- Growth optimism drives equities higher as outlook brightens on lockdown easing

- Dollar slips on risk-on mood, pound and aussie shine

- But gold supported by lingering US-China tensions

Stocks buoyed by economic reopening

Global equities extended yesterday’s strong gains with Asian indices adding between 1-3% on Tuesday and European and US futures surging by 2%. The recovery theme continues to support risk assets as more businesses around the world are given the green light to reopen, fuelling hopes of a sustainable recovery as economic life is resuscitated after weeks of shutdowns.

Japan and the United Kingdom became the latest countries to announce further relaxation of lockdown restrictions as the number of new virus cases falls in many parts of the world, allowing grounded European airlines to resume some flights.

Meanwhile, encouraging progress in the development of a vaccine for the coronavirus is helping to calm fears of a second wave of infections. The avoidance of a second wave is critical in ensuring that the recovery that’s just getting underway follows a V-shaped pattern as future lockdowns necessitated by a flare-up in the pandemic would run the risk of pushing debt-ridden economies to the brink of collapse.

For now, though, optimism is the order of the day and if Wall Street rallies at the open as indicated by stock futures, the S&P 500 and the Dow Jones should manage to clear key resistance barriers and reinforce their uptrend.

Dollar dips as US-China tensions move into the background

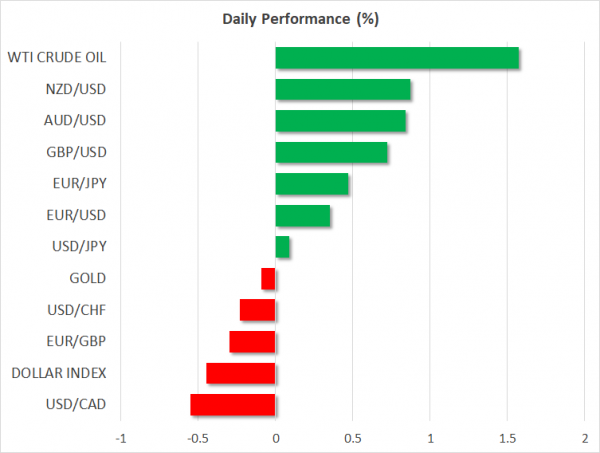

The improving risk appetite weighed on the US dollar and other safe-haven currencies on Tuesday, with the yen and Swiss franc also moving lower on the back of the growing recovery hopes. The dollar index was last down 0.4%, pushed lower by a stronger euro and pound.

The single currency climbed back above the $1.09 level, while sterling was one of the day’s best performers, along with the risk-sensitive Australian dollar, with both up about 0.7% versus their US counterparts.

The pound, which has been a laggard in FX markets throughout May, got a major boost on Monday after the UK Prime Minister Johnson announced all shops will be able to reopen from June 15 as the UK’s virus death rate continues to decline.

However, the only positive propelling the aussie higher today was the virus recovery story even as there appears to be no let-up in the brewing tensions between the United States and China, which is a key source of risk for the Australian economy as well as for global trade.

Gold not blind to persisting dangers

The United States has ratcheted up its attack on China in recent days with the communist state’s decision to impose a national security law on autonomous Hong Kong worsening already sour relations. Although Chinese officials have been trying to ease international concerns about the security bill, the anti-China rhetoric is not likely to recede anytime soon as President Trump is almost certain to use the China card in his election campaign.

It is no secret that Washington lays the blame of the virus outbreak squarely on Beijing and the threat of increased friction in the lead up to the November election is keeping gold elevated. The precious metal was only marginally lower on Tuesday, suggesting downside moves will fail to gain much traction as long as trade war and virus risks remain present.