In July, employment in Australia rose more than expected. However, full-time jobs decreased while the number of part-timers increased. The RBA projects labor conditions improving in the upcoming years and hence boosting the overall economy by driving consumption higher. After the data release, the Australian dollar experienced volatility relative to its US counterpart, rising to a near two-week high later during early European trading hours.

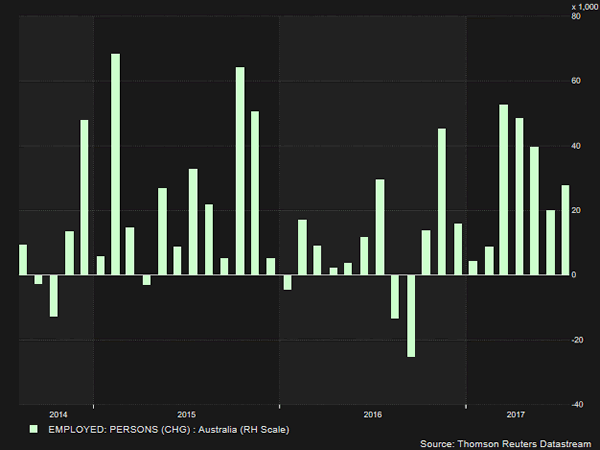

On Thursday, the Australian Bureau of Statistics published labor data for the month of July. The figures showed that the Australian economy created 27,900 new job positions (seasonally adjusted), exceeding the number of 20,000 expected by analysts, which was also June’s reading (upwardly revised from 14,000).

Overall, the participation rate ticked up by 0.1 percentage points to 65.1% while expectations were for the rate to remain unchanged at 65.0%. Turning to the unemployment rate, it slipped as expected to 5.6%, below the 5.7% seen in June and which was the result of an upward revision from 5.6%.

Breaking down the figures, full-time positions fell for the first time since April, posting the largest decline in six months, while part-time positions rose. Particularly, 20,300 full-time positions were lost compared to an expansion of 69,300 observed in the previous month. In contrast, 48,200 part-time jobs were added during July. On a yearly basis though, full-time and part-time employment were up by 197,700 and 41,600 positions respectively.

On Tuesday, the RBA minutes for the latest meeting revealed the confidence the Bank’s policymakers had on the labor market outlook, urging for a switch in focus towards the housing market, where debt levels are extremely high. In general, July’s labor data justify the RBA’s optimism about labor conditions strengthening in the future. However, with full-time positions decreasing, wages are likely to grow slowly instead as full-time payments are those which contribute the most to wage growth. Slowly growing wages are expected to restrict consumption from rising faster.

Concluding with the reaction in the forex markets, the Australian dollar had a mixed response versus the greenback upon immediate release of the numbers but later on built on yesterday’s strength (it finished the day 1.3% higher in yesterday’s trading) to rise to a near two-week high of $0.7962. The pair was last up on the day, though it gave up on a significant portion of the gains it made earlier on the day.