- BoE keeps rates unchanged, citing slowing UK economic activity

- Data since then corroborate the gloomy picture

- Upcoming indicators include monthly GDP and industrial production

- Will the pound weaken after they come out on Thursday at 06:00 GMT?

UK business surveys ring the recession alarm bells

At its latest gathering on September 21, the Bank of England decided to keep rates steady at 5.25%, citing slowing economic activity and a cooling labor market. Although officials accelerated the pace of their quantitative tightening program, the disappointment on interest rates resulted in a selloff in the British pound.

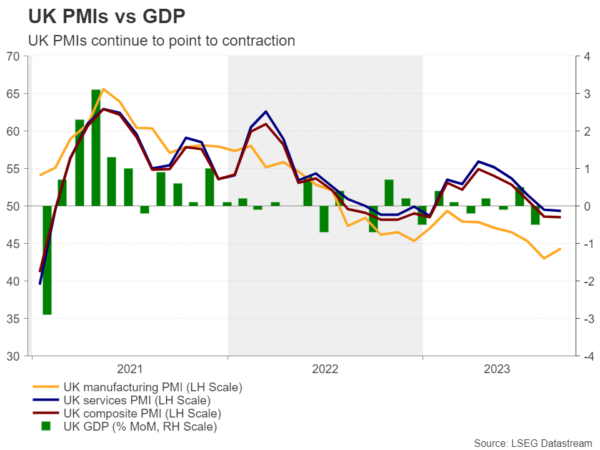

Data since then continued to paint a gloomy picture, with retail sales for August still down on yearly terms and the September PMIs still ringing recession alarm bells. Although the y/y rate of retail sales rose to -1.4% from -3.1%, a negative figure at a time when inflation is cooler than a year ago suggests that consumers continue to struggle. As for the PMIs, although the final releases revealed decent upward revisions from the very disappointing preliminary prints, all the indices remained below the boom-or-bust zone of 50, with the composite index ticking down to 48.5 from 48.6.

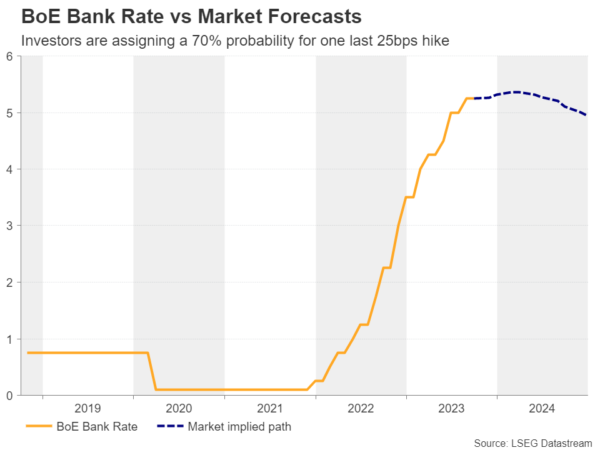

With inflation in the UK coming down faster than expected, the bleak economic outlook and the cautious approach by the BoE have prompted investors to scale back their bets regarding future hikes. Currently, they are assigning a nearly 72% probability for the BoE to stay sidelined at the November 2 gathering, with the remaining 28% pointing to one last 25bps hike. They believe that a final hike is more likely to happen after the turn of the year, with a 70% probability assigned to the March decision. However, this could well change if data continues to come on the soft side.

UK monthly GDP and industrial production are next

On Thursday, the UK releases more growth-related data. The monthly GDP for August is due out, accompanied by the industrial and manufacturing production rates, as well as the trade balance for the month. Although the PMIs are already providing a glimpse of how the economy has performed in September, disappointing results on Thursday could raise concerns that activity in Q3 has been softer than previously thought. Following the 0.5% m/m GDP contraction in July, expectations for August are for a modest 0.2% expansion.

With elevated wage growth being the only data point corroborating more interest rate increases by the BoE, a concerning picture painted by other indicators could force investors to further scale back their hike bets and start considering more rate cuts by the end of next year. Currently, the market’s implied path suggests that interest rates are likely to end 2024 at around 5%, 25bps below current levels.

Pound could stay on the back foot

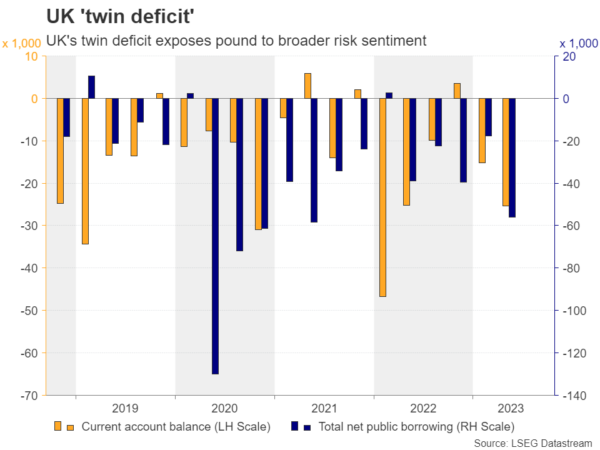

Ergo, the risks surrounding the British pound are likely to remain tilted to the downside, and pound/dollar may be the best proxy to exploit further sterling losses, as the dollar has been receiving support recently from the Fed’s ‘higher for longer’ narrative, but also from concerns surrounding the economic performance of other major economies, like China and the Eurozone. The pound is also affected by the broader market sentiment and in addition by the UK’s twin deficit, which has notably widened in Q2.

Cable has been in a recovery mode since Wednesday, when it hit support around 30 pips above the round number of 1.2000. However, it continues to trade below the key territory of 1.2310, the downside break of which likely confirmed a bearish trend reversal on the daily chart. As long as the pair remains below that zone and below the downtrend line drawn from the high of July 14, there are decent chances for the bears to take charge again and drive the battle back down to, or even below, the psychological zone of 1.2000.

Even if pound/dollar climbs above 1.2310, the chart would still be far from suggesting a positive outlook as the price will only return within the consolidation area that was containing most of the price action between March and September. For the picture to be considered bullish, Cable may need to climb all the way above the 1.2800 zone.