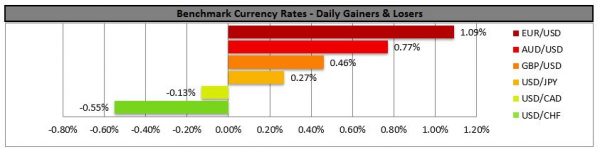

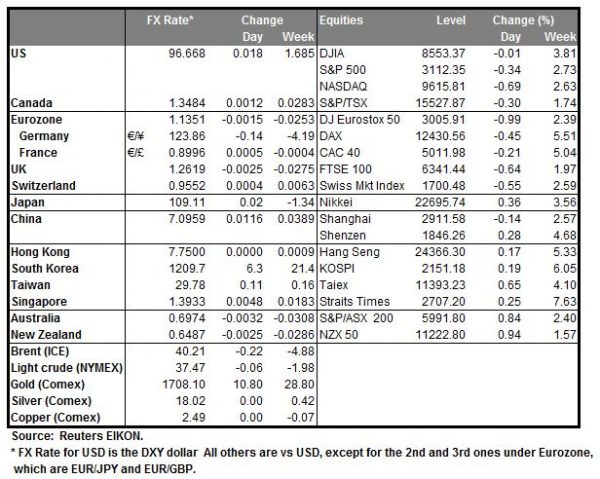

The USD weakened against a number of its counterparts yesterday, as investors continued to eye an economic recovery despite the ongoing tensions in the US-Sino relationships as well as the protests in the US. Analysts tend to note that the market seems to be unwinding long positions on safe-haven currencies such as the USD, CHF and JPY reflecting a wide degree of optimism, yet at the same time also underscore the uncertainty present. Markets are expected to focus on the release of the US employment report for May during today’s American session, and albeit the rates and figures expected are grim, some analysts have mentioned a possible bottoming out of the US employment market. Should market optimism continue to characterize the markets we could see the USD retreating, while commodity currencies could gain further ground. AUD/USD maintained its sideways motion yesterday yet broke above the 0.6940 (S1) resistance line, now turned to support. Given that the RSI indicator below our 4-hour chart seems to underscore the presence of the bulls, we tend to incline towards a bullish outlook for the pair yet would require some higher peaks and higher troughs to confirm it before we switch our current bias of a sideways motion. Should the pair actually find fresh buying orders along its path, we could see it breaking the 0.7025 (R1) line and aiming for higher grounds. Should the pair come under the selling interest of the market, we could see it breaking once again below the 0.6940 (S1) line and aim for the 0.6840 (S2) level.

ECB expands PEPP and the EUR jumps

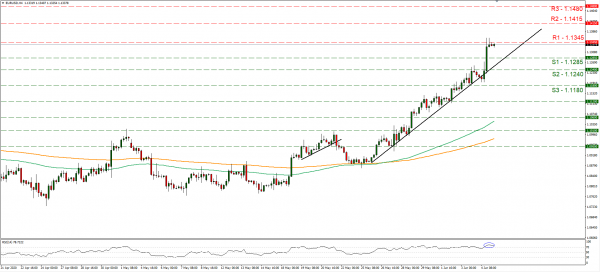

The common currency found strong support yesterday as the European Central Bank maintained rates unchanged, yet at the same time expanded its PEPP program by €600 billion, now totaling €1.35 trillion, outperforming expectations. It was characteristic that in her press conference, ECB President Christine Lagarde stated that albeit an improvement seems to be present, it still remains tepid hence action had to be taken. At the same time ECB’s projections seem to forecast that Eurozone’s economy is to shrink by 8.7% in 2020 and rebound by 5.2% in 2021, while inflation is expected to remain well below the bank’s +2.00% yoy target, creating also substantial worries. Overall the event confirmed that the ECB remains in a “whatever it takes” modus, as the bank defends its currency. EUR/USD rallied yesterday breaking the 1.1240 (S2) and the 1.1285 (S1) resistance lines, now turned to support, before testing the 1.1345 (R1) resistance line. We maintain a bullish outlook for the pair as long as it remains above the upward trendline incepted since the 26th of May which after yesterday’s jump seems to be steepening. Please note though that the RSI indicator below our 4-hour chart, remains clearly above the reading of the 70, underscoring the supremacy of the bulls, yet at the same time may imply that the pair’s long position may be somewhat overcrowded. If the bulls maintain control, EUR/USD could break the 1.1345 (R1) resistance line and aim for the 1.1415 (R2) resistance level. If the bears prevail, the pair could break the 1.1285 (S1) support line, take a retest of the prementioned upward trendline and aim for the 1.1240 (S2) support level.

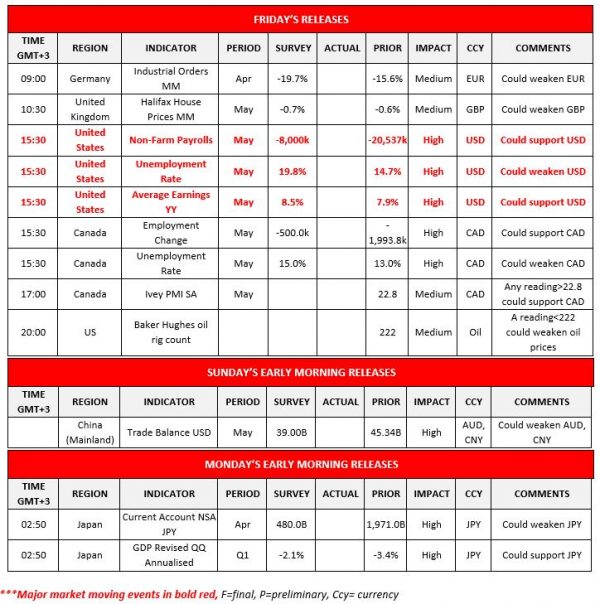

Other economic highlights today and early tomorrow

Today during the European session, we get Germany’s industrial orders growth rate for April and UK’s Halifax house prices for May. In the American session we get the US employment report for May as mentioned before, yet at the same time we also get Canada’s employment data for May, while later on we get Canada’s Ivey PMI for May and the US Baker Hughes oil rig count. On Sunday we get China’s trade data for May, while during Monday’s Asian session, we get from Japan the current account balance as well as the revised GDP growth rate for Q1.

Support: 0.6940 (S1), 0.6840 (S2), 0.6750 (S3)

Resistance: 0.7025 (R1), 0.7100 (R2), 0.7200 (R3)

Support: 1.1285 (S1), 1.1240 (S2), 1.1180 (S3)

Resistance: 1.1345 (R1), 1.1415 (R2), 1.1480 (R3)