While the largest central banks globally are close to concluding an almost 2-year rate hiking cycle, the BoJ is still formulating its action plan. The new governor has yet to make an impact, but maybe this week’s data could influence his determination going forward. Additionally, the yen bulls might finally start to feel a bit more confident and possibly attempt a more sustainable rally against the euro.

What has been happening in Japan lately?

The April 28-29 BoJ meeting failed to satisfy the growing expectations as Governor Ueda opted for a low-key start of his tenure, making no changes at the monetary policy toolkit. The yen did not enjoy the lack of significant announcement(s) from the BoJ, but it has since been recovering against key currencies.

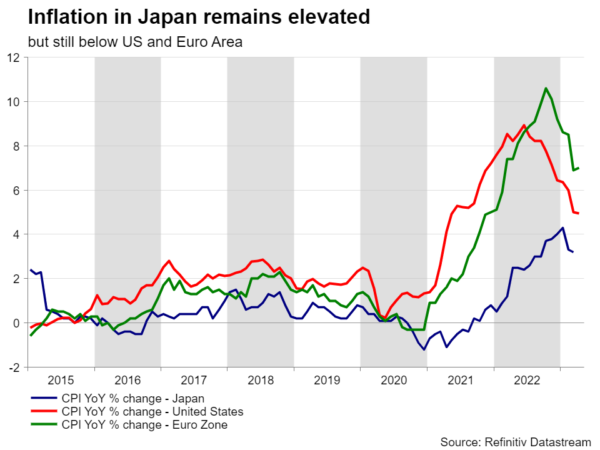

To be fair, the Japanese economy continues to show signs of life, when examining for example the Jibun PMI services for April and the consumer confidence survey. If we add to this mix the significant upside surprise at the April Tokyo CPI figures, then the country might be finally seeing light at the end of a long tunnel.

However, the BoJ remains extremely careful. The first version of meeting minutes – the full version will be published on June 21 – did not reveal much change from the Kuroda era. Interestingly though, the BoJ is focusing a lot on wages. Japanese employment has traditionally been high, but wage increases remained negligible. This changed dramatically this year with strong, above-inflation increases that should fuel consumer spending going forward. The BoJ is keen on sustainable wage increases, but it cannot intervene in the wage negotiations.

The market is clearly uncertain about BoJ’s next move, and prices in a very small chance of a policy rate change for the foreseeable future. This does not exclude tweaks in the YCC framework of course. And here lies a more medium-term issue for the BoJ. The other central banks are very close to concluding their rate hikes cycles, which means that they have built up some ammunition and are ready to react when the economy eventually slows down or even enters a recession. The BoJ though has very few available tools left to provide accommodation, as it already buys and holds a significant amount of Japanese bonds and Japanese stock ETFs.

First quarter GDP and national CPI – the starting point of Ueda’s tenure

In this environment we get a plethora of data. The national CPI print on Friday should confirm the stickiness of inflation at decent levels, especially when examining the performance of the last three decades. A weak set of data would not go down well for the BoJ and would complicate Ueda’s approach.

Additionally, on Wednesday we get the preliminary GDP for the first quarter of 2023. With the US and German prints surprising on the downside, there is sizeable risk for a similar outcome. The yen pairs are not expected to react lightly to a combination of weak data releases. To conclude, the annual G7 heads of state meeting will be held in Hiroshima on May 19-21; the Ukrainian developments and China are expected to dominate discussions.

Yen tries to find its footing

Yen bulls are staging a decent pullback as they try to partly limit their losses from the strong rally that has been in place since March 7, 2022, and has resulted in the highest level of 151.61 since October 2008. This 15-year high has many explanations and ties up well with our analysis above.

Looking ahead, the yen bulls would enjoy a move below the 145.71 level in order to erase the latest upleg. The momentum indicators appear to be on their side at the moment, but the euro bulls have not lost their confidence. They acknowledge the need for a local trough and appear to be preparing for the next move higher with the first target being the October 21, 2022 high of 148.39.