On February 14, the Japanese government officially nominated Kazuo Ueda for taking the helm at the Bank of Japan when Haruhiko Kuroda steps down in April. This has left investors scratching their heads to figure out whether and when the BoJ will scale back its ultra-loose monetary policy as inflation continues to creep up. What does the new Governor mean for the financial community and how might the yen perform hereafter?

Kazuo Ueda set to succeed Governor Kuroda

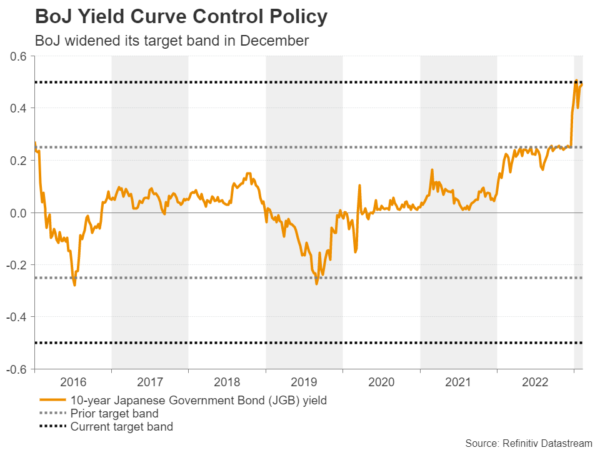

At its December gathering, the Bank of Japan decided to adjust its yield curve control policy for the first time since March 2021. Officials decided to widen the range of the target band on the 10-year JGB yield from ±25 to ±50 basis points around 0%, which raised massive speculation that the Bank may have started its own tightening crusade at a time when other major central banks, like the Fed, are getting closer to the exit.

That said, policymakers themselves poured cold water on such expectations at the January gathering, when they decided not to further tweak their yield curve control policy. Rumors that BoJ deputy governor Masayoshi Amamiya, an outright policy dove, will be Kuroda’s successor disappointed yen bulls further and combined with a spectacular jump in US payrolls, this resulted in a rally in dollar/yen.

Just last Friday, the pair pulled back as the yen regained some ground on the first rumor that Ueda will instead be the government’s choice. Traders jumped to the conclusion that he was very unlikely to be as dovish as Amamiya, but they were quickly disappointed again after Ueda said that the current monetary policy remains appropriate.

Perhaps he tried to avoid expressing his personal opinion or making any bold policy comments before he was officially nominated. The government also nominated Ryozo Himino, a former head of Japan’s banking watchdog, and BoJ executive Shinichi Uchida as deputy governors. The nominations still need approval from the Japanese parliament, but with the ruling coalition holding solid majorities in both chambers, it seems like a done deal.

A hawk or a dove?

So, who is Ueda and what does his nomination mean for the BoJ? Kazuo Ueda is an academic with a PhD from the Massachusetts Institute of Technology (MIT). People who know him say that he is a pragmatic policymaker-type academic, who will be willing to adjust according to the needs of the economy. They say that he is a listener and a consensus builder rather than a person with a strong view and a hard line on monetary policy. This makes it hard to categorize him as either a hawk or a dove.

In a column he published last July, Ueda argued against raising interest rates prematurely, but he highlighted the difficulty of maintaining yield curve control as inflation bites harder and pointed to the flaws of this policy. This may be a first sign that he may not be in a rush to take interest rates out of negative territory, but also that he may not hesitate to scrap yield curve control policy entirely should economic conditions warrant so.

Inflation continues to accelerate, wage growth spikes

Regarding Japan’s economy, the country dodged a recession in Q4, as it returned to expansion after contracting in Q3. However, growth was slower than expected as business investment slumped, suggesting that phasing out loose monetary policy conditions may not be an easy task for the Bank of Japan.

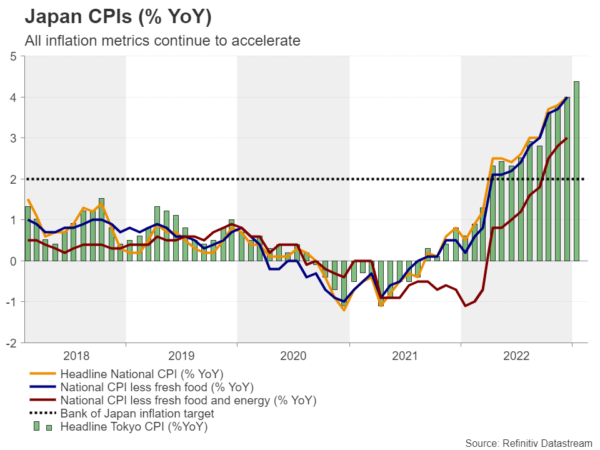

Having said that, though, inflation accelerated to 4% in December in both headline and core terms, which is double the BoJ’s objective of 2% and the highest in 41 years, while the acceleration in the Tokyo CPIs for January keeps the risks tilted to the upside.

The elephant in the room, however, may be the surge in December’s total cash earnings by 4.8% y/y, the fastest pace in 26 years, which led to the first increase in real wages since March despite accelerating inflation. With Governor Kuroda repeatedly stressing the need to keep ultra-loose policy until wages increase by around 3%, it seems strange that the yen did not respond to this data point.

All in all, flying inflation and surging wages are a cocktail that warrants scaling back more accommodation, and that seems to have been the case even before the “shunto” wage negotiations that started on January 23. Should firms agree with unions on pay increases, speculation that the BoJ may need to make another move towards normalization is very likely to increase substantially.

Normalization bets could fuel yen’s engines

With Ueda appearing to be a patient person in terms of interest rates, the focus will be on yield curve control and whether it can be abandoned. Should he become more vocal on that front as he gets closer to taking the spot, the yen’s engines may restart but whether the prevailing downtrend in dollar/yen could resume remains a mystery.

The dollar has been enjoying gains recently as investors substantially raised their implied path with regards to the Fed’s future rate increases, while on top of that, China’s reopening and estimates that the Eurozone may have averted a recession have kept risk sentiment supported and thereby the safe-haven yen weak.

A long way to go before dollar/yen downtrend resumes

For the prevailing downtrend in dollar/yen to continue, a clear dip below 127.20 may be needed. This will confirm a lower low on the daily chart and may pave the way towards the psychological zone of 125.00, marked by the inside swing high of March 28, 2022. If that zone fails to withstand the pressure, its break may set the stage for extensions towards the low of March 31 at 121.25.

Now, if Ueda’s language is interpreted as more dovish than expected, dollar/yen may extend its recovery. A break above 134.80 would take the pair above both the 50- and 200-day exponential moving averages (EMAs) and may allow advances towards the key territory of 138.00. That zone acted as key resistance between December 7 and 16 and provided decent support between November 15 and 28. Should the bulls defeat the bears there as well, they may then extend their march towards the peak of November 22 at 142.35.