The British currency continues its recovery following a test of key technical support levels. GBP/USD and GBP/CAD have risen amid moderate US dollar weakness and mixed Canadian macroeconomic data. Investor attention remains focused on upcoming economic indicators, which are due to be released over the next trading sessions. Today, the market is closely watching a batch of data from the US and Canada, including updated statistics on initial jobless claims, total continuing claims, and the Chicago Fed National Activity Index. On Friday morning, markets await the release of June retail sales figures from the UK. Against this backdrop, the pound remains highly sensitive to economic data and monetary policy signals. Should UK data prove neutral or stronger than expected, the current upward momentum may persist.

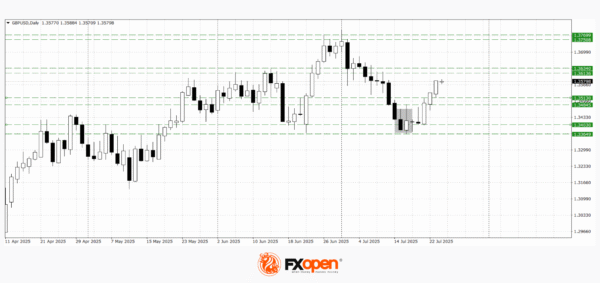

GBP/USD

Following a test of the key support range at 1.3370–1.3400, GBP/USD formed a bullish piercing line pattern. Technical analysis suggests the potential for further upside towards the 1.3610–1.3640 area. However, in the event of weak UK macroeconomic data, the pair may retreat towards 1.3480–1.3510.

Key events likely to influence GBP/USD movement:

- Today at 11:30 (GMT+3): UK Services PMI

- Today at 11:30 (GMT+3): UK CBI Industrial Order Expectations

- Today at 16:45 (GMT+3): US Manufacturing PMI

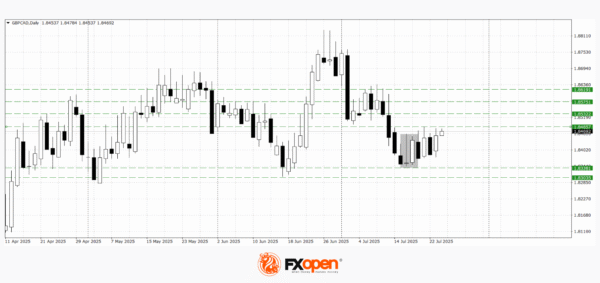

GBP/CAD

GBP/CAD has been consolidating within the 1.8340–1.8490 range for several days. A breakout above the upper boundary could see the pair test resistance at 1.8540–1.8570. However, if Canadian data proves strong or UK figures disappoint, a pullback towards 1.8300–1.8340 cannot be ruled out.

Key events likely to influence GBP/CAD pricing:

- Today at 15:30 (GMT+3): Canada Core Retail Sales

- Tomorrow at 09:00 (GMT+3): UK Core Retail Sales

- Tomorrow at 18:00 (GMT+3): Canada Federal Budget Balance

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.