- Investors have second thoughts about a Fed rate cut in June

- Dollar benefits from latest market repricing

- Spotlight turns to the NFP data on Friday at 12:30 GMT

Data and Fed rhetoric weigh on Fed rate cut bets

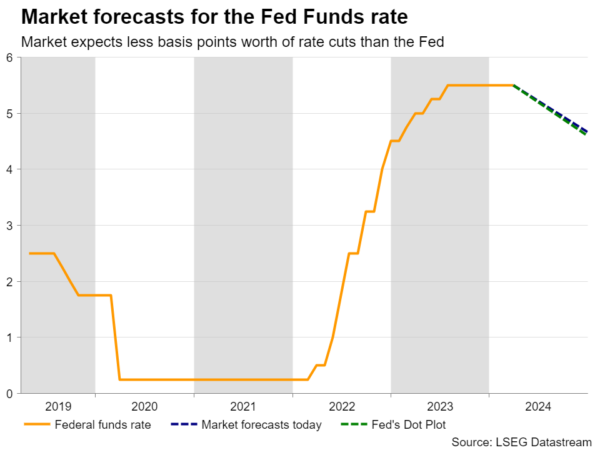

At its latest gathering, the Fed appeared more dovish than expected, still pointing to three quarter-point rate cuts for 2024. This allowed market participants to add back to their June cut bets, lifting the probability for a 25bps reduction to around 80%.

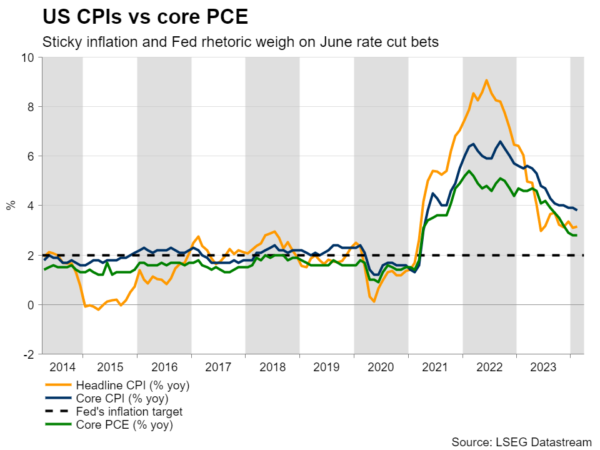

However, this proved to be a temporary assessment. Last week, Fed Governor Waller said that the Committee is in no rush to start cutting interest rates, a view echoed by Fed Chair Powell on Friday, after the core PCE index came at 2.8% y/y, as it was expected.

This allowed dollar bulls to jump back into the action, adding to their positions on Monday after the ISM manufacturing PMI for March expanded for the first time since September 2022. The prices subindex rose to 55.8 from 52.5, corroborating the outlook painted by the S&P Global flash PMIs for the month, which revealed that selling prices rose at the fastest pace in just under a year.

Combined with the upward revision of the Atlanta Fed GDPNow model to 2.8% from 2.3% for Q1, the latest developments prompted investors to push back again their rate reduction bets According to Fed funds futures, the probability of a first quarter-point reduction in June has dropped to around 65%, while the total number of basis points worth of rate cuts by the end of the year has been decreased to 68.

From anticipating around 160bs at the start of the year, the market is now expecting less reductions than the 75bps projected by the Fed itself, which adds downside risks to the dollar in case of disappointing data moving forward.

Will further easing in labor market ring the alarm bells?

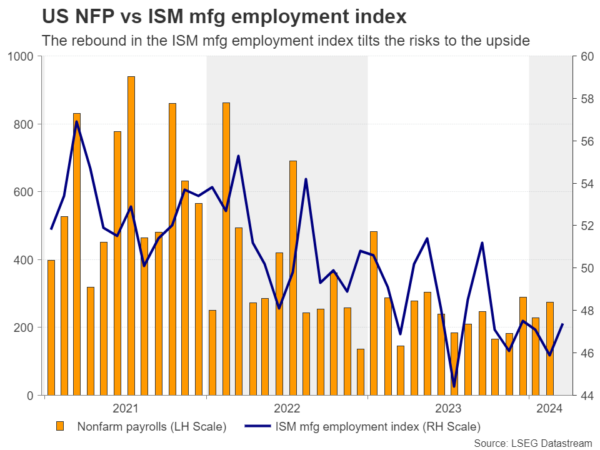

With that in mind, the next major event on investors’ agenda may be Friday’s US employment report for March. The unemployment rate is expected to have held steady at 3.9% and nonfarm payrolls are forecast to have slowed to 205k from 275k. That said, the rebound in the employment subindex of the ISM manufacturing PMI tilts the risks to the upside. Average hourly earnings are expected to slow somewhat to 4.1% y/y from 4.3%.

These numbers point to further easing in the labor market, but they are far from suggesting that a rate cut is urgent. After all another month of above 200k jobs is very encouraging for the economy, while a wage growth rate at around 4% is unlikely to help inflation come down faster than previously thought.

Dollar may continue to outperform the euro

The dollar is likely to stay the course north especially against the euro, as according to money markets, a June quarter-point reduction by the ECB is more than fully priced in, while following recent dovish remarks by ECB member Villeroy de Galhau and Stournaras, there is a nearly 20% chance for a cut at the upcoming meeting on April 11.

Euro/dollar fell below the key support zone of 1.0795 on Thursday and accelerated its slide this week, headed for the very important area between 1.0655 and 1.0695. A decisive dip below 1.0655 could carry larger bearish implications and perhaps pave the way towards the 1.0520 barrier, marked by the lows of October 26 and November 1.

Nonetheless, in case the jobs report disappoints, the pair may rebound and break back above 1.0795, but for the outlook to start looking brighter, a move all the way above the round number of 1.1000 may be needed.