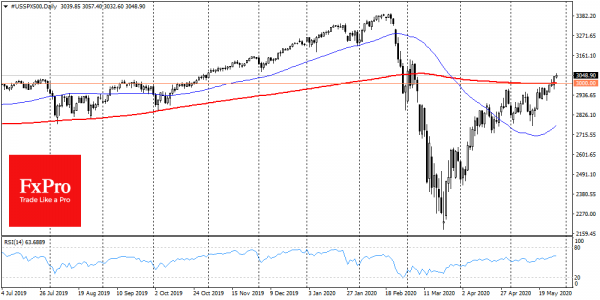

The American S&P 500 managed to gain a foothold above the 200-day average and the critical round level of 3000. The index grew 1.5%, which is an additional signal of demand in the markets and often is a harbinger of further growth.

Although one should be sceptical about the stock market growth prospects, we should be prepared for a strong impulse in the last days of the month from buyers. On Thursday and possibly Friday, the positive dynamics will likely continue to intensify.

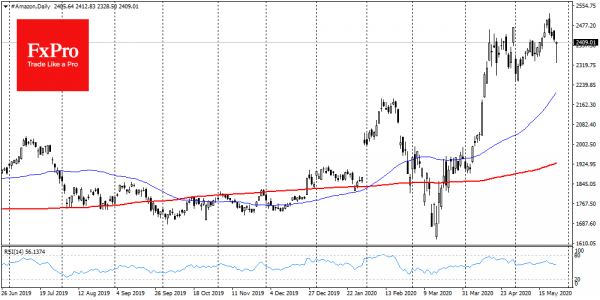

Too many hedge funds had open short positions on stocks, and now they are closing them. The so-called short squeeze (short covering) pulls up the American index. However, at the same time, there are signs that the markets are experiencing a rotation of short-term investment ideas. FAANG idea has worked out powerfully in the last two months.

Stocks of Amazon, Netflix, and Facebook – not only quickly recovered from the collapse in March, but also updated historical highs with a large margin. Microsoft and Apple have returned to their peak levels reached earlier this year. However, they’ve been feeling worse than the market in general in recent days.

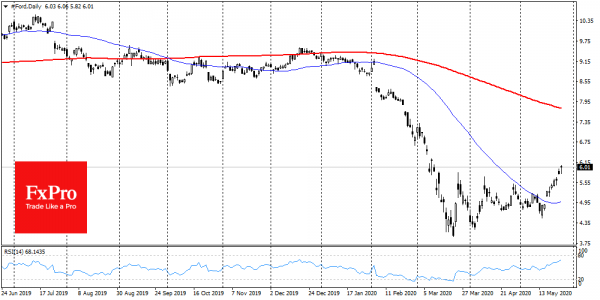

Boeing and Ford, as well as the banking sector, have been growing weaker than others since March’s collapse, but are showing more positive momentum since May 15. Overall, this means that investors are carefully taking the profits from the stars of the recent rally, looking at the former market outsiders. It seems that markets are growing more widely, relying on the hopes of economic recovery as a whole.

And here investors can face serious difficulties. Firstly, US companies continue to go bankrupt, while others continue to lose revenue and dismiss workers. The Federal Reserve’s Beige Book showed business pessimism about the pace of recovery in all regions. The economy remains close to its bottom, acting in a very different way than stock indices do. The consumer confidence index, which in May only slightly increased to April, now looks to be the correct indicator for the economy compared to the stock market, which offset 70% of the collapse due to the pandemic.

In the following months, it may well turn out that profit-taking on stocks of companies that pulled the indices up in the previous two months may put pressure on the entire market, and may not allow for expansion of recovery.