- SNB will announce its rate decision on Thursday at 08:30 GMT

- Inflation has cooled, so market is pricing 35% chance of rate cut

- For the Swiss franc, the outlook has started to turn negative

Inflation cools down

The Swiss economy is losing momentum. Economic growth slowed sharply last year, clocking in at just 0.6% in annual terms during the fourth quarter, as domestic consumption moderated while weaker growth trends in the Eurozone and China dampened exports.

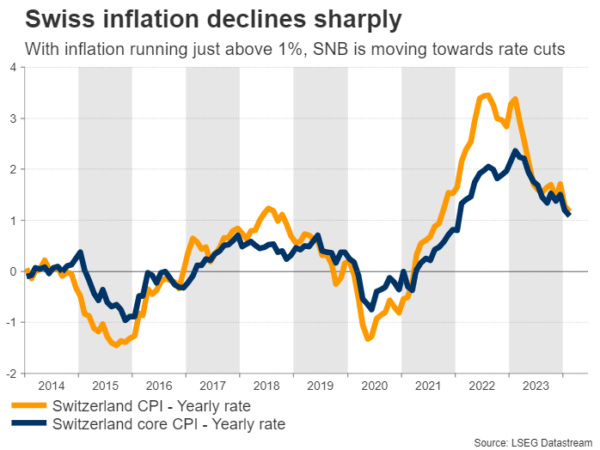

Reflecting this slowdown, inflation has declined dramatically, falling to 1.2% in February. Core inflation was even lower at just 1.1% and the government expects even more softness ahead as it recently revised down its inflation forecasts for this year.

In other words, the war against inflation is over. Instead, the new threat on the radar might be a recession if growth remains so fragile. This suggests lower interest rates are coming.

SNB to set the stage for rate cuts

With growth nearly stagnant and inflation running well below its target, the Swiss National Bank certainly has the conditions necessary to begin cutting interest rates. Markets assign a 35% probability that this could happen as early as this week.

More importantly, a rate cut is fully priced in for the June meeting, so investors are saying it is only a matter of time until the SNB takes action to support the economy.

It’s a close call, but admittedly, the argument for waiting until June seems stronger. Although the economy has lost steam, it has not fallen off a cliff either, and historically speaking the SNB usually prefers to wait until larger central banks like the ECB make their own moves first.

Hence, this might be the meeting where the SNB simply opens the door for a summer rate cut. Looking at the dollar/franc chart, the levels that could come into play on this decision are 0.8950 on the upside and 0.8870 on the downside.

Franc outlook is increasingly grim

Either way, the outlook for the Swiss franc has started to shift to negative. While the franc was the best-performing currency of 2023, the landscape has changed drastically this year, with several of the factors that bolstered the franc going into reverse.

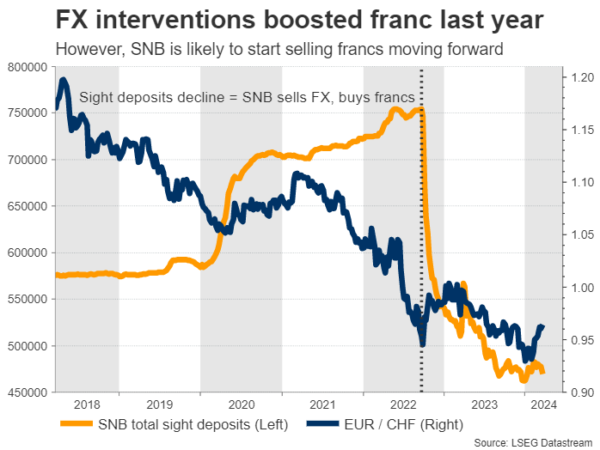

Chief among those is the SNB’s strategy on FX interventions. Last year, the SNB was consistently buying francs on the open market, to help the currency appreciate and dampen imported inflation in the process. But with inflation cooling off, there’s no incentive to do that anymore.

Incoming data confirms the SNB has stopped buying the franc, and with inflation running so low, it could shift back to selling francs soon in an attempt to boost imported inflation.

With the central bank also moving towards rate cuts, there isn’t much that can help revive the franc, which has already fallen more than 5% against the US dollar this year.

The franc’s best chance at a comeback would be an episode of panic in global markets that fuels demand for safe haven assets. Even in this case though, it’s doubtful whether any boost would last long in an environment where FX interventions are working against the currency.