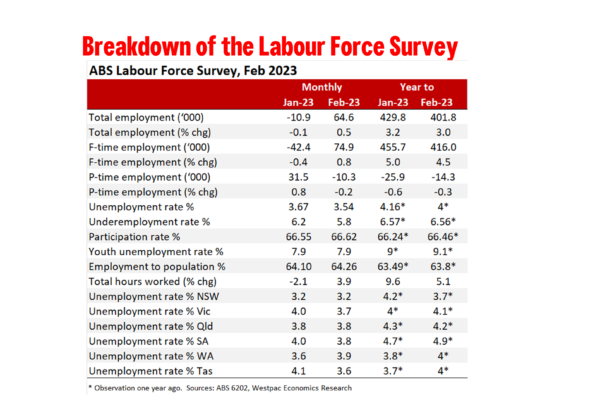

Total employment: +64.6k from –10.9k (revised from –11.5k); unemployment rate: 3.5% from 3.7% (unrevised 3.7%); participation rate: 66.6% from 66.5% (unrevised 66.5%).

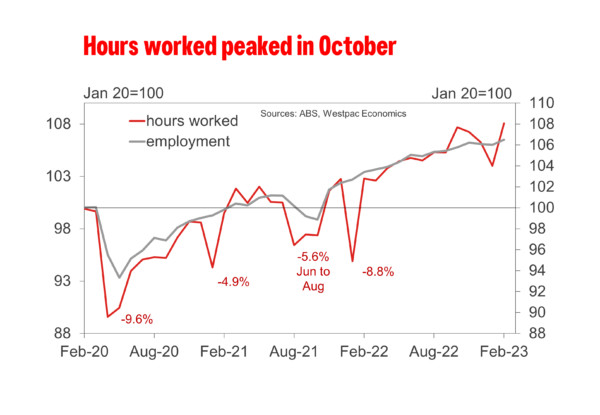

Total employment rose by 64.6k (0.5%) in February 2023, more than reversing the two consecutive monthly declines in January (–10.9k) and December (–16.6k). Accordingly, seasonally adjusted hours worked increased by 3.9% in February, much larger than the increase in employment.

Revisions to the recent history of the series has also seen a slight improvement in the pace of employment growth leading into year-end, and a slightly more muted pace of job declines over the December and January period.

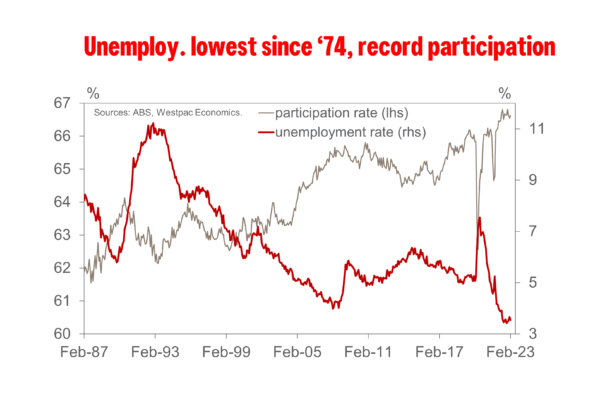

The February print therefore confirms our expectations that the softer pace of jobs growth observed over the December and January period, albeit material, was exacerbated by quirks around holiday seasonality, suggesting that the Australian labour market has begun the year on a firmer footing than what was initially anticipated.

In particular, the January survey reported a larger-than-usual number of people waiting to start a new job, which as a proportion of the labour force, rose from a pre-pandemic average of around 4% to 5.2% in January 2023. The ABS reports that a majority of these people returned to their jobs in February, hence the bounce in employment growth.

Reflective of the fact that many of these individuals were likely not counted as part of the labour force in January – not actively searching for work given they have a job to go to – the participation rate increased by 0.1ppt to 66.6% in February. The employment-to-population ratio also lifted by 0.2ppt to 64.3%, just shy of the 64.5% record high observed in November.

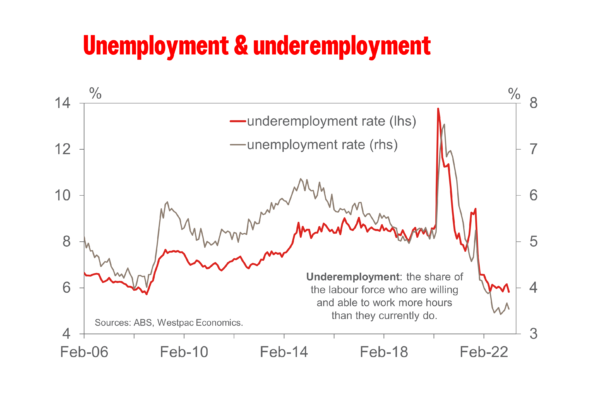

The lift in participation saw the labour force grow by 48.1k, lower than the gain in employment, resulting in the unemployment rate falling to 3.5%, rounded to two decimal points, the decrease (from 3.67% to 3.54%) amounted closer to just 0.1ppt. The underemployment rate also posted a substantial decline, down from 6.2% to 5.8%, which alongside the improvement in unemployment and hours worked, suggests that all of the employment gained was full-time, with some switching from part-time to full-time also evident.

The gains in employment look to have been broadly based across the nation with all major states posting an increase, led by Vic (+0.3%), following SA and WA (+0.2%) then NSW and Qld (+0.1%). The unemployment rate held flat in NSW (3.1%) and Qld (3.8%), declined in Vic (-0.3ppt to 3.7%) and SA (-0.2ppt to 3.8%) and rose in WA (+0.2ppt to 3.9%).

Overall, the February report does suggest that the Australian labour market has begun the year on a firm trend, though we do expect outcomes to soften moving into the second half of the year. We are processing the numbers and working through how they will impact on our current labour market forecasts.