Interest rate differentials have crushed the Japanese yen. The currency is down 18% against the US dollar this year, sinking to its lowest levels in three decades. However, there is light at the end of the tunnel. With the Bank of Japan opening the door for tighter policy and the government rolling out new spending just as the Fed prepares to shift into lower gear with its rate increases, this brutal downtrend seems to be approaching its conclusion.

The story so far

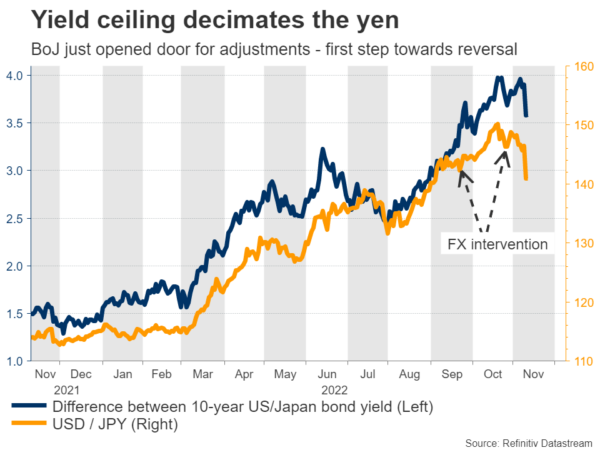

It’s been a stormy year for the yen, and central bank policies lie at the heart of its troubles. Every major central bank has raised interest rates to fight inflation, except for the Bank of Japan. This divergence has caused rate differentials to widen, making the yen less appealing relative to other currencies. In essence, capital is leaving Japan, searching for higher returns abroad.

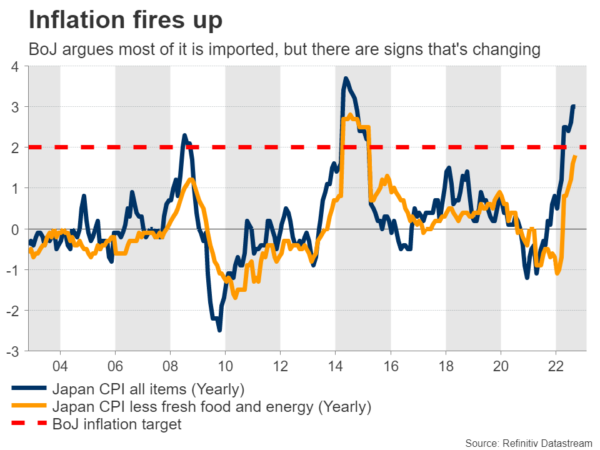

Even though inflation is running at 3%, the BoJ believes this phenomenon is mostly the product of broken supply chains and a severe energy shock, so it will fade away soon. Since wage growth and inflation expectations in Japan remain low, they argue there is little domestically-generated inflation. Therefore, it is unnecessary to raise interest rates in response.

Instead, the government has chosen to defend the currency with direct FX interventions to scare away speculators. The problem with this strategy is that it doesn’t address the source of the problem, it merely slows the bleeding. It is also quite costly as the nation has to burn through its FX reserves, and there are several ways it can backfire.

BoJ capitulates

Yet, the wind of change is blowing. Last week, BoJ Governor Kuroda stated that his central bank could make its yield curve control policy “more flexible” in the future. This yield strategy has decimated the yen, so adjusting it would be the first step towards a trend reversal.

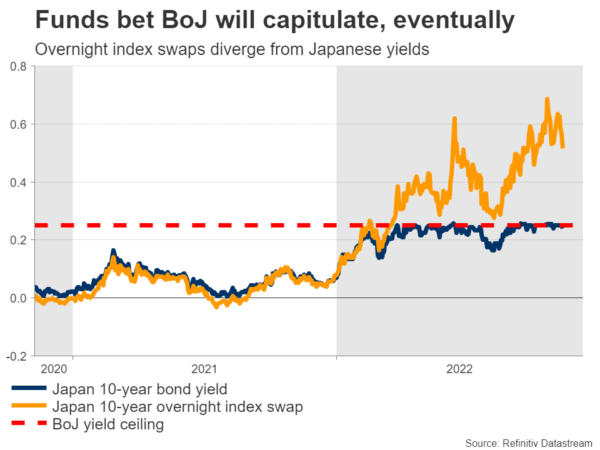

Yield curve control effectively places a ceiling on Japanese bond yields. Every time the 10-year yield attempts to cross above 0.25%, the central bank steps into the market to stop the rally. Since Japanese yields cannot rise beyond this threshold, interest rate differentials mechanically widen against the yen as foreign central banks raise rates.

The possibility of adjusting this strategy was also mentioned in the summary of opinions from the Bank of Japan’s latest meeting. Some policymakers expressed support for an eventual withdrawal of these radical policies, mainly because of signs that inflationary pressures are becoming more entrenched.

Encouraging developments

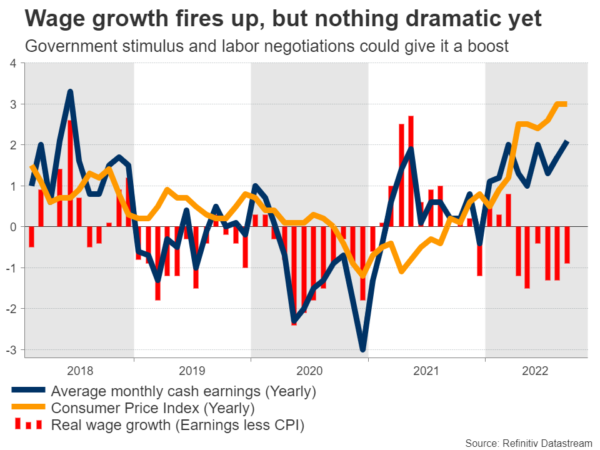

Behind this change in the BoJ’s thinking lies a shift in economic data. There are clear signs that inflationary pressures are finally broadening out into categories beyond energy, giving policymakers confidence that inflation will be more persistent. Arguing the same point, wage growth has fired up lately, although not dramatically.

Another encouraging development was the $200bn economic stimulus package that the government is about to roll out, to help ease the impact of the cost-of-living crisis on consumers and companies. Importantly, this package also includes measures to encourage companies to raise wages, which will be music to the ears of the Bank of Japan.

In fact, Japan’s largest labor organization agreed to seek a 5% pay increase in the upcoming spring wage negotiations, which would be the highest in nearly 25 years. Coupled with the upcoming stimulus package, wage growth could finally be on the verge of a serious acceleration. This would be crucial in convincing the BoJ to recalibrate policy.

Big picture

Overall, the outlook for the yen remains dark, but there is light at the end of this tunnel. Slowly but surely, the interest rate divergence that has crippled the currency seems to be coming to an end, with the Fed slowing down as the Bank of Japan moves towards tighter policy.

Hedge funds are betting heavily on the possibility that Japan’s yield curve control will be loosened and yields will be allowed to edge higher, something evident by the widening spread between Japan’s 10-year bond yield and overnight index swaps. However, the timing of any shift is highly uncertain and will ultimately depend on wage dynamics.

In the rest of the world, several central banks have started to slow down the pace of rate increases as they approach the end of their tightening cycles. Most important among them is the Fed, which signaled it might go down to a half-point rate increase at its next meeting in December. Incoming economic data have corroborated this prospect, taking the steam out of the dollar.

All told, picking bottoms in financial markets is notoriously difficult. While the yen could still hit new lows, the scope for further losses seems limited from here, especially with the government prepared to intervene in the FX market. Any real comeback might be a story for next year, but the yen’s fortunes have started to improve.