U.S. Highlights

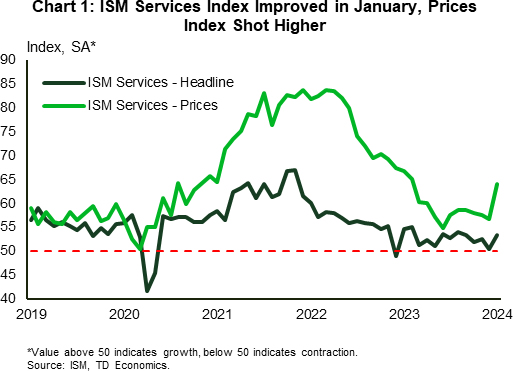

- The ISM Services index, which was on the cusp of falling into contractionary territory in December, improved notably in January, rising 2.9 points to 53.4. The one blemish to the report was a sharp move up in the prices index.

- With little on the data front, a series of Fed speeches took center stage this week. The key message was that with the economy remaining on decent footing, the Fed could afford to show patience on rate cuts. This didn’t interrupt the uptrend in equity markets, with the S&P 500 reaching a new milestone – the 500 mark.

Canadian Highlights

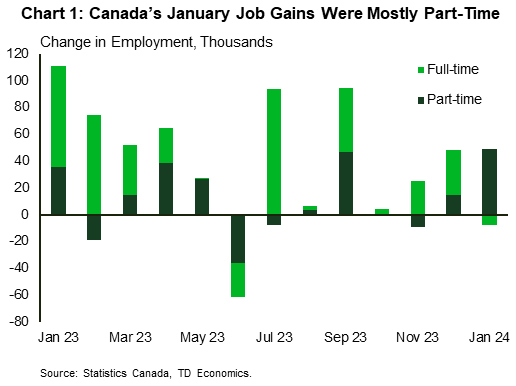

- January’s job gains came in stronger than expected, and the unemployment rate ticked down. However, the details under the hood painted a much more mixed picture of Canada’s labour market.

- December’s merchandise trade balance flipped to a modest deficit as imports rose, supported by strong domestic demand.

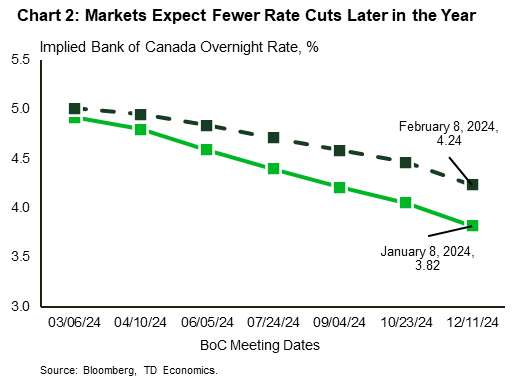

- This week’s messages from the Bank of Canada were hawkish, on balance. Without further progress in inflation, the BoC has little desire to start cutting rates. Given the current economic backdrop, markets price their expectations for the first rate cut to June or July of this year.

U.S. – Fed Officials Continue to Signal Patience on Rate Cuts

Recent economic reports focusing on GDP and employment growth have driven home the point that the U.S. economy remains on solid footing. This week’s limited data provided further support to this view. In this vein, several Fed officials this week reiterated their message that there’s no rush to cut interest rates, with bond yields trending moderately higher as a result. In what appeared to be a return of ‘good news being good news again’, stock markets shrugged off the prospect of interest rates remaining higher for longer and continued to trek higher, with the S&P 500 reaching another milestone by hitting the 5000 mark.

The ISM Services index, which was on the cusp of falling into contractionary territory in December, moved up notably in January, rising close to three points to 53.4. Looking under the hood, gains in three of the four main subcomponents helped lift the index higher. Of note, the employment sub-component flipped to signaling growth, as it jumped 6.7 points to 50.5. The one blemish to the report, was the fact that the prices index shot higher in January (Chart 1). A month of data does not make a trend, but the increase could signal additional inflationary pressure ahead.

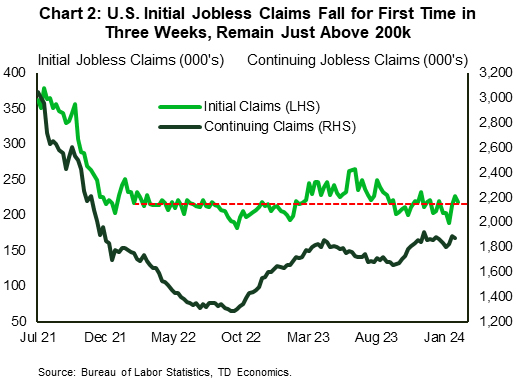

Weekly jobless claims data were consistent with a healthy labor market. Initial and continuing jobless claims continued to head lower (Chart 2). While several companies have announced plans to trim headcount this year, this is not yet being reflected in labor market data, suggesting that other businesses are growing.

With very little in the way of primary data releases, speeches from several Fed presidents and other Fed officials took center stage this week. Overall, the messaging was similar: the Fed needs to see further improvement on inflation, and with the economy on solid footing it can afford to be patient about the timing of rate cuts. Their remarks largely echoed those made by Fed Chair Powell on Sunday. Besides reiterating his message that the Fed is wary of cutting rates too soon, Powell covered a lot of ground in the ‘60 Minutes’ interview. Two comments a bit peripheral to monetary policy stood out. The first was on commercial real estate (CRE), where Powell characterized the risks as a ‘manageable’ problem for larger banks, and alluded to the low probability of a repeat of the events that unfolded during the Global Financial Crisis. However, he did note that some smaller banks that have large exposures to CRE may ‘close or be merged out’.

The other comment from Powell that stood out was his assertion that the U.S. is on an “unsustainable” fiscal path, with debt growing faster than the economy in the long run. To this end, the Congressional Budget Office (CBO) released new 10-year projections this week, which showed that the ratio of federal publicly held debt to GDP will rise from 97.3% last year to record high of 116% by 2034.

Looking ahead to next week, January’s inflation report will take center stage. The BLS released revisions to CPI data this morning, which were relatively minor and left the year-on-year path for inflation broadly unchanged. As for January, the market consensus expects a further moderation in the core measure.

Canada – The BoC to Remain Inflation-Focused

As the Lunar New Year approaches, the Canadian economy strides into the celebration with an upbeat tempo. Employment – the focal point of this week’s economic calendar – came in stronger than anticipated at 37K new jobs in January, and the unemployment rate moved down a tick. This helped lift the equity market for the day, but not enough to push the benchmark index into the positive territory for the week (at least at time of writing). The Government of Canada 5-year bond yield, which got pulled up last week after strong U.S. employment report, gained another 10 basis points.

Delving into the particulars of January’s labour force survey paints a far more complex picture. Signs of softening demand included job gains being largely in part-time positions, while full-time employment edged lower (Chart 1). Furthermore, private sector hiring, which is more sensitive to economic cycles, contributed only 7k positions – one fifth of today’s gain. However, for now, the labour market remains fairly tight. The unemployment rate edged down, and remains low on a historic basis, and average hourly wage growth of 5.3% year-on-year is still too discomforting for the Bank of Canada.

In other economic news, December’s merchandise trade balance flipped to a modest deficit after four consecutive months of surplus. The pull-back in exports was broad-based with the biggest drag coming from motor vehicles and parts exports. Total imports rose for a second month, primarily supported by the rise in consumer goods, indicative of strength in consumer spending, also evident in the latest spend data.

With economic data still showing some resilience, it’s no surprise that this week’s messaging from the Bank of Canada was more hawkish. Both Macklem’s speech in Montreal and January’s summary of deliberations emphasized a pivot in communication. The narrative has shifted from rate levels to the duration of restrictive policies required to tame inflation back to the 2% target. Central to this challenge is persistent shelter price inflation, which risks accelerating amidst relatively buoyant housing market activity. Higher home prices would result in direct implications on ‘owned accommodation’ inflation, but would also increase the cost of renting, amid higher borrowing cost and stretched affordability.

On this point, Macklem cautioned that the Bank has little power to influence house price dynamics, as housing remains chronically undersupplied. This underscores the complexity of addressing inflation as more than half of CPI components are growing at a rate higher than 3%, suggesting that it remains broad-based and stubbornly above the desired threshold. To get these components to decelerate faster requires a stronger pull-back in other parts of the economy. Without this progress, the Bank may be cautious about starting to cut rates. Market reactions have been telling, with the likelihood of a March-April rate cut receding below 30%, and expectations for 2024’s rate reductions adjusting downward (Chart 2).