Summary

- As was widely expected, the FOMC made no major policy changes at its meeting today. Specifically, the Committee unanimously agreed to keep its target range for the federal funds rate unchanged at 0.00% to 0.25%.

- But the Committee also teed up a rate hike in March when it stated that “it will soon be appropriate to raise the target range for the federal funds rate.”

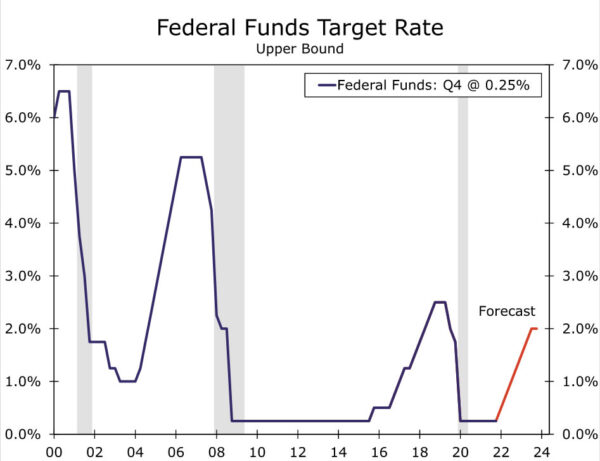

- We look for the FOMC to hike rates by 25 bps per quarter between Q1-22 and Q3-23—a total of 175 bps—but acknowledge that the risks seem skewed toward the FOMC moving at a faster pace and/or by more than we currently forecast if inflation remains uncomfortably high.

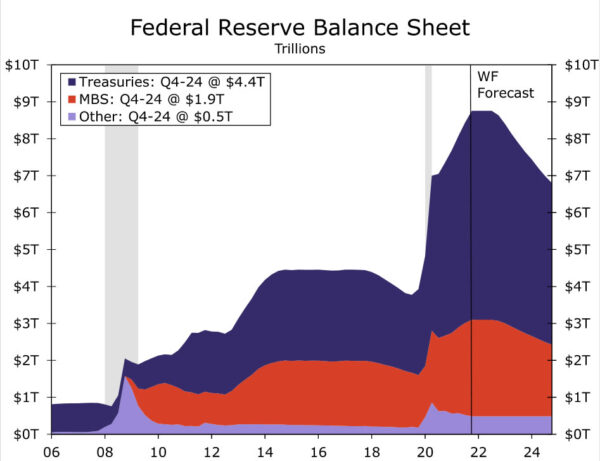

- The FOMC also released a document entitled “Principles for Reducing the Size of the Federal Reserve’s Balance Sheet.” These principles, in conjunction with statements that Chair Powell made in his post-meeting press conference, suggest that the Committee will not rush headlong into shrinking its balance sheet, but that it is moving closer.

- We expect that the FOMC will announce at the September policy meeting that it will begin balance sheet reduction in the fourth quarter, and that the amount of run-off will accelerate over the subsequent few months.

As was widely expected, the Federal Open Market Committee (FOMC) made no major policy changes at its meeting today. Not only did the Committee unanimously decide to keep its target range for the federal funds rate unchanged at 0.00% to 0.25%, but it also will continue to “taper” its purchases of Treasury securities and mortgage-backed securities (MBS) by $20 billion and $10 billion respectively per month. At this pace of tapering, the Federal Reserve is set to end its asset purchases in March.

But if there were any questions about when the FOMC may begin to tighten policy, they were answered by today’s statement. For starters, the Committee dropped its opening paragraph in which it has previously said that it was “committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.” In other words, it appears that the FOMC does not think the economy is being “challenged” anymore. More tellingly, the statement said “with inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate.” And in his post-meeting press conference, Chair Powell said that there was “very strong support” on the Committee for moving soon.

The statement also noted that “risks to the economic outlook remain, including from new variants of the virus.” The Committee also said it “would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.” But unless the economy comes completely off the rails between now and the next FOMC meeting on March 16, we think the Committee will announce a 25 bp hike in its target range for the fed fund rate at that meeting (Figure 1). Furthermore, we look for the FOMC to hike rates by 25 bps per quarter through the second half of next year. In sum, we forecast that the FOMC will lift its target range for the fed funds rate to 1.75% to 2.00% by Q3-2023. That said, the risks seem skewed toward the FOMC moving at a faster pace (i.e. more than 25 bps per quarter) and/or by more than we currently forecast if inflation remains uncomfortably high.

The FOMC also released a document entitled “Principles for Reducing the Size of the Federal Reserve’s Balance Sheet.” The Committee continues to see “changes in the target range for the federal funds rate as its primary means of adjusting the stance of monetary policy,” and that it “intends to reduce the Federal Reserve’s securities holdings over time in a predictable manner.” Chair Powell also indicated in his press conference that discussions about how and when to reduce its balance sheet are just beginning.

To us, this all means that the FOMC will not rush headlong into reducing the size of its balance sheet and once it does, it intends to be more or less on autopilot. As we discussed in a recent report, we forecast that the FOMC will announce at the September policy meeting that it will begin balance sheet reduction in the fourth quarter, and that the amount of run-off will accelerate over the subsequent few months (Figure 2).