The Canadian dollar has fallen versus the US dollar on Thursday with little help from energy prices that are softer after OPEC compliance concerns and awaiting the U.S. non farm payrolls (NFP) to be published on Friday, August 4 at 8:30 am EDT.

Canadian employment data will also be published on Friday. The jobs data has crushed expectations this year, with an outlier in the report published in May. While the forecast remains close to the past two month’s estimate of 11,000 jobs the Canadian economy added 54,500 and 43,300. The US NFP report will get most of the spotlight as the USD will trade based on the indicator release, Canadian dollar investors will be on the lookout for confirmation of a strong recovery north of the border.

NAFTA renegotiations talks will begin in two weeks. Mexico and the US have said they favour a quick resolution to avoid further politicizing the negotiations with upcoming elections in 2018. Today the Mexican Minister of the Economy Idelfonso Guajardo has said that under a best case scenario the NAFTA would not be implemented before the end of 2018.

The USD/CAD gained 0.227 percent in the last 24 hours. The currency pair is trading at 1.2619 awaiting the US and Canadian employment reports from July. The loonie is near a two week low after having rallied for most of 2017 against the USD on the back of rising Trump uncertainty and a sudden change in monetary policy rhetoric for the Bank of Canada (BoC).

The central bank cut rates twice in 2015 to soften the blow to the economy from a drop in oil prices, but as crude has stabilized thanks to the efforts of the Organization of the Petroleum Exporting Countries (OPEC) the central bank had a quick turnaround in June and is now expected follow the July interest rate hike with another in October. The timing of the decision makes sense if the Canadian central bank wants to see if the Fed decides to start reducing stimulus in September and a Canadian rate rise could preempt a rate hike by the Fed in December

Housing prices in Canada, specially in Toronto seem to have come down following a change in regulation and the 25 basis rate hike in June. A second rate hike in October would further cool rising house prices as mortgage prices would climb. Toronto home sales have dropped 40 percent compared to a year ago, but higher prices prevail gaining 5 percent over the same period.

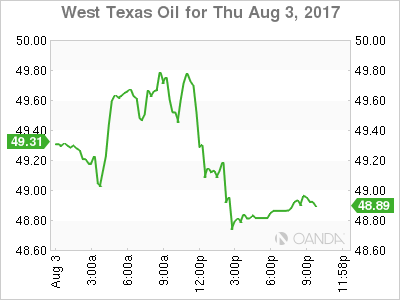

Energy prices fell 1.519 percent on Thursday. West Texas Intermediate is trading at $48.74 after yesterday’s US crude inventories in particular the larger than expected rise in gasoline demand but the rise in Organization of the Petroleum Exporting Countries (OPEC) exports has reversed the trend.

The OPEC and other major producer agreement to limit crude production has stabilized prices but it enters into uncertain territory ahead of a meeting to discuss tighter compliance of members. There have been several voices of dissent and Iraq and the United Arab Emirates (UAE) are seen as wavering as their compliance numbers have slipped. The meeting on August 7 and 8 follows through the meeting in Russia last month where the same topics were discussed.

Market events to watch this week:

Friday, August 4

8:30 am CAD Employment Change

8:30 am CAD Trade Balance

8:30 am USD Average Hourly Earnings m/m

8:30 am USD Non-Farm Employment Change