- Today the ECB decided to cut the policy rate by 25bp, so the deposit rate now yields 2.50%. The most important part of the decision was its assessment of the restrictiveness of its monetary policy stance. The ECB now sees that monetary policy is ‘becoming meaningfully less restrictive’, which means it assesses that the current rate level is closer to the terminal rate than previously.

- Given the strong uncertainty, Lagarde clearly guided that the data-dependent approach is probably higher than ever, thus there was no guidance or commitment to an April cut. Today’s decision was a consensus, with none opposing, but Holzmann abstained.

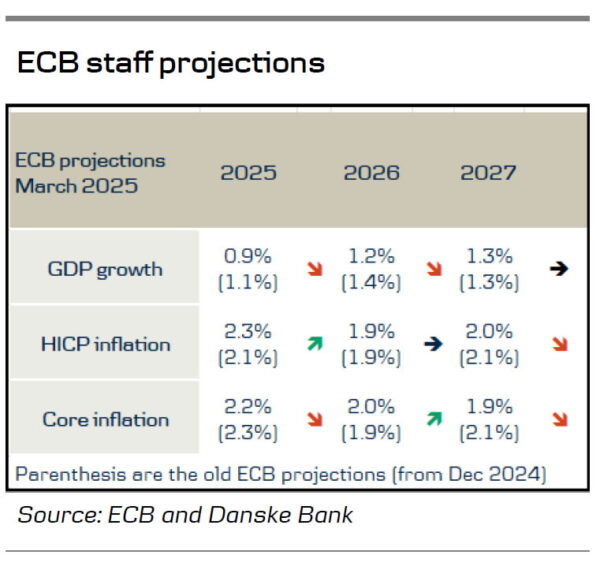

- The staff projections lowered the growth forecast for 2025 to 0.9% y/y (down from 1.1%) and 2026 to 1.2% y/y (down from 1.4%). Inflation was revised higher in 2025 to 2.3% from 2.1% due to energy prices, but as futures have since declined, we do not interpret that as a hawkish signal, also reflected by the core inflation forecast being revised down to 2.2% from 2.3%

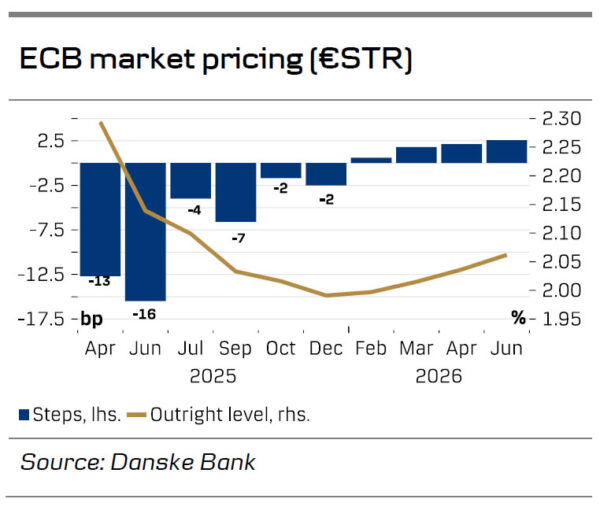

- Markets have repriced the ECB expectations in recent days, not least following the change to the German fiscal position and spending package. Currently there are almost two additional cuts from the ECB until year-end priced, which is about one cut less than earlier this week.

Disinflation remains on track and the economy faces challenges

Lagarde noted that the disinflation process remains well on track and that the upward revision to the staff 2025 inflation forecast from 2.1% y/y to 2.3% y/y reflected stronger energy prices in January. Energy prices have since declined and the ECB staff also revised down the core inflation forecast for 2025 to 2.2% y/y from 2.3% y/y, so we do not interpret the higher headline forecast as a hawkish signal. The ECB continues to communicate that most measures of underlying inflation and inflation expectations suggest inflation will settle around the 2% target. Thus, for 2025 and 2026 the forecast changes to inflation were minor (see table to the right).

The ECB emphasised that the economy continues to face challenges, leading staff to lower their growth forecasts once more – to 0.9% for 2025 (down from 1.1%), 1.2% for 2026 (down from 1.4%), and 1.3% for 2027. The reductions for 2025 and 2026 are attributable to reduced exports and ongoing weakness in investment, partly due to high trade policy uncertainty and broader policy unpredictability. Increasing real incomes and the gradually fading impact of previous rate hikes remain the key factors underpinning the expected rise in demand over time.

Fiscal easing in Germany and rising EU defence spending not affecting current monetary policy stance

Lagarde noted that most recent data shows that manufacturing activity continued to decline in the first two months of 2025, despite improvements in surveys.

Meanwhile, services are resilient, and a robust labour market supports a gradual rise in consumption, although demand for labour has moderated, and surveys indicate a slowdown in employment growth in January and February. Overall, the risks to the growth outlook are tilted to the downside and Lagarde added tariffs as a downside risk and defence and infrastructure spending as a new upside risk. Lagarde says that impact of German fiscal plans and EU defence spending will depend on the details and that they have not incorporated any impact yet in their monetary policy. She does note, however, that it will be positive growth.

No guidance for April

With the high uncertainty around the near-term risks, Lagarde refrained from committing to any policy decision at the upcoming meetings; in fact, it was not clear whether the ECB intends to cut or halt at the upcoming April meeting based on today’s information. The repetition of the ECB’s data dependence, and probably being more than ever as Lagarde phrased, leads to an increased focus on incoming data and the inflation outlook. Markets took the guidance as marginally hawkish and now price the ECB April meeting at 12bp.

Based on today’s information, we are not as confident about the outlook for the April cut as we were previously. While it remains our baseline scenario, we also point to the significant inflation and activity data (e.g. PMI) as key points. Also, Lagarde’s speech next week at the Watchers conference will be key in our view.