Today’s price action has been rather dull, although investor sentiment was still overall positive with Asian and European stocks and US index futures extending gains and the dollar easing further lower with risk-sensitive currencies edging higher after Monday’s sharp reversal. However, since the European open, index futures have seen no further bullish momentum, as investors await the US open for direction, ahead of the Powell’s testimony and some US macro pointers in the afternoon. Some investors are also probably realising that the Fed’s corporate bond buying programme was already introduced in March and thus should have been priced in.

Tensions in the Korean peninsula has so far had very little impact on the markets, although gold was again correlating positively with the stock markets – possibly getting some tailwind support after North Korea decided to blow up its joint liaison office with the South near the border town of Kaesong as tensions between the two sides escalate. The tensions between the South and North have never had massive implications for the global markets, but it will add to a list of growing worries, nonetheless. So, by all means, keep an eye on it but I doubt this will be a major focus area for investors.

Indeed, there are bigger worries out there. Covid-19 resurgence, for example. It is still worth keeping this, although judging by Monday’s reversal, the resurgence of coronavirus cases in the US and China is apparently not too big a worry for the markets yet, but that could obviously change at any time. It is a big unknown: we don’t know whether a second wave of infections is going to come back strongly, or whether fears over a second wave will be sustained – and so far, it hasn’t. Additionally, we don’t know what a second wave would exactly look like. But the good news is the world is — or should be — much better prepared now, and local hotspots of infections should be controlled more effectively this time around.

Meanwhile, in economic news:

UK jobless claims rose by an additional 529 thousand applications in May compared with 405K expected, while the number for April was revised to show more than 1.033 million rather than 0.857 million reported initially.

The big upsurge in jobless claims has seen the number of workers on UK payrolls plunged by more than 600,000 between March and May. However, the unemployment rate has remained unchanged at 3.9% in the three months to April thanks to the government’s support schemes.

Coming up:

US retail sales (due at 13:30 BST) are expected to jump 8% in May, following the 16.4% plunge in April. Core sales are seen rising 5.5% after the 17.2% drop in April.

Industrial production (due at 14:15 BST) is expected to rise 3.0% month-over-month, after an 11.2% drop the month before.

Fed Chair Jay Powel’s testimony to Congress will start around 15:00 BST, while Fed Vice Chair Richard Clarida is also speaking later tonight. Powell’s remarks are widely expected to re-iterate the Fed’s downbeat assessment of the economy made at the FOMC press conference last week.

So, ahead of the upcoming US data and Powell’s speech, investors seemed happy thus far in today’s session to keep the focus on more stimulus after the Fed announced to buy individual corporate bonds under its Secondary Market Corporate Credit Facility (SMCCF) on Monday, which overshadowed fresh worries over the resurgence of coronavirus cases in the US and China. Sentiment has been boosted further by reports that the Trump administration is preparing a $1 trillion infrastructure spending package, aimed to stimulate economic growth. However, it remains to be seen how the government would be able to fund the latest stimulus package. It is also possible the market may not like what Powell is going to say regarding the economy, even if he would be merely echoing previous remarks from last week.

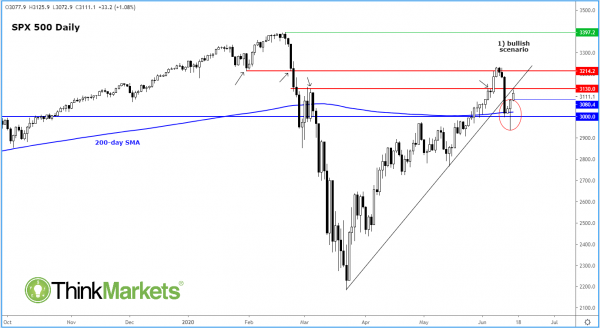

S&P 500 holds 200-day average

The S&P 500 is retesting the backside of the broken bullish trend line around 3130 after holding the 200-day average and key support at 3,000 following a brief breakdown. The bulls will want to see the index reclaim the broken trend, while the bears will want to see the index break back below the key 3000 level. It would be very bearish, in my view, if the S&P were to end today’s session well below Monday’s high of around 3080 after the day’s key reversal. The 3080 level is now the first line of defence for the bulls.