Key takeaways

- SPX 500 maintains bullish momentum, rallying to a fresh all-time high of 6,745 despite the ongoing US government shutdown.

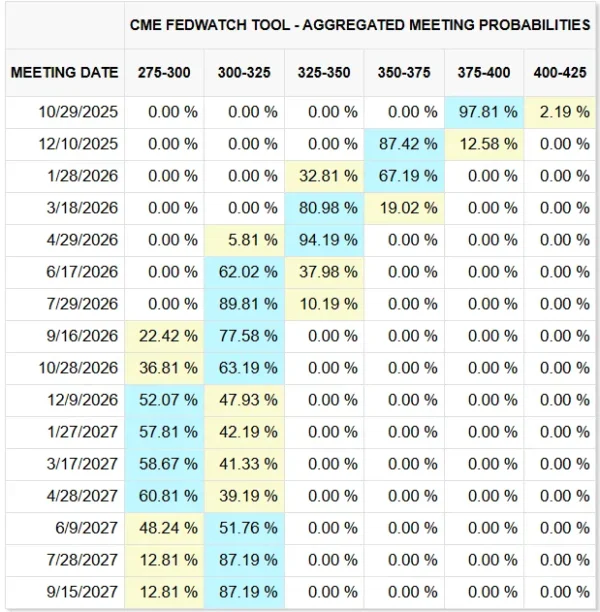

- Fed rate cut expectations remain elevated, with markets pricing a 98% chance for October and 87% for December.

- Technical outlook stays positive, with key support at 6,690 and upside targets at 6,800–6,850 within the medium-term uptrend channel.

- Sector rotation favours risk assets, with Consumer Discretionary outperforming Consumer Staples, reinforcing bullish sentiment.

The price actions of the US SPX 500 CFD Index (a proxy of the S&P 500 E-mini futures) have staged the expected bullish reversal, rallied by 2% and hit the 6,730/6,745 resistance zone. It notched another fresh all-time high of 6,745 on Friday, 3 October 2025, during the start of the European session at the time of writing.

The US government entered its second day of shutdown with US President Trump ratcheting up pressure on the Democrats to end the shutdown by threatening to slash “thousands” of federal jobs.

Increased odds of Fed rate cuts fuelled the bullish optimism for US stocks

Fig. 1: FOMC outcome probabilities as of 3 Oct 2025 (Source: CME FedWatch tool)

The US stock market brushed aside potential economic headwinds, instead focusing on growing expectations of a more dovish Federal Reserve, which propelled the S&P 500 and Nasdaq 100 to fresh record highs on Thursday, 2 October 2025.

Based on the latest data from the CME FedWatch tool, the Fed funds futures market is pricing a 98% probability of a 25-basis-point Fed rate cut at the upcoming 29 October 2025 FOMC meeting. Expectations for a third 25-basis-point cut in 2025 have also strengthened, with odds rising to 87% for the 10 December meeting, which would lower the Fed funds rate to a range of 3.50%–3.75% (see Fig. 1).

All in all, a more dovish Fed is likely to increase liquidity, in turn, fuelling a positive feedback loop into risk assets such as US stocks.

Also, do take note that the Bureau of Labour Statistics’ non-farm payroll data for September is likely not to be released today due to the ongoing US government shutdown. The key focus later in today’s US session will be the private surveyor ISM Services PMI for September, with its employment sub-component.

Let’s now focus on the latest short-term trajectory (1 to 3 days), relevant key elements, and new key levels to watch on the US SPX 500 CFD Index.

Fig. 2: US SPX 500 CFD Index minor trend as of 3 Oct 2025 (Source: TradingView)

Preferred trend bias (1-3 days)

Maintain bullish bias for the US SPX 500 CFD Index with an adjusted key short-term pivotal support at 6,690 as it continues to oscillate within its minor and medium-term uptrend phases.

It’s minor bullish impulsive up move sequence remains intact, with next intermediate resistances coming in at 6,800 and 6,850 (Fibonacci extension) (see Fig. 2).

Key elements

- The US SPX 500 CFD Index has continued to evolve within a medium-term ascending channel in place since 23 May 2025. The upper boundary/resistance of the ascending channel is projected at 6,850.

- The hourly RSI momentum indicator of the US SPX 500 CFD Index remains in a bullish momentum condition as it is being supported by an ascending trendline, holding above the 50 level.

- The relative chart of the cyclical-oriented equal-weighted S&P 500 Consumer Discretionary sector ETF versus the defensive-oriented equal-weighted S&P 500 Consumer Staples sector ETF has just rebounded after a retest on its 20-day moving average on Thursday, 2 October 2025. This development signals continued outperformance in Consumer Discretionary over Consumer Staples, reinforcing the case for an ongoing bullish impulsive movement in the US SPX 500 CFD Index.

Alternative trend bias (1 to 3 days)

A break below the tightened 6,690 key short-term support negates the bullish tone for a minor corrective pull-back to expose the next intermediate supports at 6,650 and 6,615 (also the 20-day moving average).