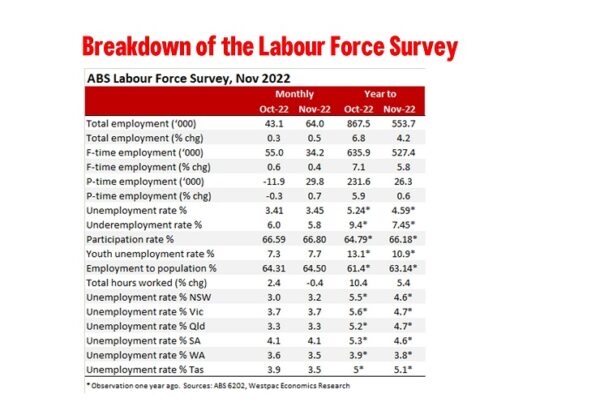

Total employment: 64k from 43.1k (revised from 32.2k); unemployment rate: 3.4% from 3.4% (unrevised 3.4%); participation rate: 66.8% from 66.6% (revised 66.5%). A strong update not just because of the larger than expected gain in employment, and a robust lift in participation to a new record high, but also the upward revisions to both employment and participation.

The 0.5% gain in employment lifted the three-month average increase to just under 40k per month but due to base effect employment growth in the year moderated to 553.7k/4.2%yr from 867.5k/6.8%yr. It also lifted the employment/population ratio to a new record high of 64.5%.

The participation rate increased by 0.2ppt to 66.8% November, returning to the previous record back in June 2022 when it was 1.0ppt higher than before the pandemic. Female participation also returned to the historical high of June, lifting 0.2ppt to 62.4% per cent. Male participation rate also rose 0.2ppt to 71.3%.

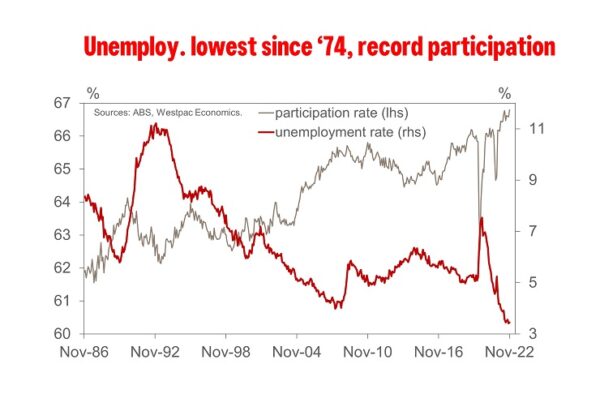

Australian has the tightest labour market seen in a generation (at least) highlighted not just by the lowest unemployment rate since November 1974 (3.4%) but a record high in both participation and the employment to population ratio.

The lift in participation saw the labour force grow 71.3k, more than matching the gain in employment holding the unemployment rate flat at 3.4%; at two decimal place the unemployment rate rose to 3.45% from 3.41% so it only just rounded down.

Our year end forecast for 3.3% (quarter average) is now quite hard to achieve but not because of poor employment outcomes but rather to higher than expected participation thus the labour market is set to end the year in a stronger than expected position.

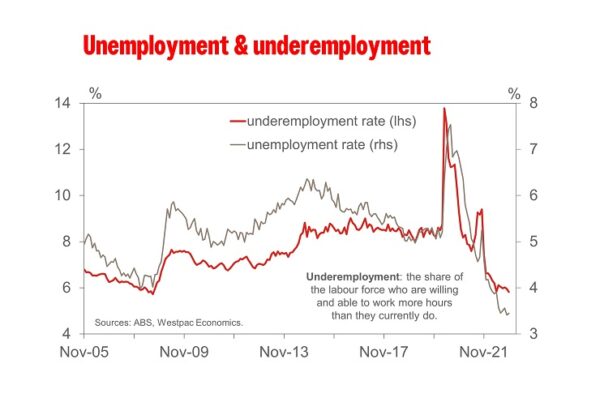

Underemployment, those employed who are willing and able to work more hours if offered them, fell 0.2ppt to 5.8%. Underemployment has been lagging the improvement in unemployment which may have been an indicator that the labour market was not as strong as it first appeared – if the labour market was that tight why were the underemployed being worked harder? We did think that misallocation, underemployed workers were in sectors, or with skills, that were is less demand. Give the recent fall maybe this was part of the story and thus a timing issues as labour is not perfectly mobile or substitutable.

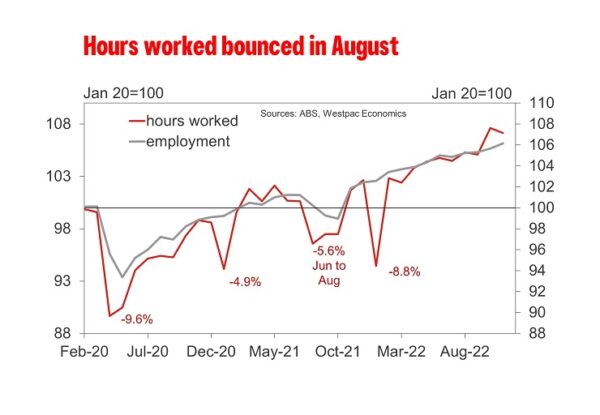

Monthly hours worked decreased by 0.4% in November but following on from a 2.4% surge in October the recovery in hours worked remains ahead of employment. Despite the relatively strong growth in hours worked during 2022, there continued to be a higher than usual number of people working reduced hours due to illness. In November, the number of people working reduced hours due to illness grew by 50k, to 520k which is still around a third higher than we usually see at this time of the year.

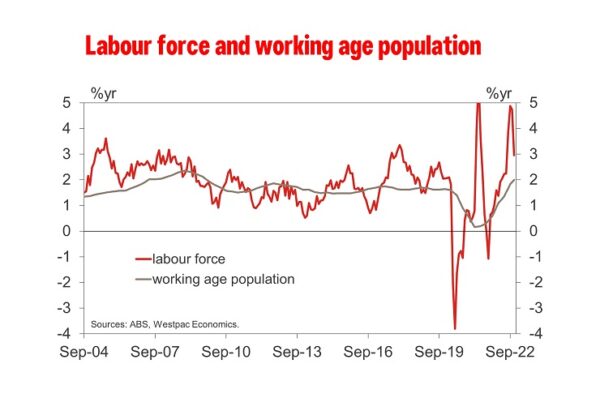

We again note that the Labour Force Survey continues to report a pickup in immigration with growth in the working age population lifting. From around 20k per month last December it lifted to 38.8k in October and lifted by a similar amount in November. Annual growth in working age population has now lifted from just 0.6%yr in December to 2.0%yr which is stronger than the pre-Covid pace of between 1.6%yr to 1.7%yr.