- Better than expected US non-farm payrolls for April have failed to ignite US dollar bulls.

- Two outliers; the safe haven currencies, CHF and JPY underperformed against the US dollar due to the resurgence of risk-on behaviour in the US stock market.

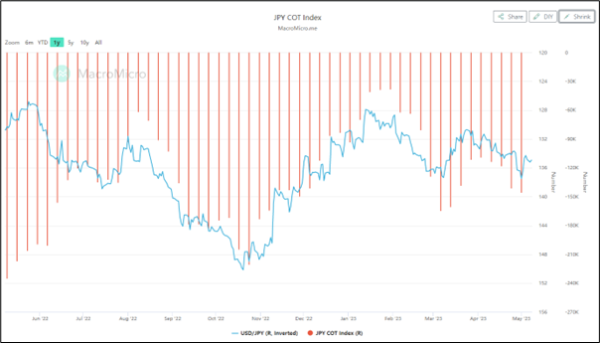

- JPY future’s bearish positioning has highlighted a risk of a short-term revival of JPY’s strength.

Last Friday, the better-than-expected US official non-farm payrolls data (labour market) for April failed to trigger a meaningful rally in the US dollar in general where the US Dollar Index ended the 5 May US session with a loss of -0.16% to close at 101.28, a whisker away from its 100.95 key medium-term support that has been tested twice so far in past four weeks.

Even the recovery in the 2-year US Treasury yield which added 12 basis points to close at 3.92% last Friday reinforced by the rosy US payrolls data that put a halt to the prior three sessions of daily losses has failed to ignite the bulls in the US dollar.

Interestingly, the major currencies that underperformed against the US dollar last Friday were the safe haven pair duo; CHF (-0.5%) and JPY (-0.4%), and the primary driver was the risk-on behaviour seen in the US stock market.

The benchmark S&P 500 has managed to reduce its initial accumulated losses of -2.6% from last Monday to Thursday by more than half, ending last Friday’s US session with a minor weekly loss of -0.8% attributed mainly by stellar returns of Apple, NVIDIA and Tesla that on the average contributed 26% of last Friday’s S&P 500 daily gain of +1.85%.

Also, the Bank of Japan’s (BoJ) latest guidance from its recently concluded monetary policy meeting in April is still skewed towards maintaining its ultra-dovish stance at least in the short term that is likely to have put a cap on traders’ bet on further JPY’s strength and weakness on the 10-year Japanese Government Bond (JGB) price.

Based on the latest weekly Commitments of Traders report as of 1 May 2023 compiled by the Commodity Futures Trading Commission (CFTC) on US exchange-listed FX futures market on the JPY futures contract (take note that JPY is quoted as the base currency & USD as the variable currency), it has indeed shown that traders’ sentiment is skewed towards a more bearish positioning on JPY.

Trader’s sentiment from the Commitments of Traders report is measured by the difference between the net open positions of large non-commercials (speculators) and the large commercials (hedgers/dealers). A positive number represents net long positions on JPY and a negative number represents net short on JPY.

JPY futures’ bearish positioning is building up

Fig 1: JPY futures net positioning trend as of 1 May 2023 (Source: MacroMicro, click to enlarge chart)

Since 3 April 2023, the weekly reported net open positions on the JPY futures market have indicated a steady increase of net shorts positions on JPY from -109,302 contracts to -145,845 as of 1 May 2023 which suggests that traders’ sentiment on the JPY is getting bearish on an incremental basis.

An important point to note is that sentiment on financial assets can significantly impact their tradable prices in the short to medium term if such sentiment has reached an “overcrowded” positioning situation. Too much bearish sentiment can lead to an upside reversal in the prices of the financial asset (the opposite, contrary opinion effect) and vice versa for too extreme bullish sentiment.

These contrary opinion effects are being triggered easily due to a lack of further catalysts to support the initial “overcrowded” positioning and new related data or news flow that goes against the narrative that built up the initial sentiment.

A closer inspection of the latest sentiment of JPY futures by considering prior positioning levels with the movements of JPY/USD, the current reported net short open positions of -145,845 is coming close to a level of around -205,000 (40% away) that led the JPY to strengthen by +16% against the US dollar from 21 Oct 2022 to 16 January 2023.

Hence, the current bearish positioning of JPY in the futures market seems to be reaching “overcrowding” levels where the risk of an upside reversal (JPY strength) in the short to medium term cannot be ignored. Two likely catalysts are the reduction of the current bullish sentiment status of the US stock market and this Wednesday, 10 May release of US inflation data for April.

USD/JPY Technical Analysis – Post NFP rally has started to fizzle out

Fig 2: USD/JPY trend as of 8 May 2023 (Source: TradingView, click to enlarge chart)

Last Friday, 5 May post-US non-farm payrolls bounce seen in the USD/JPY has stalled at the 38.2% Fibonacci retracement of the prior minor decline from the 2 May 2023 high of 137.77 to 4 May 2023 low of 133.50.

Short-term upside momentum has turned lacklustre as the 4-hour RSI oscillator has failed to make a break above its corresponding resistance at around the 50% and has yet to hit its oversold region (below 30%).

A break below 133.75 intermediate support exposes the next support at 131.80 which is the lower limit of the short-term range configuration in place since 1 March 2023 swing high. On the other hand, a clearance above 135.65 jeopardizes the bearish tone to see the next resistance coming in at 137.70.