First, a review of last week’s events:

EUR/USD. The dollar has been falling for six straight weeks. The USD index (DXY) fell to the minimum values since May 2018. In total, it has lost about 10% in the last five months. And now, it seems that the fall has stopped: the EUR/USD pair is moving along the side corridor within 1.1700-1.1910 for the second week in a row. Attempts to break through its upper border on August 05-06 ended in failure, and the pair completed the five-day period at 1.1785 on Friday August 07.

The U.S. President, who attacked China’s social networks, added to the strength of the dollar. The bears await a full-scale resumption of trade wars between Washington and Beijing like manna from heaven, and hope that Donald Trump will not limit himself to this one-time attack.

Congress, which has not yet been able to reach an agreement on new stimulus measures for the U.S. economy, helped the dollar to strengthen a little. As a result, the growth of stock indices stalled, and investors’ views turned to the American currency again.

U.S. macroeconomic indicators released last week, also forced to talk about the fading of positive dynamics. The Private Sector Employment Report (ADP) looked rather weak, and activity indices based on credit card transactions and mobile traffic were at levels 10-30% lower than before the COVID-19 crisis.

The NFP indicator seems to have turned green, but, in fact, the figure of 1.763 million is not newly created, but old jobs, to which people who had previously been sent on forced long-term vacations returned. Recall that in May and June this figure was 2.7 million and 4.8 million, respectively. So the July result was the worst for the period.

GBP/USD. Since March, during the entire period of the crisis, the GBP/USD pair has been showing a close correlation with EUR/USD, practically repeating all its fluctuations. The British pound approached its March high on Thursday, August 06, reaching the height of 1.3185. Some analysts believe that this happened following the meeting of the Bank of England. However, one can disagree with this. Rather, the blame is the general drawdown of the dollar, the DXY index of which dropped to a low these days.

The meeting of the British regulator, as expected, offered no surprises. The Bank of England decided to leave the key interest rate unchanged at 0.1%, and the target volume of the QE program at £745 billion. At the same time, the Bank’s management believes that the UK economy will recover from the effects of the pandemic until the end of 2021, and the pace of its recovery again will depend on the pandemic itself. In general, there is no certainty. At the same time, the regulator believes that there is no urgent need to adjust its monetary policy, and even more so, it is not worth discussing the introduction of negative interest rates. Such a move could create difficulties for banks, which are already suffering serious losses associated with the COVID-19 pandemic.

As a result, the British currency, just like the European one, moved sideways against the dollar, holding in a trading range 1.2980-1.3185. The final chord was set at 1.3055;

USD/JPY. The Bank of Japan is a member of a consortium of several other central banks, including the UK, Europe and Canada, that have teamed up to explore the prospects and challenges of a digital currency launch. Now Japan is actively working to launch the digital yen, for which a special supervisory committee has even been created. Perhaps this event will attract the attention of investors, but so far the fiat yen has again dropped out of sight of large financial “sharks”: over the past five days, the range of its fluctuations did not exceed 115 points, and the Japanese currency ended the trading session almost in the same place where it started a week ago – at around 105.90;

cryptocurrencies. The opinion that cryptocurrencies can make everyone, even a child, a millionaire, was confirmed last week. However, this does not always happen in an honest way. So, a few days ago, the police detained 17-year-old Graham Clark, who is accused of organizing hacker attacks on celebrity

Twitter accounts. Among others, his targets were Elon Musk, Barack Obama and Joe Biden, on whose behalf he organized bitcoin fraudulent actions. So, this teenager turned out to be the owner of 300 BTC, which at the current exchange rate is about $3.5 million!

As for adult residents of the United States, Cornerstone Advisors have recently published the results of a study according to which 15% of Americans already own bitcoins or other altcoins, and half of them have become crypto investors in the last six months. On average, new investors, who have invested more than $67 billion in the crypto market, spent about $4,000 each. Most of them are high-income people (about $130,000 a year) with college degrees. And interestingly, almost 100% of investors are men.

And now for the news that scared many members of the crypto community. After an impressive rise to a height of $12,080, on Sunday, August 02, the price of bitcoin unexpectedly, within just a few minutes, collapsed to $10,500, causing panic among investors. However, to their delight, there was no further decline, and the quotes quickly returned to the $11,000 mark. Rupert Douglas, head of institutional sales at Koine, said the move was driven by the liquidation of long positions at high prices. Thus, on this day, positions worth $147 million were liquidated on the BitMEX cryptocurrency exchange. All in all, during this “gray Sunday” cryptocurrency market capitalization lost about $30 billion, falling from $361 to 331 billion.

The level of $11,000 became a new powerful support for BTC/USD, pushing back from which, the pair was able to rise again to the zone of $11,500-11,850 by Friday 07 August. The total cryptocurrency market capitalization has also almost recovered, reaching $357 billion. The Crypto Fear & Greed Index is at 77, which is about the same as seven days ago.

The ETH/USD pair is back in the $400 zone. It should be noted that the growth rate of ethereum trading volumes in spot and futures markets is increasing faster than the same rate of bitcoin. If the trade volume ratio between ETH and BTC was only 16% in September 2019, so far this figure has risen to 50%. In the futures market, it climbed from 8% to 29% over the same period. Figures are based on cryptocurrency exchanges Binance, Coinbase, Bitfinex, Kraken and Bitstamp. According to CoinGecko, daily trading volumes of transactions in ethereum currently exceed $15.1 billion, behind the same indicator of bitcoin by only 25%. However, the capitalization of ETH is still significantly – 5.25 times – lower than that of BTC.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

EUR/USD. The Fed’s balance sheet has not been growing for several months, and the Treasury has accumulated more than $1.7 trillion in its vaults. As a result, we are seeing a slowdown in the recovery of the US economy, which is likely to still force the government and the Fed to take new measures to stimulate it. Otherwise, instead of a V-shaped rebound, a W-shaped recession will become reality, and Donald Trump will finally lose the already weak chances of re-election.

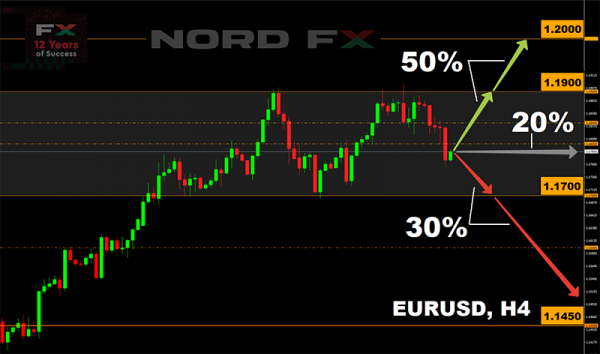

50% of the experts believe that the next stage of pumping the economy with liquidity and other measures of fiscal stimulus will not take long. Therefore, the dollar will continue its fall, and the EUR/USD pair will continue to grow. The nearest targets are 1.1840, 1.1900 and 1.2000.

20% of analysts expect the continuation of the lateral trend of the pair within 1.1700-1.1910, and the remaining 30% believe that within the next few weeks it will return to the area of 1.1450.

Apart from half of the experts, graphical analysis is looking to the north, as well as 80% of oscillators and 85% of trend indicators on D1. The remaining 20% of the oscillators give signals that the pair is overbought.

We are waiting for data on the US consumer market in the coming week, which will be released on Wednesday August 12 and Friday August 14. And if the consumer price index is forecast to stay flat, retail sales could show a decline in July from 7.5% to 1.7%. Also, on Friday, preliminary data on Eurozone GDP for the second quarter will be known;

GBP/USD. Apart from the weak dollar, the Bank of England’s refusal to cut interest rates and increase the asset purchase program plays for the pound. On Wednesday August 12, UK GDP data for QII will be released, which is forecast to have contracted by 20.2%. By comparison, the Eurozone economy fell by 12% over the same period and the US one by 9.5%. And investors assumed that such a difficult situation could force the regulator to take additional stimulus measures. However, the firm position of the Bank’s management should allay their fears and help the British currency not only stay afloat, but also push it further up against the dollar.

This is exactly what 60% of experts believe at the moment, supported by 90% of oscillators and trend indicators on D1. Resistance levels are 1.3185, 1.3200 and 1.3285. 40% of analysts have taken the opposite position. Support levels are 1.2980, 1.2900, 1.2765 and 1.2670. As for the graphical analysis, it draws a continuation of the lateral movement of the pair in the range 1.2980-1.3185 on H4, followed by a decrease to 1.2900;

USD / JPY. 50% of experts, supported by graphical analysis on H4, believe that in the coming days the pair will once again try to test the level of 106.40, and, if successful, rise another 100 points higher. Intermediate resistance is at 106.65. 20% of analysts are in favor of sideways movement, and the remaining 30% are waiting for the pair to fall first to support at 105.30, and then to 104.75. The ultimate target is the July 31 low at 104.18.

Now a few words about indicators. While their readings for EUR/USD and GBP/USD on H4 showed complete chaos and relative order on D1, the opposite is true for the Japanese yen. It is almost impossible to bring indicator signals on D1 to any denominator. But on H4 65% of oscillators and 80% of trend indicators are painted green. However, the number of oscillators signaling the pair is overbought is also quite large: 25%. And 10% of them have taken a neutral position, painted grey;

cryptocurrencies. Bloomberg experts confirmed the forecast for the value of bitcoin at $20,000 by the end of this year. “After a slump of 60 percent in 2014, the value of the coin increased several dozen times over the following three years. The decline in 2018 was about 75 percent. Bitcoin had previously approached $20,000 and even took the corresponding barrier, but quickly slipped. In the current reality, the coin has every chance to gain a foothold at peak values,” Bloomberg experts say.

The value of the cryptocurrency may also be affected by macroeconomic factors, including the policy of low rates of the US Federal Reserve. Many large countries are trying to get out of the crisis as soon as possible, and therefore allow the drawdown of fiat. Against the background of such fluctuations, bitcoin has a chance to come out on top in investor preferences.

Well-known analyst TV presenter Max Kaiser, who expects a rapid rise in BTC/USD to $28,000, also confirmed his forecast. According to him, bitcoin will not have noticeable levels of resistance before this mark. The December 2017 high in the region of $20,000 will not become it either. “Then a short pullback, and an assault of $100,000 with renewed energy,” Kaiser continued his forecast, though he did not name a time frame for it.

But it was identified by the co-founder of Morgan Creek Digital Anthony Pompliano, who said that the quotes of the first cryptocurrency will reach $100,000 by December 2020. Another popular cryptanalyst, Plan B, indicated a longer term. Based on the Stock-to-Flow (S2F) model, he calculated that bitcoin would rise to the specified mark only by the end of the next year, 2021.

Experts of the Zubr cryptocurrency platform decided to somewhat cool the ardor of enthusiasts. They conducted a study of the volatility of BTC and came to the conclusion that, despite the increased volatility compared to traditional assets, the main cryptocurrency maintains “market equilibrium” most of the time. Analysts at Zubr found that after sharp changes in bitcoin price, in most cases, there is an almost symmetrical percentage move in reverse. This means that soon, after rising above $12,000, the price of bitcoin may return to the $10,000 mark.