, even well before the spread of COVID-19. Clearly the effect of the virus will be significant, however, we believe the Indian economy will manage to register positive year-over-year growth in the first quarter of the year. Nationwide lockdown measures were not put in place until the end of March, and with India being a large oil importer, the sharp decline in crude prices should be a net positive for India. Looking ahead, the slowdown in Q2 will be much more severe and the Indian economy will likely contract on a year-overyear basis. The lockdown starting in March has been extended multiple times, and while some social distancing measures have been lifted in less vulnerable parts of the country. Mobility has been largely suppressed, with sentiment and activity slumping as a result. This has shown up in data as the services PMI fell to 5.4 in April, a record low, while the manufacturing PMI also declined significantly.

Previous: 4.7% Wells Fargo: 2.9% Consensus: 1.0% (Year-over-Year)

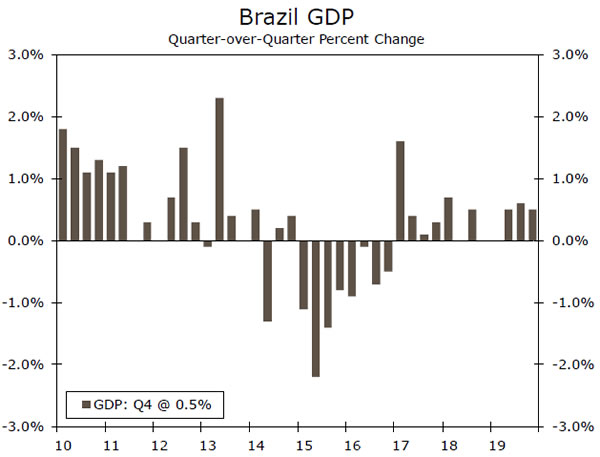

Brazil GDP • Friday

Brazil’s economy is likely to contract in Q1 as the dual effect of COVID-19 and low commodity prices put pressure on the economy. Expectations for a more pronounced recovery in Brazil have faded amid the spread of COVID-19, and we expect further disruptions to the economy in Q2. While lockdown measures have not been strictly enforced, in fact the current administration has not encouraged the population to social distance, we expect consumer activity to slow significantly. Renewed and elevated political risk tied to President Bolsonaro will likely also weigh on capital flows and investment into Brazil, which could compound and exacerbate the economic slowdown for most of 2020. Given the amount of challenges Brazil faces, it really comes as no surprise that the currency is the worstperforming currency in the world through mid-May. The effects of COVID-19, elevated political risk and a dovish central bank have caused the real to sell-off close to 30% year-to-date.

Previous: 0.5% Consensus: -0.9% (Quarter-over-Quarter)

Point of View

Interest Rate Watch

60 Minutes, Fed Minutes & 20-Years

Jay Powell’s 60 Minutes interview set off a discussion about just what he was advocating for in the way of additional fiscal relief. The Fed Chair was careful to avoid the appearance that he was giving any advice to Congress but noted while “a lot of that money is just starting to flow through the economy,” there is no way of knowing whether what has been passed to date “will be enough.” He went on to say that “it may be that the Fed has to do more. It may be that Congress has to do more.”

Interpretations of the Powell’s interview ran the gamut, with many suggesting the Fed was advocating for more fiscal stimulus. Our read finds a less specific prescription. Powell stated that while there are good reasons to expect the economy to be back on the road to recovery this summer, the path to a full recovery will be long. Given the long time needed to fully recover, some additional monetary and fiscal stimulus may be needed along the way to “avoid longer term damage to the economy.” Powell did not advocate any particular policy or suggest the Fed or Congress needed to act immediately.

The minutes of the Fed’s April 28-29 meeting suggest that there are a wide range of views about how COVID-19 will play out and a number of members raised concerns about how a second wave would impact the economy. All agreed that a tightening in Fed policy is a long way off and there was some discussion about how best to provide forward guidance. The discussion revolved around whether there should be dataspecific or time-specific guidelines for when the Fed would begin to normalize policy.

The Treasury’s auction of 20-year bonds went fairly well. This marked the first sale of 20-year bonds since 1986. The new issue went out at a yield of 1.22% but has since traded nearly 10 bps below that level. Yields remained in a fairly narrow range over the course of the week, despite a strong equity rally early in the week on promising results on the development of vaccine by Moderna. Concerns about rising tensions with China and concerns about a further tightening in China’s governance of Hong Kong also contributed to the decline.

Credit Market Insights

Mexico Debt Likely to Continue Rising

Like many of the world’s economies, Mexico has also been hit hard by the dual challenges of COVID-19 and low global commodity prices. In an effort to offset the negative effect, the Central Bank of Mexico cut rates 175 bps this year, in addition to the 100 bps of cuts in 2019. Despite these efforts, we believe the central bank will need to continue easing monetary policy aggressively, given that Mexico is one of the only countries that has not deployed large fiscal policy to help its economy weather the COVID-19 pandemic. That said, tight fiscal policy will not likely prevent Mexico’s fiscal deficit from widening this year, as the oilprice collapse and lower taxes are likely to push debt higher. As of 2019, Mexico’s fiscal budget deficit fell to 1.6% of GDP from a year earlier, but analysts look for the deficit to jump to 4.3% of GDP by the end of 2020. Meanwhile, public-sector debt was marginally higher in 2019 compared to the year prior and is expected to jump again in 2020, driven by peso depreciation, coupled with subdued GDP growth and increased net debt issuance. In the scenario debt continues to rise and the fiscal deficit widens further, it could potentially result in Mexico’s sovereign credit rating being further downgraded, teetering toward junk status. That said, we expect credit rating downgrades to continue, which will likely result in additional capital outflows in the future, placing additional downward pressure on the Mexican economy and currency.

Topic of the Week

Gradual Re-opening Now Underway

As stay-at-home orders are incrementally being relaxed, the focus has shifted from physical health implications of COVID-19 to what it means for the financial health of businesses and households.

Stay-at-home restrictions have been largely working as intended. Your mileage may vary based on where you are in the country, but on-trend the number of new confirmed cases across the country has been trending lower. To be clear, this is still bad news for the thousands of people who tested positive in recent days, but it is a marked improvement from where we were in March when the case counts were rising at a sobering rate.

The fact that this downtrend is occurring amid increased testing is also encouraging. The trend improvement in case counts is a necessary prerequisite for a re-opening program that is in keeping with the CDC’s guidelines.

We hit a major milestone this week on the long road to recovery: every one of the 50 states has begun at least some incremental phase of re-opening. Getting this right and avoiding any “false starts,” as Fed Chair Jay Powell recently put it, is key to our forecast for an upturn in economic activity in Q3.

A top question from clients these days is “As the country re-opens in the coming weeks and months, what should we be watching?” Among the most important indicators on our list are initial jobless claims and the daily change in confirmed COVID-19 cases. Both are still too high, but both are moving in the right direction.

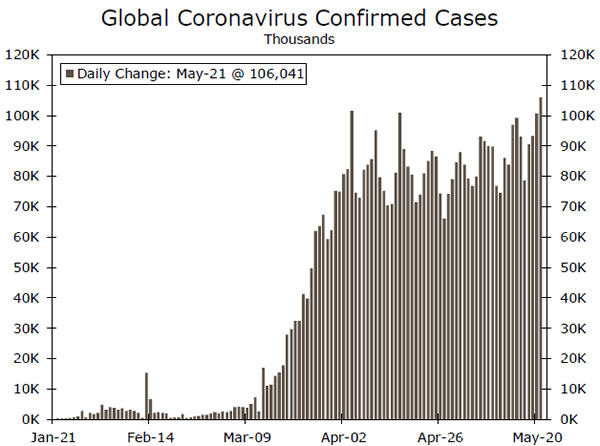

With over 1.5 million COVID-19 cases, the United States is still the epicenter of this global pandemic, home to more than 30% of the cases globally, at least going off the confirmed case counts. However, that share is dropping.

The global tally of confirmed new cases is leveling off but is stubbornly refusing to come down. Aside from the unthinkable human suffering, especially in developing economies, this continued spread is not conducive to robust global growth nor is it good for supply chains.