The Bank of Canada will be focused on the March Canadian consumer price index report next Tuesday after another upward surprise in U.S. price growth created doubt about the U.S. Federal Reserve’s rate-cutting plans this year.

Slower price growth in Canada in recent months and a sharply underperforming Canadian economy have “increased confidence” among BoC policymakers that inflation will continue to slow. But the central bank wants to see more evidence before shifting to interest rate cuts.

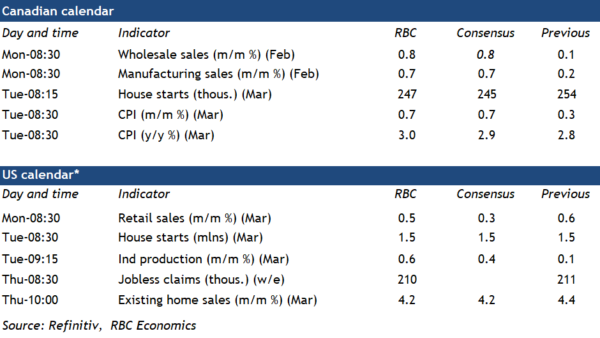

We expect year-over-year price growth in March to tick higher to 3% from 2.8% in February largely due to higher gasoline prices pushing energy costs further above year-ago levels. Food price growth should be little changed—still above 3% but slower than the 10% plus peak increases in late 2022.

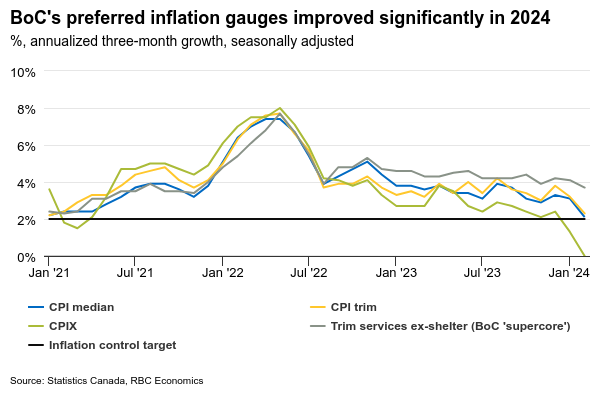

The CPI data is often volatile and clothing prices, in particular, could rebound in the spring after milder-than-usual temperatures slowed demand and prices over the winter. The BoC will be more focused on its preferred list of core measures—which are designed to look through volatility in any one subcomponent—for signs that broader inflation pressures continue to ease. We look for growth in the BoC’s preferred trim and median measures to hold close to the February pace both on a year-over-year and three-month rolling average basis. The latter slowed to a 2.2% average annualized rate in February.

Week ahead data watch

We expect Canadian manufacturing sales to tick up 0.7% in February in line with Statistics Canada’s advance indicator. Much of that growth was driven by higher sales in the petroleum and coal subsector. Sales volumes likely dipped given the industrial product price index edged up 0.7% in February.

StatCan’s early estimate of “core” wholesale sales increased by 0.8% in February with sales in machinery, equipment and supplies, motor vehicles and parts and accessories and building material and supplies subsectors going up during that month.

March housing starts likely stood at 247,000, given that building permits grew at a slower pace (8%) in February, down from 13% in January.

U.S. retail sales likely ticked up 0.5% in March, following 0.6% growth in February led by price-related sales increase at gas stations. But auto sales dipped during that month, partially offsetting some of the growth.