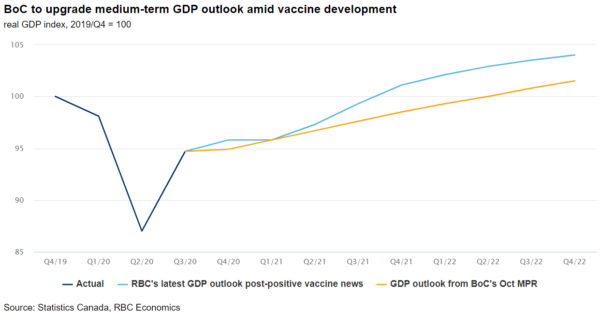

The Bank of Canada’s first rate decision of 2021 is expected to yield no change to its policy stance with the overnight rate holding at 0.25% and the quantitative easing program intact. Along with the rate decision, the Bank of Canada will publish the Monetary Policy Report which will garner more interest. We expect the bank to adjust their economic projections to show a steepening in the growth curve as escalating virus spread and containment measures make a major dent in near-term growth expectations while positive vaccine developments boost projections for the second half of the year.

When the central bank last updated their outlook they assumed that vaccines would not be widely distributed until mid-2022. The timing of that milestone looks likely to occur up to a year earlier with almost half a million doses already administered by mid-January. Further, the vaccines appear to be significantly more effective than initially hoped underpinning optimism that the economy will be able to reopen more substantively over the summer.

Near-term growth concerns have raised some speculation that policymakers could opt for a ‘micro’ interest rate cut – perhaps moving the overnight rate from its already low 0.25% to a smaller but still positive number. We think the bank will look to the substantial fiscal support already in place, including the expanded EI payments and the new CRB, as sufficient to get the economy through the current rough patch and onto a firmer trajectory as vaccinations become more widely distributed.

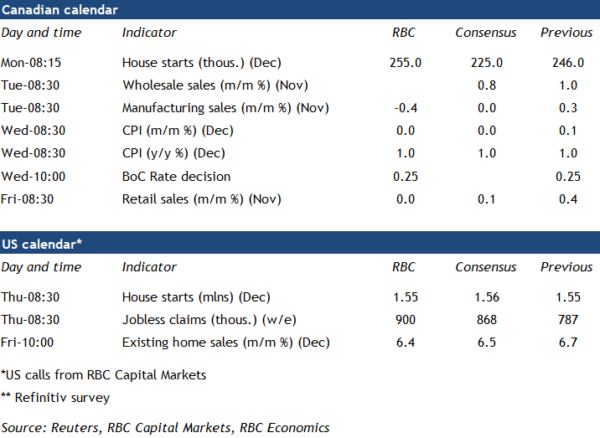

Week ahead data watch:

- Housing starts likely held up well in December amid strong permit issuance data preceding the month. Ontario’s newly announced restrictions on non-essential construction could mean fewer starts in January.

- We expect the headline CPI price index to have remained flat in December, as seasonal strength from food prices offset weakness in other categories.

- StatCan’s preliminary report is that manufacturing sales dipped 0.4% lower in November. Production in the sector, though, likely remained robust with that momentum expected to have continued into December with hours worked rising and PMI showing record improvement.

- The end of 2020 reportedly saw retail sales holding flat in November before dialing lower in December (from our own consumer tracking data) amid added restriction on non-essential retail in Ontario and Quebec.