Saudi Arabia and Russian backpedalling popped oil’s balloon on Friday as Hurricane Nate props up prices in Asia.

The rot set in as both Russia and Saudi Arabia seem to backtrack on their comments that a one-year extension of the production cut was a done deal, with comments softening this stance to an “all options are on the table” tone. This was more the straw that broke the camel’s back as it was the excuse that short-term speculators needed to head en-masse for the door and aggressively cut longs into the weekend. One suspects, in fact, this move would have occurred on Thursday had the Saudis and Russia not been so upbeat.

Oil has found some relief this morning, with both contracts slightly higher at 55.90 and 49.30 respectively, as Hurricane Nate shut down 90.0 % of the U.S. offshore crude production over the weekend. Additionally, much of the refining capacity is temporarily shut across the Gulf seaboard as well as a precaution. The dead cat bounce though suggests that the support may only be transitory.

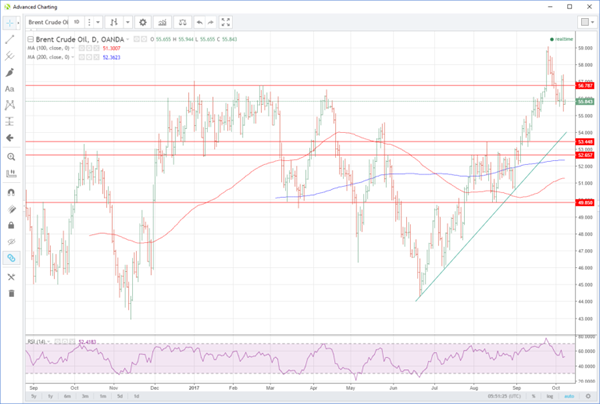

Brent spot has support at 54.90 initially with a break suggesting a test of the trend line support at 54.00 is on the cards. Resistance is now at 57.40, a formidable looking double top.

WTI spot is toying with its 200-day moving average at 49.20 with support close behind at 48.85. A break signals a test of 48.00 and then 47.60, the 100-day moving average. Resistance rests at 50.60 and then 51.00.

Silver’s price action is particularly constructive given the general strength of the U.S. dollar and its lower beta to geopolitical noise then gold. Time will tell as to whether this reflected its more oversold condition, or whether it is a general signal that the worst may be over for the precious metal correction.