- Fed will announce its latest decision at 18:00 GMT Wednesday

- Almost certain to keep rates steady, so focus will fall on ‘dot plot’

- Signals of fewer rate cuts this year could help the dollar recover

Solid economy pushes back Fed cuts

The US economy continues to defy expectations. Economic growth is on track to hit 2.5% this quarter, juiced by enormous government spending and solid consumer demand.

Labor markets have shown some early signs of loosening lately, but remain tight by historical standards. While the unemployment rate has risen a little, it is still below 4%, and there are no signs of widespread layoffs. Corporate America isn’t hiring so much anymore, but it isn’t firing workers either.

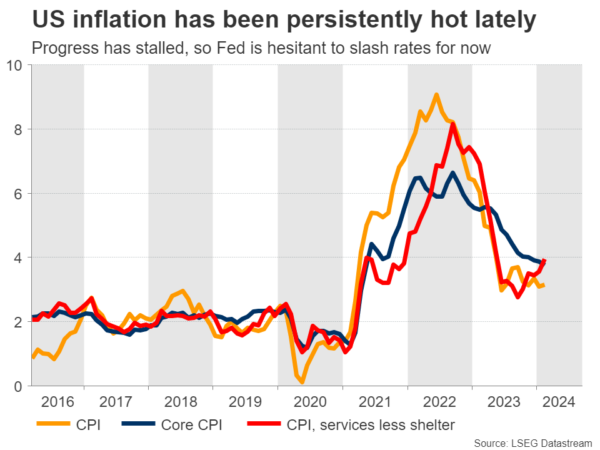

Reflecting this economic resilience, inflation has been persistently hot in recent months. While price pressures have cooled substantially over the past year, the progress has slowed down, with inflation being stickier than investors had hoped. It increasingly seems that the ‘last mile’ in bringing inflation down to its 2% target will be the most difficult part.

As such, investors have unwound bets of heavy Fed rate cuts. The market is currently pricing in just three rate cuts for this year, down from six a few months ago.

All eyes on the dots

Fed officials are almost certain to keep interest rates unchanged on Wednesday. As such, the market reaction will depend mostly on the updated economic forecasts, the new rate projections in the famous ‘dot plot’, and what Chairman Powell says during his press conference.

Back in December, the Fed signaled three quarter-point rate cuts for this year. Yet, considering that inflation has been hotter than anticipated lately, the risk is that the new ‘dot plot’ points to fewer cuts this year, perhaps just two.

Such an outcome would likely be positive for the dollar, and negative for rate-sensitive assets like gold. That said, any such reaction is unlikely to be huge. Investors know that it’s only a matter of time until rates come down, even if the timeline is pushed back a little.

Taking a look at the dollar/yen chart, a spike higher could propel the market above the 50-day simple moving average (SMA) currently at 148.33, turning the focus towards the 148.70 zone. If buyers slice above it, the next resistance barrier might be the 149.70 region.

On the flipside, a Fed that keeps the dots unchanged to signal three rate cuts this year could bring ‘relief’ to investors and spark the opposite market reactions. In this case, dollar/yen could drop towards the 146.45 support area, which roughly encapsulates the 200-day SMA as well.

Note that dollar/yen will also be impacted by the Bank of Japan rate decision, which is due early on Tuesday.

What does the dollar need to rally?

All told, the dollar is the second-best performing major currency this year, slightly behind the British pound. That said, the dollar’s gains have not been very impressive, which is strange since the US economy is stronger than most of its competitors, especially in terms of growth.

One element behind the dollar’s inability to truly capitalize on its strong economic fundamentals has been the sanguine tone in stock markets, which has curbed demand for safe haven assets like the dollar.

Therefore, for the dollar to stage a sustainable rally, it might require a correction in high-flying stock markets. If that happens to coincide with a worsening economic outlook in the rest of the world, it would be the dream scenario for the reserve currency.