Summary

- We look for the FOMC to keep its target range for the federal funds rate unchanged at 5.25-5.50% at its meeting on September 20. Most market participants expect rates to remain on hold as well.

- Recent data suggest that the U.S. economy generally remains resilient despite the 525 bps of rate hikes that the FOMC has delivered since March 2022. That said, it appears that the monetary tightening of the past 18 months is beginning to have its intended effect. The labor market is becoming less tight, and price pressures are easing.

- There remains some distance to go before reaching the Fed’s inflation target of 2% on a sustained basis. Therefore, we expect the post-meeting statement will continue to signal that the Committee maintains a hawkish bias.

- The FOMC will release its quarterly Summary of Economic Projections (SEP) at the conclusion of the meeting. We expect that the September SEP will portray a more optimistic outlook for the U.S. economy than the last SEP did in June. Specifically, we look for the FOMC to raise its forecast for real GDP growth this year while also nudging down its outlook for inflation.

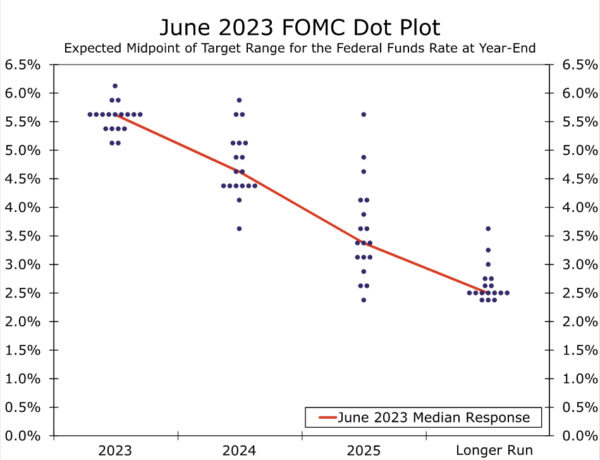

- We do not expect major changes in the “dot plot.” The median dot for 2023 stood at 5.625% in the June SEP, which would imply another 25 bps rate hike between now and the end of the year. We think it will be a close call on whether the median stays at 5.625% in the new dot plot or drops to the current midpoint of 5.375%. We lean toward the latter, though the August CPI report, to be released on September 13, may be the ultimate deciding factor.

- We do not think the median dots for 2024 and 2025 will change much, if at all, though some of the highest dots may be reined in a bit.

Standing Pat in September, but with a Hawkish Bias

After having raised the fed funds target range by 75 bps at four consecutive meetings beginning in June of last year, the FOMC has gradually slowed the pace of subsequent policy tightening. The FOMC hiked rates by 50 bps in December 2022, then slowed the pace of tightening to 25 bps at each of its first three meetings of this year. A “skip” in June followed by another 25 bps hike at its most recent meeting on July 26 suggests that the pace of tightening has slowed even further, consistent with the policy rate nearing—if not already having arrived at—its ultimate destination for this cycle.

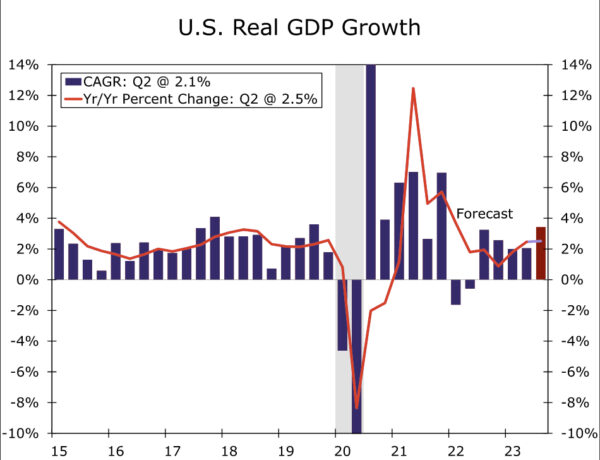

We expect the FOMC will leave the fed funds target range unchanged at 5.25-5.50% at the conclusion of its next meeting on September 20. Economic activity has continued to hold up relatively well considering the 525 bps of cumulative rate hikes since March 2022. GDP growth looks set to strengthen in Q3-2023, underpinned by a pickup in consumer spending (Figure 1). Survey data also suggest that growth has improved over the past few months, with the ISM services index rising to a six-month high in August.

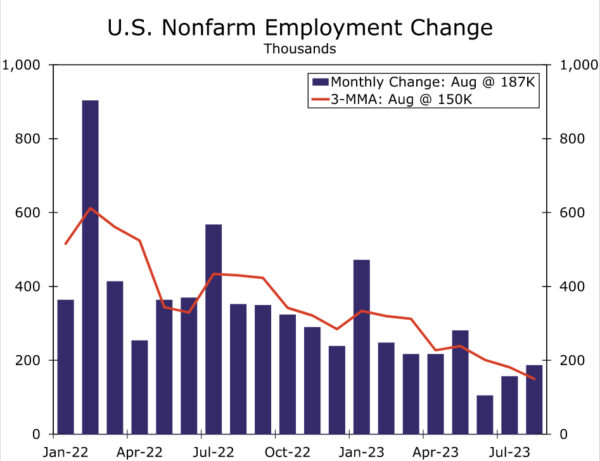

Yet recent data on the labor market and inflation suggest that the policy tightening of the past 18 months is beginning to have its intended effect more clearly. Nonfarm payroll growth has slowed to a three-month average of 150K from a reported 244K when the FOMC last met in July (Figure 2). Supply and demand for labor are moving toward a better balance. The unemployment rate rose to 3.8% in August, its highest rate since February 2022, fueled by a surge in the labor force. Demand for new workers has cooled, as evidenced by a sharp decline in job openings in July; however, low and steady layoffs indicate employers are holding on to existing workers. With businesses more easily meeting hiring needs, labor cost growth has started to slow (Figure 3).

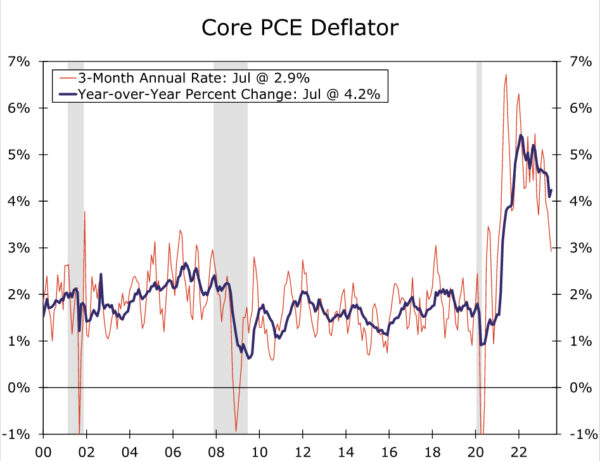

Inflation also has started to make encouraging progress toward the Fed’s 2% goal, even if there remains some distance to go before reaching it on a sustained basis. Core PCE inflation, historically the FOMC’s preferred gauge of the underlying trend in inflation, slowed to a 2.9% annualized rate in July, the first sub-3% reading in two-and-a-half years (Figure 4). Some of the biggest pandemic-era drivers of inflation are fading, with core goods prices declining and housing inflation slowing over the past two months. The FOMC will get one more key inflation reading before its policy decision with the August CPI report on September 13. If core CPI prints in line with the consensus and our own expectations (+0.2% month-over-month), the three-month annualized pace of price increases would slow to 2.0%.

Even if the August core CPI surprises to the upside, we doubt it would spur the FOMC to hike again next week. Policymakers have been stressing that the cumulative amount of rate hikes and uncertainty surrounding the lagged effect of policy changes require moving more cautiously at this juncture of the cycle and assessing a longer period of data before determining its next move. In addition, a few relatively hawkish members of the Committee have indicated they are comfortable leaving the fed funds rate unchanged in September. For example, in an interview on September 5, Governor Waller said that the recent data would “allow us to proceed carefully” and that “there’s nothing that is saying we need to do anything imminently.” Furthermore, the FOMC has been loath to spring a surprise decision on markets. Interest rate futures contracts currently point to less than a 10% chance of a hike next week, a rather low probability if next week’s decision hinged on the outcome of Wednesday’s CPI report.

With progress on inflation still tentative, the labor market cooling only gradually, and GDP continuing to chug along, we expect the post-meeting statement will continue to signal that the Committee maintains a hawkish bias. Specifically, the statement likely will note considerations for “additional policy firming” rather than hint at an extended pause in order to maintain optionality at its following meeting on November 1. The characterization of current economic conditions in the post-meeting statement are likely to be little changed, except for a modest downgrade to the description of recent job growth.

Summary of Economic Projections: A More Optimistic Outlook

The September FOMC meeting will include an update to the Committee’s Summary of Economic Projections (SEP). The last SEP was released at the conclusion of the June 13-14 FOMC meeting, and since then the economy has outperformed expectations. The June SEP contained a median real GDP growth projection of 1.0% for 2023. Based off the strong data over the past few months, we expect this forecast will be revised materially higher, perhaps as high as 2.0%. We suspect the median projection for real GDP growth in 2024 and 2025 will be revised a bit lower to reflect that some of the anticipated slowdown has been delayed rather than forgone, but we doubt the downward revisions will be as big as the upward move for 2023. Accordingly, we expect the median projection for the unemployment rate to tick down by a tenth or two for 2023 and beyond.

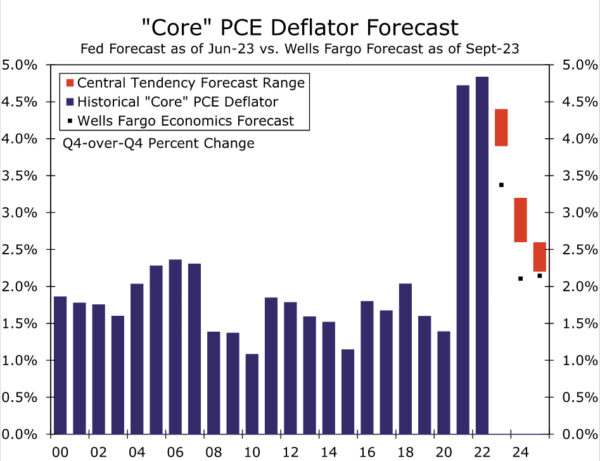

Perhaps even more encouragingly, this more optimistic outlook for output growth and the labor market likely will be accompanied by some downward revisions to the Committee’s inflation projections. As discussed earlier, the slowdown in inflation over the past few months has been impressive. In June, the median FOMC participant expected headline PCE inflation of 3.2% and core PCE inflation of 3.9% for 2023. Our latest forecast looks for headline and core PCE inflation to be 3.0% and 3.4%, respectively, on a year-over-year basis in Q4-2023 (Figure 5). We doubt the Committee’s projection for 2023 core PCE inflation will fall all the way to 3.4%, but 3.6% or so strikes us as plausible. The 2024 and 2025 median projections for core inflation may also tick lower by a tenth or so. If realized, this would mark the first downward revisions to the Committee’s median core inflation projections since 2020, a key sign that the central bank is feeling more confident that it is starting to get price growth back in check.

What will a stronger economy and slower inflation outlook mean for the dot plot? We suspect the answer is not much. Given that inflation continues to recede, we doubt the FOMC will want to signal tighter monetary policy than what was conveyed in the June SEP. That said, we doubt the median dots will fall much either. Committee members probably will be wary of sending an overly dovish signal when the fight against high inflation remains incomplete. The June projections showed a median fed funds rate of 5.625% for year-end 2023 (Figure 6). Assuming the FOMC does not hike rates at the September meeting, the June dot plot would imply one more 25 bps rate hike at one of the two remaining FOMC meetings of the year. We think it will be a close call on whether the median stays at 5.625% or drops to the current midpoint of 5.375%. We lean towards the latter, though the August CPI report, to be released on September 13, may be the ultimate deciding factor. For 2024 and 2025, we do not think the median dot will change much, if at all, though some of the highest dots may be reined in a bit as the case for very restrictive monetary policy in 2024 and 2025 has receded.

The September SEP also will include the initial rollout of the Committee’s projections for 2026, but we doubt this will be a major game changer for markets. We suspect the median projections for 2026 will look much like the “longer-run” forecasts from the June SEP: roughly 2% real GDP growth, an unemployment rate at or slightly above 4%, inflation near 2% and a fed funds rate at or slightly above 2.5%.