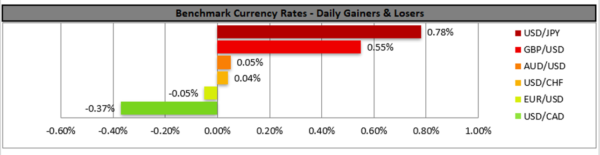

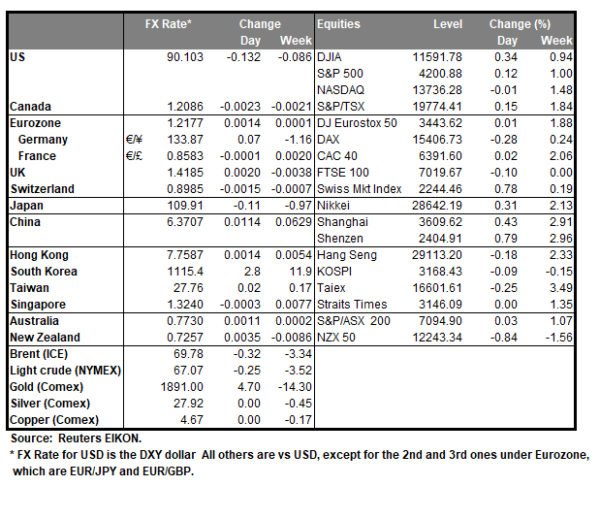

The pound tended to gain against the USD, as well as against the EUR and JPY, as BoE policymaker Vlieghe mentioned the possibility of the bank proceeding with a rate hike late next year, or even earlier should the UK economy rebound more quickly than expected. On the other hand, the USD jumped against JPY, as worries in the land of the rising sun are high concerning the path of the pandemic, the pace of economic recovery and the summer Olympics, while Tokyo’s state of emergency may be extended. The common currency tended to weaken against USD, GBP and CHF as ECB’s De Cos statements hinting that the area’s inflationary pressures are of temporary nature and Panetta’s comments that it may be too early for ECB to taper its QE program maintained a dovish tone and may have invited the bears. Overall, the USD remained relatively stable, providing the chance to other currencies to take the initiative, while the market’s attention is turning to the release of April’s inflationary data as well as the consumption rate. The rise of gold’s price semes to have been paused, given that the USD remained relatively stable halting its weakening and US yields tended to rise as characteristically the US 10-year treasury yield reached 1.62% yesterday. Oil prices tended to be on the rise as the uncertainty about Iranian oil continues, while analysts tend to note that the OPEC+ group may retain its plans to gradually ease its production cuts.

GBP/USD was on the rise yesterday breaking the 1.4145 (S1) resistance line now turned to support. Despite the rise of cable, its overall sideways movement seems to be maintained, hence we keep our bias in favour of its continuation. Note though, that the RSI indicator below our 4-hour chart is above the reading of 50 which may imply that the bulls could have a slight advantage. Should the pair find fresh buying orders along its path, we may see it breaking the 1.4275 (R1) resistance line and aim for the 1.4390 (R2) resistance level. On the flip side should a selling interest be displayed for cable; we may see the pair drop below the 1.4145 (S1) support line and aim for the 1.3990 (S2) level.

USD/JPY also was on the rise, breaking the 109.25 (S1) resistance line, now turned to support and continued to rise testing the 109.95 (R1) resistance line. It should be noted that the main body of the pair’s price action, has remained between the 109.95 (R1) resistance line and the 108.35 (S2) support line and given also that USD/JPY has stabilised just below the 109.95 (R1) level, we tend to maintain our bias for a sideways motion as described above. For our sideways bias to change in favour of a bullish outlook, we would require a clear breaking of the 109.95 (R1) resistance line. Please note that the RSI indicator below our 4-hour chart, has slightly surpassed the reading of 70, which may imply that the pair is overbought and may correct lower. Should the bulls actually regain control over the pair’s direction, we may see it breaking the 109.95 (R1) resistance line and aim for the 110.90 (R2) level. Should the bears take over, we may see the pair breaking the 109.25 (S1) support line and aim for the 108.35 (S2) level.

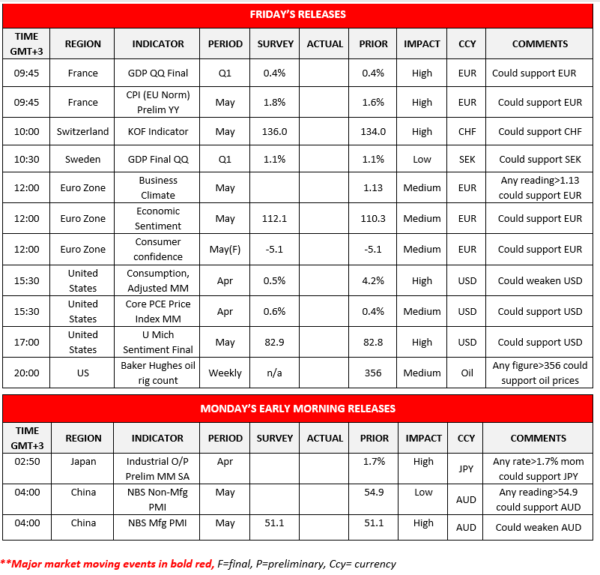

Other economic highlights today and the following Asian session:

Today during the European session, we note France’s final GDP rate for Q1, France’s CPI (EU normalised) rate for May, Switzerland’s KOF indicator for May, Sweden’s GDP rate for Q1, and from the Eurozone the Business climate, economic Sentiment and final consumer confidence indicators all being for May. In the American session, we get the US consumption rate as well as the Core PCE Price Index growth rate, both for April, as well as the final US University of Michigan consumer sentiment for May, while oil traders may be more interested in the weekly Baker Hughes oil rig count. During Monday’s Asian session we note the release of Japan’s preliminary industrial output growth rate for April, while Aussie traders may be more interest on the release of China’s National Bureau of Statistics (NBS) PMI readings for May, with special interest being placed on the manufacturing sector’s reading.

Support: 1.4145 (S1), 1.3990 (S2), 1.3845 (S3)

Resistance: 1.4275 (R1), 1.4390 (R2), 1.4530 (R3)

Support: 109.25 (S1), 108.35 (S2), 107.65 (S3)

Resistance: 109.95 (R1), 110.90 (R2), 111.70 (R3)