The recent rally in the markets may not be over, argues Morgan Stanley, which, however, adds: “let the bulls not rejoice, the Fed’s upcoming pivot on monetary policy will not be good, the worse is ahead of us.”

Since June, the market has rallied on mere suspicion that the Federal Reserve will ease monetary tightening, pivoting, or slowing the cycle of interest rate hikes. However, each time expectations have been defied, with Fed Chairman Jerome Powell preaching that the question of when to moderate the rate of increases is less important than the maximum interest rate and the time frame of the restrictive monetary policy.

Before the pandemic, the Fed’s narrative was to let inflation roll, rather than trying to keep inflation low for too long. This seemed reasonable as inflation is easy to deal with by raising interest rates and slowing economic activity. But the real problem is deflation. It is a very different story as it is an entrenched situation that is difficult to change.

Today, according to Powell, the Fed’s concern is that inflation may take hold, which will cause pain in the economy. Also, he mentioned that If we tighten too much, we can support economic activity, and the window for a soft landing in the economy is narrowing dangerously.

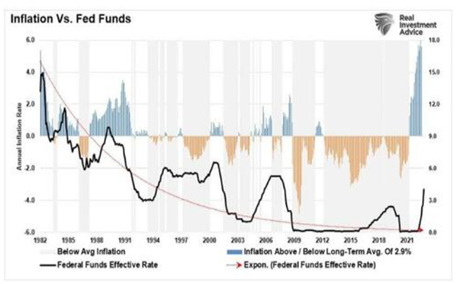

This confirms what we already know, that the Fed is beginning to realize that the risk of a “hard landing” is increasing. However, the reality is that inflation is not much of a problem. If the Fed did nothing, high prices would cure high prices. The real risk remains a deflationary spiral that suppresses economic activity and prosperity. Deflation is a much more insidious problem than inflation in the long run. This is why, for the past decade, the Fed has flooded the economy with liquidity and zero interest rates. Since the ‘’Great Recession’’, inflation has been consistently well below this average and even the target rate of 2%.

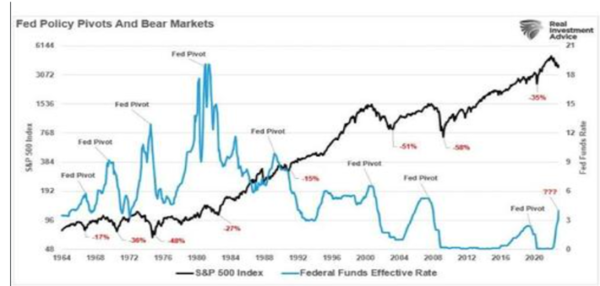

Although monetary interventions and zero interest rates failed to generate organic growth above 2%, they raised asset prices, inflated bubbles, and widened inequality. This leaves only two options for monetary policy. The first is for central banks to put the brakes on interest rates and allow inflation to run its course. Doing so would, of course, lead to a softer landing, but would theoretically stabilize inflation at higher levels. The second option, and the one chosen, is to raise interest rates until the economy slips into a deeper recession. Both options are bad for stocks. Of course, the second is significantly more dangerous as it creates an economic or financial event with serious consequences until the Fed’s aggressive rate hike campaign “breaks” something. Then there will be a “policy shift’’ or a ‘’pivot’’.

The expectation that when the Fed finally makes a “pivot” it will end the bear market may prove futile. Historically, when the Fed cuts interest rates, it is not the end of bear markets in stocks, but rather the beginning. The majority of “bear markets” appear after a Fed’s Pivot. The reason is that change comes with the recognition that something is broken financially (recession or credit event). When this event occurs and the Fed takes action, the market discounts lower economic and profitability rates.

The difference between producer and consumer price indices remains problematic. Historically, this suggests that producers will absorb inflation, eroding profit margins as consumer demand deteriorates due to precision. That could provide temporary relief to stocks in the near term as interest rates fall in anticipation of the change before the reality sets in on how much 2023 EPS estimates need to be cut.

Once the reversal begins, the Fed will cut interest rates to zero and restart the next QE program, which will start the next bull market cycle.

Elliott Wave analysis – SP500

From An Elliott wave perspective we see drop from 2022 highs as a correction, but as long the upper trendline resistance from 4800 holds the change in trend is uncofnrimed. Key bull/bear level is at 4100 area. We need this one broken to make sure price can travel higher.