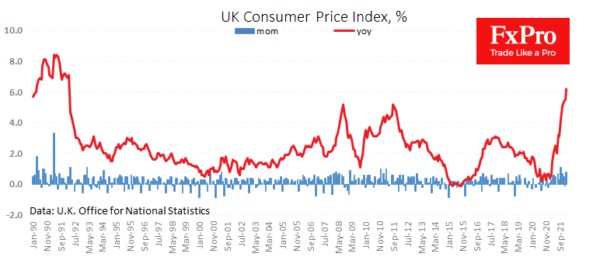

After the traditional January reset, UK consumer prices continued their flight. Morning data showed that CPI rose by 0.8% last month and 6.2% year-over-year. This data is 0.2 percentage points above market expectations, indicating that prices rise faster than initially forecast.

Last week the Bank of England indicated that inflation could peak near 8% but failed to vote unanimously to raise rates. In contrast, it would be much more logical to speed up rate hikes with inflation accelerating.

The Central Bank’s more dovish stance than circumstances requires turns the market reaction to solid inflation figures upside down. The British currency is under pressure to release stronger-than-expected figures as investors overestimate real bond yields.

This currency reaction to inflation is mainly a characteristic of emerging markets, where confidence that the situation is under the control of the Central Bank is not too strong. So far, we are only witnessing a cautious distrust of the Bank of England by Forex traders.

However, the example of Japan, whose currency has lost over 6% in 3 weeks, clearly shows signs of a loss of confidence in central banks in developed countries which remain on the side of the economy and have not entirely switched over to fighting inflation.