- Fed stays on pause and maintains two rate cuts outlook.

- But opinions within FOMC diverge; hawks may hold the upper hand.

- Are the trade war and Trump’s criticisms causing fractures at the Fed?

Trump not happy with ‘Mr. Too-Late’ Powell

President Trump has made it no secret that he is not happy with the job that Jerome Powell is doing as the current chair of the Federal Reserve. From name calling to outright demanding a rate cut, Trump’s patience with Powell appears to be running thin. Although, if anyone has earned the right for random outbursts, it is Powell, who’s so far, maintained a dignified silence during the course of Trump’s second term.

If rumours are to be believed, Trump will soon name a nominee for Powell’s successor, even though his term doesn’t end until May 2026. It is not usual for a US president to announce a nomination for the Fed chair so early. But after likely realizing that forcing Powell out of his post could create a constitutional headache for the administration, not to mention a strong backlash by investors, Trump’s best option right now might be to appoint a ‘shadow’ chair.

Are lower yields Trump’s main objective?

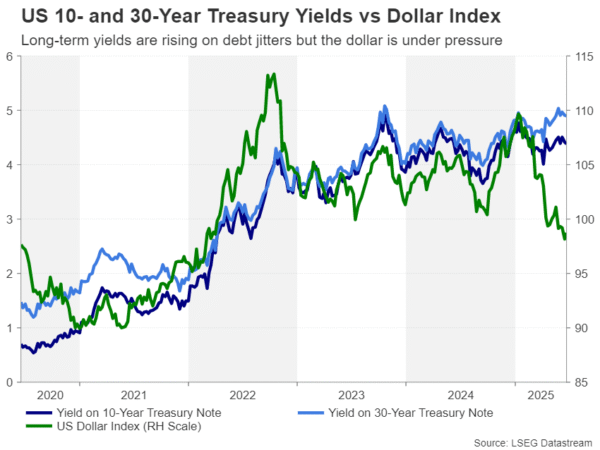

It’s hard to tell how markets would react to such a move, but presumably, the goal would be to undermine Powell by guiding policy expectations on a different path. If the Fed chair nominee were to signal a lower rate path from the Federal Open Market Committee’s (FOMC) official projections, this could potentially help to bring down Treasury yields.

Lower yields, particularly on long-dated Treasuries, could prove crucial for Republicans, who are struggling to agree on big spending reductions as they push through their tax cut agenda, by keeping the cost of debt repayments as low as possible. This is the main frustration that Donald Trump has with Powell, as bond markets have been sending warning signals lately to Capitol Hill to get a grip on the mounting national debt.

However, a substantially more dovish Fed runs the risk of inflaming inflation and inflation expectations, which in turn could push bond yields further up. Therefore, monetary policy that is too loose and not compatible with keeping inflation low can actually lead to higher long-term borrowing costs.

A hawkish turn

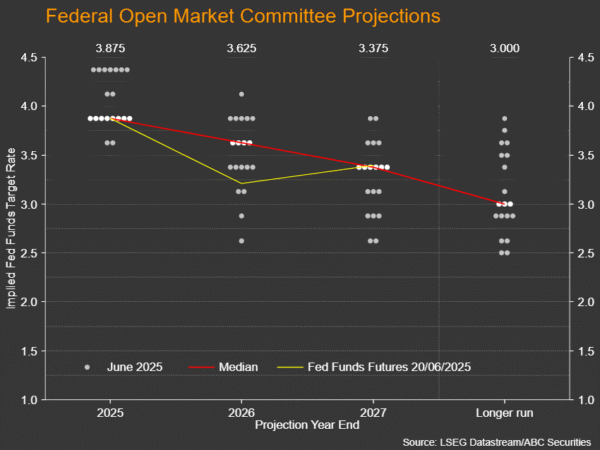

But Trump may be fooling himself in thinking that a different chair would change much when it comes to monetary policy. Whilst the Fed chair can steer policy in a certain direction, it is up to the entire FOMC to vote on policy decisions, and judging by the latest dot plot, it is hard to deny that there’s been a significant hawkish shift at the June meeting compared to March.

A total of 11 FOMC members voted for rate cuts of 50 basis points or more for 2025 at the March meeting, with eight members predicting fewer reductions. But the doves declined slightly to 10 members in June, while the hawks increased to nine, with seven of them preferring to keep rates on hold for the rest of the year. This shift was also evident in the dot plots for 2026 and 2027.

Will there be a summer inflation surge?

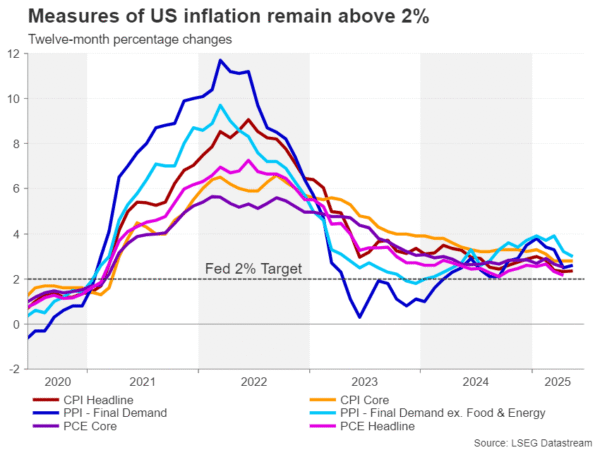

Powell was explicit in his post-meeting press briefing in warning that inflation is set to rise during the summer and it appears that many of his colleagues share his concerns. There is a lot of uncertainty as to how much of the higher costs faced by businesses from the tariff hikes will be passed on to the consumer.

Much will depend on what happens on July 9, when the 90-day extension of the reciprocal tariffs expires. If enough trade deals have been agreed by then and Trump decides to offer further extensions to those countries that the US has yet to reach a deal, the Fed is more likely to feel confident that the impact of the tariffs on inflation will be a one-off effect and not hesitate to cut rates on the first sign of trouble in the economy.

Stagflation is the Fed’s worst nightmare

However, if Trump doesn’t get the trade deals he wants and re-imposes some tariffs, policymakers will want to remain on pause for the foreseeable future. The danger here is that if there’s still no agreement with major trading partners like the European Union (EU), Trump is threatening to slap tariffs that are even higher than the original reciprocal levy rates announced on ‘Liberation Day’.

But potentially the bigger problem in this scenario is that the downside risks to the economy would also increase, raising the prospect of stagflation. And this is where real frictions could develop within the FOMC. About half the committee is more worried about the economy, specifically the labour market, which is part of the Fed’s dual mandate, than it is about inflation. While the other half are more concerned in maintaining the Fed’s credibility on inflation.

A balancing act on two fronts

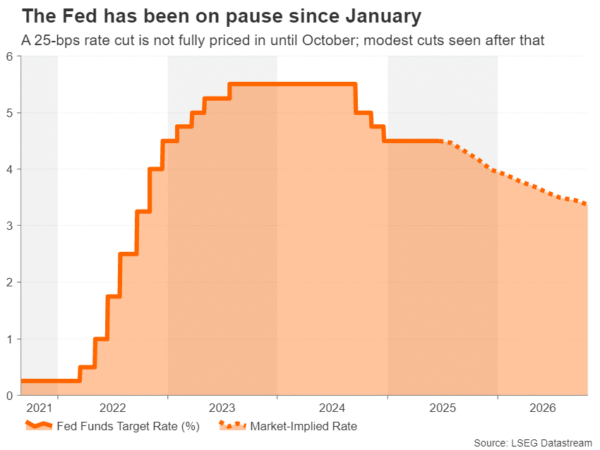

This balancing act is what has put the Fed on pause since the start of 2025. A shadow Fed chair that is more dovish than Powell could tilt the balance in favour of more cuts. However, should the dissent become more visible and louder, this could have a destabilising effect on financial markets, as it would generate significant uncertainty at each meeting as well as knock investor confidence in the Fed’s own forecasts.

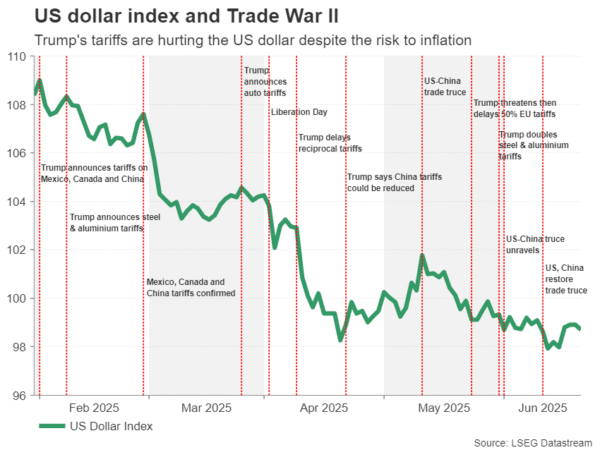

The US dollar has already suffered a heavy blow from Trump’s trade war, losing its shine as the world’s reserve currency. If investors start to lose faith in the Fed too, the dollar’s woes are likely to only worsen, while gold could be the main beneficiary of a fractious Fed and sliding US currency.