Bumps along the road

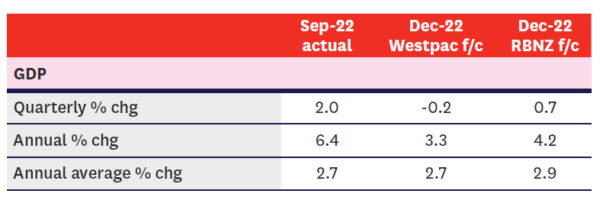

- We expect a 0.2% fall in GDP for the December quarter, following two quarters of extremely strong growth.

- This does not necessarily mark the start of a recession. GDP data has been choppy since Covid, and the details don’t tell a consistent story about whether monetary policy is biting.

- Nevertheless, it does show that the economy is coming from a less overheated starting point than the Reserve Bank thought.

- We think that will nudge them towards a smaller 25 basis point hike at the April OCR review.

Weak Q4 not a sign of recession – yet.

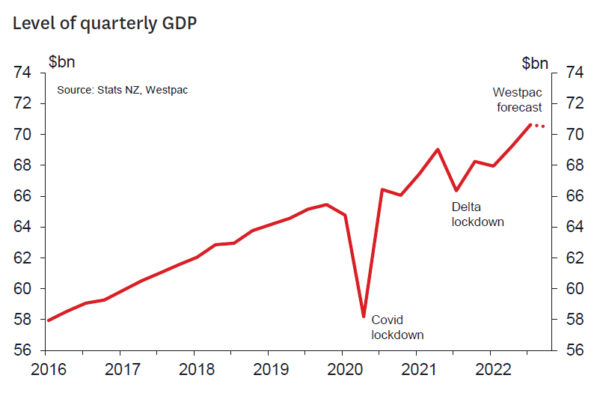

The New Zealand economy went on a tear through the middle part of last year, as the return of overseas tourists lifted GDP by almost 4% over the June and September quarters. Coming off the back of that, we were already bracing for much more subdued growth in the December quarter. But the final batch of indicators released last week actually suggest a slight contraction. We now estimate that GDP fell by 0.2% in the December quarter.

Whether this is a sign that recession has come upon us earlier than expected is unclear. The GDP figures have been choppy since the Covid pandemic, with Stats NZ often having to use alternative data sources, and with the border closure in particular throwing out the normal seasonal patterns in activity. If our forecast is right, this will be the third time in two years that we see a drop in quarterly GDP that wasn’t the result of a lockdown.

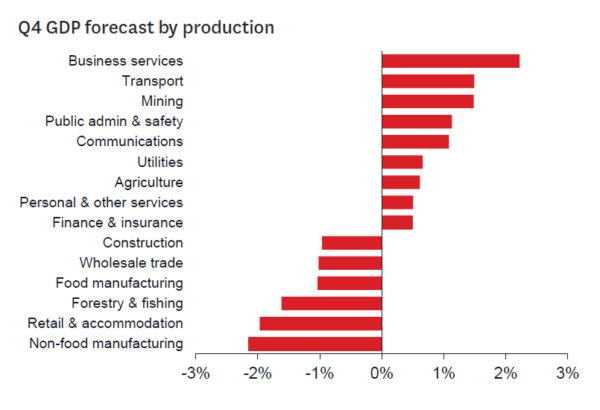

Moreover, the details don’t tell as clean a story as we might like about the Reserve Bank’s efforts to slow the economy. Goods-producing sectors were softer across the board in the December quarter, with retail, wholesaling, manufacturing and construction all likely recording declines. But services sectors are still looking robust – and not just those relating to international tourism, but areas like professional services as well. There’s no obvious reason why tight monetary policy would have such disparate effects.

Some of the higher-frequency data that was genuinely weaker at the end of last year has picked up a little in the last two months. Card spending showed that the December splurge was smaller than usual, but January and February were more like normal. The manufacturing PMI remained below 50 in the December quarter (signalling a contraction in activity), but has risen above that mark again.

Finally, we know that March quarter GDP is going to be affected by the January floods and Cyclone Gabrielle. And as the 2011 Christchurch earthquake showed, the initial loss of activity can end up being almost immediately outweighed by the boost from repairs, replacement and cleaning up. While we did have a small drop pencilled in for March quarter GDP, it’s likely that we’ll end up revising that higher.

Notwithstanding the current volatility in the GDP numbers, we still think that the scene is set for the economy to head into recession later this year. Homeowners will increasingly be rolling onto much higher mortgage rates in the coming months. That will require some belt-tightening on their discretionary spending, until activity is reined back in to more sustainable levels.

We now expect a 25bp OCR hike in April.

Our forecast is around the middle of the range of market forecasts (although almost all locally-based forecasters are picking a negative number). More importantly, it’s looking a lot weaker than the 0.7% increase that the Reserve Bank assumed in its February Monetary Policy Statement. That doesn’t preclude the case for tighter monetary policy – the economy is still coming from an overheated starting point, just not as much as the RBNZ thought.

The RBNZ’s February projections sat somewhere between a 25 and a 50 basis point hike at the next OCR review on 5 April. Previously we favoured a 50 point move, on the basis that the RBNZ’s recent tactic have been to move quickly towards where it thinks the OCR needs to be. But with the likelihood of a much weaker than expected GDP result – and effectively no other major data releases between now and April – we now expect the RBNZ to lean towards a smaller 25 basis point increase.

For now we’ve kept the peak of our OCR forecasts at 5.50%, with two further 25 basis point hikes in May and July. The April review is not a full Monetary Policy Statement so the RBNZ won’t be publishing new projections anyway. But in February there was a sense that the RBNZ has deferred the question of how high interest rates will need to go until the May review, when they will have a better sense of the inflationary effects of both the cyclone’s impact and the fiscal response.