The European Central Bank is widely expected to announce a ramping up of its pandemic emergency purchase program (PEPP) on Thursday at 11:45 GMT as the Eurozone economy slowly emerges from weeks of lockdown. But as the euro rallies on the prospect of a double dose of fiscal and monetary stimulus, a smaller-than-anticipated increase in the PEPP and signs of opposition to further policy easing may spoil the party.

Pandemic stimulus to be boosted

The ECB has been dropping strong hints in the run up to its June 3-4 meeting that a policy boost is on the way as it tries to shore up virus-stricken economies across the euro area. Although investors had been hoping that policymakers would have reached a decision on additional stimulus at the previous meeting in April, it is the norm for the ECB to wait for the latest macroeconomic projections to be readied before making up its mind.

Some might also say that having even gloomier economic forecasts at your disposal would make it easier to argue for extra firepower if you are Christine Lagarde and have a few sceptic Governing Council members sitting at the decision table. Speaking last week, President Lagarde said the ECB’s previous forecasts of a best-case scenario were “out of date” and that “It’s very likely that we are somewhere between the medium and severe scenarios”.

Further sounding the alarm bells, Governing Council member and Bank of Italy Governor Ignazio Visco warned about deflationary risks from the virus crisis. Headline inflation in the Eurozone fell to a 4-year low of 0.1% year-on-year in May, and while underlying inflation remained steady, this still gives the ECB doves another reason to press for even looser monetary policy.

Room for disappointment

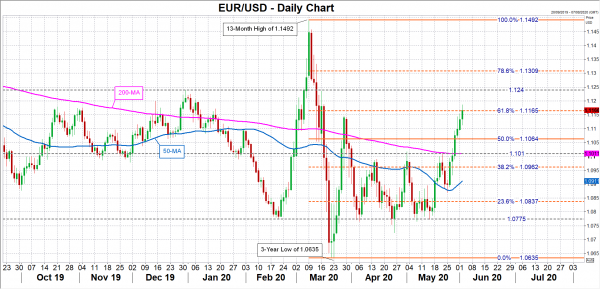

So the question being asked now is by how much will the Bank increase the size of the PEPP. The most likely outcome is something between €250 and €500 billion. But anything less than €500 billion is sure to leave markets disappointed and may pose a setback for the euro, which has been bolstered by economic recovery hopes. Euro/dollar has broken through major chart barriers and is approaching levels not visited since mid-March after France and Germany put forward a proposal for a €500 billion EU virus rescue fund, which the European Commission has incorporated into a €750 billion package.

Legal complications

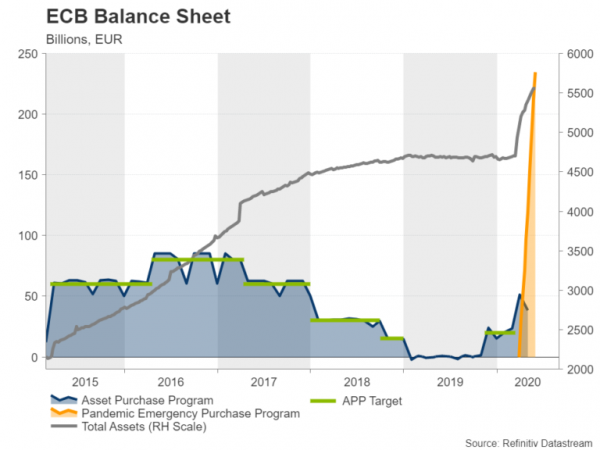

Although there is a real risk that countries such as Austria and the Netherlands may try to scale down the package, that’s not the only problem facing the euro. A court in Germany recently ruled that the ECB’s debt-crisis era asset purchase program (APP) is in violation of the German constitution, threatening to cut off the Bundesbank’s participation in that program. While the ruling has no immediate impact on the ECB, policymakers may think twice before dismissing German opposition to unconventional and large-scale asset purchases.

Hence, a decision to beef up the PEPP only modestly, say €250 billion, could be interpreted by investors that the ECB is being careful not to overstep the line, dampening expectations of future stimulus.

Recovery hopes are underpinning the euro

The euro could jump higher in such a scenario, possibly clearing the immediate resistance of the 61.8% Fibonacci retracement of the March down leg around $1.1165 and making a run for the $1.1240 barrier, where prices peaked in December. However, such a move is likely to be only a knee-jerk reaction, as a hawkish stance would soon revive fears of a slow recovery and start weighing on the currency.

Similarly, a dovish announcement could initially push down the euro before improving sentiment for the Eurozone economy puts the bulls back in charge. Downside moves could pull the euro back to the $1.1010 area where the 200-day moving average is flatlining. But should the stimulus plans remain on track, the euro could stretch its rally towards the 78.6% Fibonacci just above the $1.13 level in the coming weeks.

Will the ECB remove the capital key?

The most positive outcome for the markets would be for the Bank to not only add another €500 billion to its emergency program but to also scrap the rule on the capital key, which requires government bond purchases to be made in proportion to the size of member states’ economies. This has meant German bunds have made up a larger portion of the ECB’s purchases even though countries like Italy would benefit more from having a greater share.

The ECB already decided not to apply its other restriction – the limit of buying no more than one third of a country’s total eligible government bonds – for the PEPP. But removing the capital key could prove more contentious. Still, it only shows the ECB is far from running out of ammunition if the virus fallout were to worsen. The question is, just how far is the ECB willing or allowed to go?