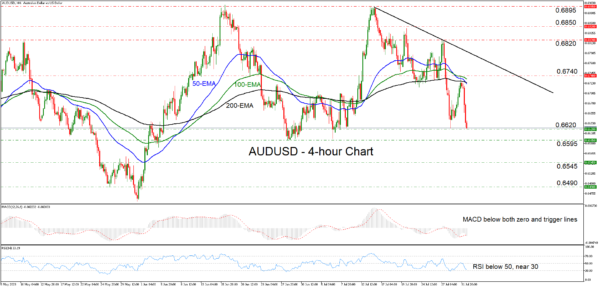

AUDUSD tumbled on Tuesday after the RBA decided to refrain from lifting interest rates, with the pair falling all the way down to the low of July 28 at around 0.6620. Overall, the price structure remains of lower highs and lower lows below the downtrend line drawn from the peak of July 14, which keeps the short-term outlook bearish.

Both the RSI and the MACD are detecting negative momentum, corroborating the view that the pair may be poised to continue drifting south for a while longer. The former lies below 50, close to its 30 line, while the latter runs below both its zero and trigger lines, pointing down.

A decisive break below 0.6620 would confirm a forthcoming lower low on the 4-hour chart and may initially target the 0.6595 zone, which offered support on June 28 and 29, as well as on July 6. If the bears are not willing to stop there either, then they may decide to extend their march towards the 0.6545 territory, which acted as a resistance back in May.

For the outlook of this pair to brighten, the bulls have a lot of work to do. They may need to climb all the way above the 0.6820 zone, as such a break will confirm the pair’s return above the aforementioned uptrend line and perhaps above all three of the plotted exponential moving averages. The next stop may be at around 0.6850, the break of which could carry extensions towards the 0.6895 barrier, which stopped the bulls from driving further north both in June and July.

To sum up, AUDUSD suffered heavy losses today after the RBA decided to remain on hold, with the broader picture pointing to a near-term downtrend that may be poised to extend to lower levels.