Mixed economic data and political turmoil has hurt USD

The US dollar is mixed against majors after staging a comeback late in the week. The USD regained some ground even though the biggest indicator in the market the U.S. non farm payrolls (NFP) report disappointed by adding less than the expected number of jobs (156,000 versus 180,000) but the data point that had more significance was the low pace of growth of wages at 0.1 percent. A third rate hike for US interest rates could be pushed back to next year if inflation does not pick up convincing the Federal Reserve.

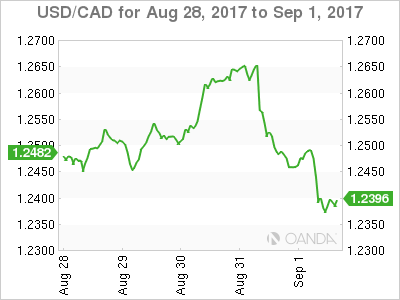

The Canadian dollar was of the biggest movers against the USD. Canadian GDP for the second quarter destroyed expectations with a 4.5 percent quarterly growth when a slight slowdown was expected. The strength of the economy has put a second rate hike to the Canadian benchmark rate firmly on the table. The Bank of Canada (BoC) will be publishing a rate statement on Wednesday, September 6 at 10:00 am EDT.

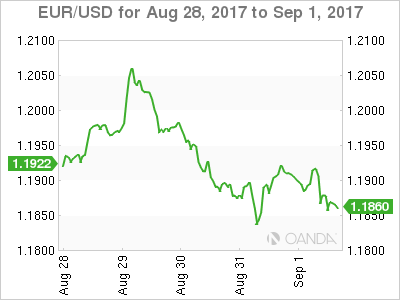

The EUR kept losing ground as the week passed with reports of the council not having a final decision on its plans for tapering quantitive easing. The lack of communication has allowed the USD to appreciate versus the single currency ahead of its September monetary policy meeting. The European Central Bank (ECB) will publish its benchmark rate on Thursday, September 7 at 7:45 am EDT. ECB President Mario Draghi will offer a press conference at 8:30 am EDT. There is a sense of urgency as the ECB Governing council will hold its first formal talk on the subject leaving just two meetings before the end of the year.

The EUR/USD dropped 0.154 percent in the last five days. The single currency is trading at 1.1868 near weekly lows after the USD managed to recover from losses earlier in the week when the pair touched 1.20 only to start sliding downward as positive US data was released. The U.S. non farm payrolls (NFP) was the most anticipated indicator this week and it disappointed with a headline jobs miss and soft wage growth in the United States.

The Trump administration has used hardball tactics ahead of the second round of NAFTA renegotiations that are taking place in Mexico City. Although the treaty itself leaves the door open for any member to exit the deal by giving six months notice, there are winners and losers of the deal in all three countries. American businesses would be hurt by a sudden end to the agreement, although their gain came from the job losses suffered in America that propelled Mr. Trump into the White House. American companies are hard at work lobbying for the deal to be reshaped for the modern world, but instead are getting anxious at Trump’s tweets threatening to end NAFTA. The three nations have signed non-disclosure agreements on the negotiations leaving the market to speculate on the talks as they happen.

The comments from European Central Bank (ECB) President Mario Draghi were thought to be one of the most awaited during the Jackson Hole summit in late August, but failed to bring any light into what the next steps would be for the central bank. With their September monetary policy meeting close at hand, some communication around the timeline of the tapering of quantitive easing. Little word could mean no plans to launch the tapering program in September, leaving it up once again for a December monetary policy with a major decision like in previous years. The ECB will post its rate statement on Thursday, September 7 at 7:45 am EDT and will be followed by a press conference with Mr. Draghi at 8:30 am EDT.

Gold rose 2.44 percent this week. The yellow metal is trading at $1,323.70. The commodity was the biggest winner of a soft August employment report. The lack of a strong wage growth component is putting into question the U.S. Federal Reserve’s plans for a third rate hike in 2017 and helping gold reach higher. The metal had its second best month in August only after January. The threat of North Korea as well as the turmoil in Washington and the impact of Hurricane Harvey had the dollar under pressure from geopolitical events. Macro indicators offered little help with Jackson Hole comments offering no support of the USD and although the ADP jobs report and an improvement on second quarter GDP were offset by the miss of the NFP report.

US Oil prices dropped 1.054 percent this week. The price of West Texas Intermediate is trading at $47.04 after the impact of Hurricane Harvey has caused a glut of crude oil, while limiting the capacity to refine it into gasoline making the price of the distillate soar. The Department of Energy has released 4.5 million barrels of the US strategic reserve destined to be refined in Louisiana to try to keep prices stable until refineries in Texas can reopen.

US oil interests are also under threat as the NAFTA trade talks take place in Mexico City. The treaty has allowed US producers to sell refined products back to Canada and Mexico, but could end up being caught in a tariff war if Trump decides to walk off the negotiating table.

The USD/CAD fell 0.712 percent in the last five days. The currency pair is trading at 1.2384 near weekly lows. The Canadian dollar took advantage of the ills that affect the USD and combined with strong economic indicators appreciated during the week.

The Canadian economy surprised to the upside with a 4.5 percent GDP growth in the second quarter being expectations of a 3.7 percent increase. This makes Canada the best performing country in the G7 and has put a rate hike before the end of the year firmly on the table. The Bank of Canada (BoC) is set to deliver its rate statement on September 6, which could be too early with market analyst favouring the October monetary policy meeting which could give the central bank enough time to see what its American and European counterparts will be launching in September. Bond markets are pricing in a 37.8 percent probability of a rate hike in September, up from yesterday’s 20.9 percent. The October rate hike has a 86.8 percent chance according to fixed income prices.

The Bank of Canada (BoC) will release its rate statement on Wednesday, September 6 at 10:00 am EDT. The better than expected second quarter GDP has increased the probability of a rate hike in September, but the majority of analysts still view October as a more likely scenario. The Canadian benchmark rate sits at 0.75 percent and still 25 basis points below where the rate was in early 2015 before the BoC made two proactive rate cuts.

Market events to watch this week:

Monday, September 4

- 4:30 am GBP Construction PMI

Tuesday, September 5

- 12:30 am AUD Cash Rate

- 12:30 am AUD RBA Rate Statement

- 4:30 am GBP Services PMI

- 9:30 pm AUD GDP q/q

Wednesday, September 6

- 8:30 am CAD Trade Balance

- 10:00 am CAD BOC Rate Statement

- 10:00 am CAD Overnight Rate

- 10:00 am USD ISM Non-Manufacturing PMI

- 9:30 pm AUD Retail Sales m/m

- 9:30 pm AUD Trade Balance

Thursday, September 7

- 7:45 am EUR Minimum Bid Rate

- 8:30 am EUR ECB Press Conference

- 8:30 am USD Unemployment Claims

- 11:00 am USD Crude Oil Inventories

- Tentative CNY Trade Balance

Friday, September 8

- 4:30 am GBP Manufacturing Production m/m

- 8:30 am CAD Employment Change

*All times EDT