Bitcoin price has been rallying in the past week, trading comfortably above the $47,000 mark in the current trading session. This recent uptrend is largely attributed to a wave of short position liquidations on cryptocurrency exchanges as transaction volume exceeded $120 billion in the past 24 hours. Moreover, most major altcoins exploded to fresh highs, benefiting from Bitcoin’s significant upside breakout. Is this the start of a bullish cycle for cryptocurrencies even though the dust from the war has not settled yet?

Massive crypto adoption from the banking sector boosts demand

Last week, many renowned financial institutions announced initiatives that promote the use and trading of cryptocurrencies. More specifically, the leading investment bank Goldman Sachs reshaped its homepage to feature cryptocurrencies, the metaverse, and digitalization as the latest and most pioneering market themes. This move attracted a lot of attention from investors and social media users, who pointed out that the bank has come a long way from its original assessment, which was that Bitcoin should not be considered an asset class.

In addition, last Thursday Israel’s largest bank, Leumi, announced that it will become the first Israeli bank to provide cryptocurrency trading to its clients. Considering that Israel does not have a regulatory framework for cryptocurrencies yet, this move indicates the willingness of major banks to accelerate the adoption of cryptos to avoid being left out of a swiftly developing market.

El Salvador president announces the issuance of the first Bitcoin bond

El Salvador is aiming to be the first country to issue a Bitcoin-backed bond to fund the construction of the first “Bitcoin City”. The main plan is to use geothermal power from volcanoes to power Bitcoin mining as well as the city’s infrastructure. This might prove a huge development for the crypto space as miners are being pressured by regulators to adopt more sustainable and environmentally-friendly power sources.

More and more businesses launch cryptocurrency features

South Korean tech behemoth LG Electronics announced in its latest annual general meeting on Thursday that it plans to expand its businesses into the cryptocurrency and blockchain sectors. More specifically, their objectives include the creation of a crypto exchange market and the development of blockchain-based software.

In other news, the non-profit organization Luna Foundation Guard (LFG) invested over $1.1 billion in Bitcoin to ensure the sustainability of Terra’s algorithmic stablecoin (UST). Additionally, the firm has committed to accumulate $10 billion worth of Bitcoin for its project reserves, while the firm is claiming to have $3 billion of dry power to spend immediately but it is currently facing some technical issues.

Can Bitcoin’s upside breakout continue?

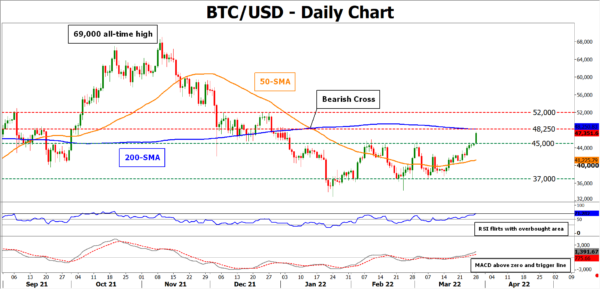

From a technical perspective, Bitcoin’s price profoundly sliced through the upper boundary of its recent sideways move. Should the bullish pressures persist, the price could encounter significant resistance at the $48,250 region, which overlaps with its 200-day simple moving average.

On the other hand, if investors who had entered the market in its recent bull phase liquidate their positions to limit their losses, the crucial $45,000 mark could now act as a supporting floor for the price.