U.S. Highlights

- Chair Powell’s testimony threw the market in to risk-off mode with both the Treasury and equity market falling on the week.

- The economy added 311k jobs in February, well ahead of the consensus forecast of 225k, reinforcing the resilience of the job market.

- There’s still plenty of data to come in before the Fed’s rate decision, with next week’s inflation report the most important.

Canadian Highlights

- As widely expected, the Bank left the overnight rate unchanged at 4.5% this week. So far, the economy has evolved largely in-line with the central bank’s expectations, meeting the conditions set to pause on rate hikes.

- Today’s employment report showed that the labour market remained tight in February, adding 22k new positions on top of the blockbuster 150k gain in January. Labour market resilience suggests that the BoC may have to wait longer to see a meaningful slowdown in hiring.

- A significant increase in government payouts and subsidies combined with still-elevated household wealth and savings may be blunting the impact of higher interest rates on consumers, making the usual monetary policy lags even longer.

U.S. – Jobs Market Stays Strong

Chair Powell’s bi-annual testimony to Congress pushed the market into risk-off mode as his explicit remarks put the half-point rate hike back on the table. In his statement, Powell highlighted the strength of the latest economic data, “which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated”.

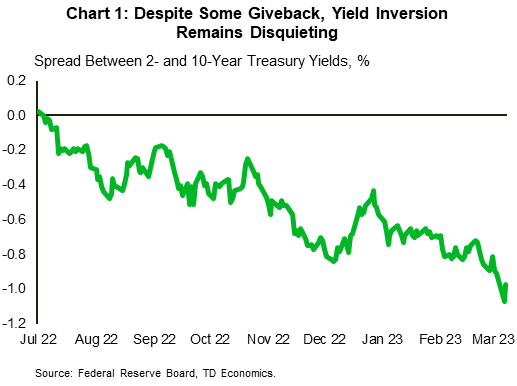

Treasuries plunged to fresh lows, with the two-year yield moving briefly above 5% for the first time since July 2007, while keeping the ten-year yield hovering just below 4%. As a result, the spread between the two (one of the strongest market-based recession indicators) widened to the 100-basis point mark before narrowing back to 90 bps by the end of the week (Chart 1). This is the deepest inversion since 1981. The equity market was as volatile, with the trouble at SVB Financial Group adding to shock. The S&P 500 Index moved below the 4,000-level finishing the week with a 3.4% loss (at the time of writing).

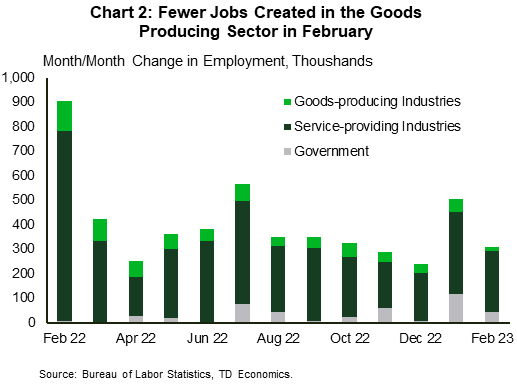

Today’s payrolls report didn’t help settle the markets. The employment number came in stronger than anticipated (at 311k v. 225k expected), suggesting that there is considerable strength in the jobs market. The unemployment rate returned to 3.6% as the labor force expanded, lifting the participation rate to 62.5%. Notably, the monthly increase in the goods producing sector was the smallest since May 2021, with job gains tilted towards the services sector (Chart 2). The trend pace of average hourly earnings growth over the past three months slipped to the slowest pace of growth in nearly two-years. However, hourly earnings don’t adjust for compositional effects across sectors, and have been running well below other metrics in recent months. February’s softness is likely in part due to job gains concentrated in lower-wage sectors and jobs losses in some higher-wage ones.

The tight labor market was also evidenced in January’s Job Openings and Labor Turnover Survey (JOLTS). While job vacancies declined to 10.8 from an upwardly revised 11.2 million in December, they remain high, suggesting that demand for workers exceeds supply – a condition that will continue to support wage growth.

There’s still plenty of data to come before the Fed’s March 21-22 meeting, when the Fed decides on the rate hike and releases updated economic projections. Next week, we’ll have more details on CPI and retail sales for February. The former has more bearing on the rate decision, as it makes up the second half of the Fed’s dual mandate (besides maximum employment), while the latter may contribute to the Fed’s understanding of consumer spending momentum. To convince FOMC members to keep the same pace of rate hikes as in December, price changes would need to provide evidence of a decelerating trend. Today, the probability of a 50-basis points hike settled around 40% – higher than 28% last week but lower than more than 70% earlier this week.

Canada – BoC on Hold Amid Defiant Labour Market

It was on eventful week, with both the Bank of Canada interest rate announcement and jobs data on the docket. As expected, the Bank left the overnight rate unchanged at 4.5%. So far, the economy has evolved largely in-line with the central bank’s expectations, meeting the conditions set out for the Bank to pause on rate hikes. Economic growth continued to slow, coming to a halt in the final quarter of last year. The Bank noted that the labour market remained very tight, however it is not yet worried about it, expecting demand for workers to ease in the coming quarters. Ditto for inflation, which it expects to slow from 5.9% in January to around 3% by the middle of this year.

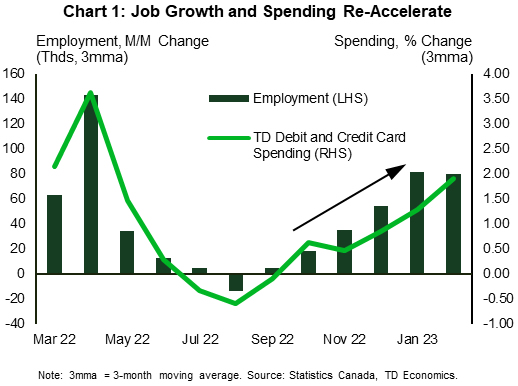

It is likely a matter of time before a slowdown shows up in the employment numbers. However, the latest resilience in job growth suggests that the Bank may need to wait a little longer for this to materialize. Hiring has re-accelerated in recent months, and consumer spending – as captured by debit and credit card transactions – followed suit (Chart 1). Today’s employment report showed that the labour market continued to roll in February, adding 22k new positions on top of the blockbuster 150k gain in January. The unemployment rate held steady at 5%, total hours worked increased and wage growth has accelerated.

The Bank of Canada’s pause contrasted with hawkish comments from Fed Chair Jerome Powell, who noted this week that the incoming economic data has been stronger than expected and the Fed will need to raise rates higher than previously anticipated. This will widen the gap between the two policy rates.

On that note, the BoC Deputy Governor Carolyn Rogers stated every country has different circumstances and needs “to chart its own course to return to price stability.” She noted that Canada’s highly indebted households make them more vulnerable to higher rates than their American counterparts. Indeed, the Bank might be wise to wait and let the economy absorb the 425 basis points of monetary tightening. So far there are no signs of broad-based financial stress among the Canadian households, but many have not yet been exposed to higher debt servicing costs.

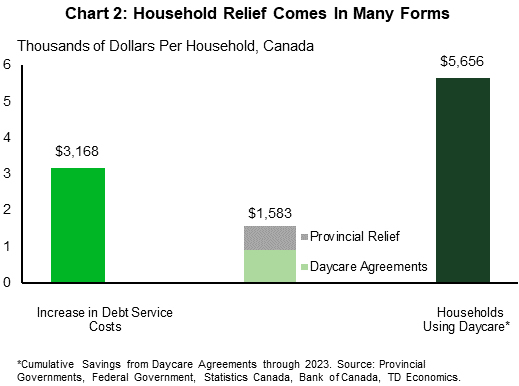

It is also important to be mindful that this economic cycle is not like the others. Households are facing higher rates from a from a relatively strong financial position, with still elevated levels of wealth and savings. This could blunt their sensitivity to rate hikes, making the usual policy lags even longer. In addition, as we note in this week’s perspective, income is getting a boost from a significant increase in government payouts and subsidies, mitigating some of the hit from higher debt servicing costs (Chart 2). This is juicing the economy, running counter to what the BoC is trying to accomplish, and something the Bank needs to keep an eye on as we head into a busy government budget season.