The euro rallied to an eighteen-month high as traders reacted to the €750 billion deal reached yesterday. The deal, which came after four days of intense negotiations, will help provide immediate relief to countries like Italy and Spain that have been affected significantly by the pandemic. It will achieve this without adding significant debt to these countries since most of the funds will be in the form of grants. This deal came at a time when economic data from Europe has been positive. For example, retail sales, employment, and PMIs have been relatively encouraging.

The Japanese yen strengthened against the US dollar as traders reacted to the PMI numbers from Japan. According to Markit, the preliminary PMI rose from the previous 40.1 to 42.6. This data means that while the sector is still contracting, it is making some progress. The data came a day after the country released its June inflation data. The headline CPI rose from 0.0% to 0.1% while the core CPI rose from -0.2% to 0.0%. Still, these numbers suggest that the Japanese economy has a long way to go before it fully recovers.

The US dollar declined slightly as traders reacted to a statement by Mitch McConnel, the Republican leader in the senate. In a statement to the press, he said that he backed a new round of stimulus, including direct cheques to American families. He said this after he met with Donald Trump at the White House. If passed, this will be the third stimulus package to include direct cheques. In the first $2.2 trillion packages, Americans making up to $99,000 per year received up to $1,200 from the Treasury Department.

EUR/USD

The EUR/USD pair rose sharply as traders reacted to the new funding deal in Europe. It is now trading at 1.1547, which is the highest level since January last year. The price is above the 50-day and 100-day exponential moving average on the daily chart. The RSI has moved above the overbought level of 70 while the dots of the Parabolic SAR are below the price. Therefore, the pair is likely to continue rallying as bulls target the next resistance at 1.1600.

USD/JPY

The USD/JPY pair dropped to 106.65, which is the lowest it has been since July 15. On the four-hour chart, the price is below the short and medium-term moving averages. It is also below the 23.6% Fibonacci retracement level. Also, the pair has formed a triple bottom and a descending triangle pattern. This means that the price is likely to continue falling as bears target the next resistance at 106.50.

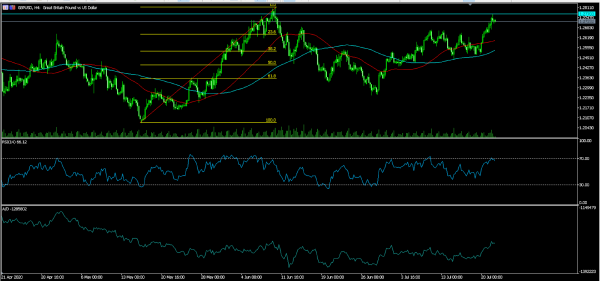

GBP/USD

The GBP/USD pair rose to an intraday high of 1.2770, which was the highest level since June this year. The price is above the 23.6% Fibonacci retracement on the four-hour chart. It is also above the 50-day and 100-day simple moving averages. Also, the RSI has jumped to its highest point since early this month. The accumulation/distribution indicator has also risen. Therefore, the pair is likely to continue rising, with the next target being at 1.2800.