Trading in the region of $37.35700 in today’s session, Silver looks to continue bullish momentum shown in Friday’s session, rallying from monthly lows.

Silver (XAG/USD): Key takeaways from today’s session

- Writing after Friday’s weak job report, Silver has found support on a weakened dollar and as traders adjust expectations for Fed monetary policy

- Latest developments on trade tariffs are also boosting safe-haven inflows, benefiting silver pricing

Silver (XAG/USD): Weak US labor data bodes well for precious metals

Having recently succumbed to short-term selling pressure from all-time highs made in late July, recent US jobs data has helped bolster precious metal pricing.

Missing expectations by some margin, coupled with some significant revisions to previous months, Friday’s nonfarm payroll represents not only a poor result, but poses a serious threat to previously held convictions that the US labor market is healthy.

This goes double for the Fed, who have used the perceived health of the US labor market as a reason to defer the lowering of rates.

Meanwhile, POTUS Donald Trump claims the jobs numbers have been doctored for political gain, firing BLS official Erika McEntarfer. If nothing else, this raises questions on how future economic data will be recieved by markets alike.

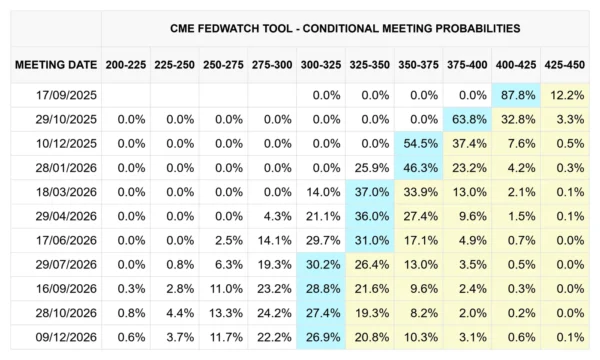

At least one outcome has been a defiant increase in rate cut bets, with market ovewhelming predicting the Fed will cut in their upcoming decision, which is a undeniable positive for silver pricing.

CME FedWatch, 04/08/2025

Putting things in perspective, silver, previous metals in general, boast one of the best yearly performances of all asset classes bar crypto, even while US rates have have been maintained at ~4.50% since December of last year.

Silver (XAG/USD): Commitment to reciprocal tariffs silver positive

In a relationship well studied by the market, recent developments surrounding tariffs are safe-haven flows, weakening the dollar, and ultimately increasing silver pricing.

Most recently, Trump has renewed his commitment to reciprocal tariffs, and although revised lower than first planned, the White House remains committed to a new era of protectionism for US domestic industries.

This time, it would seem that Brazil is one of the worst-affected countries, and is now subject to a 50% tariff on all US-bound imports since August 1st, since a formal trade agreement between the two nations was not made.

While the eventual outcome of trade tariffs, for better or worse, is yet to be fully understood, any increase in market uncertainty surrounding US trade continues to boost silver pricing.

Silver (XAG/USD): Technical analysis (04/08/2025)

Silver (XAG/USD), OANDA, TradingView 04/08/2025

- On the daily timeframe, silver currently approaches an area of resistance at ~37.29833. If able to break and hold, this can also act as an area of support

- Having broke the upward trendline, silver will need to stablise before price is able to push higher