Canadian labour market and international trade reports will be closely watched ahead of the Bank of Canada’s next interest rate decision on Oct. 29 after last month’s cut.

The BoC made the move in September following a deterioration in the labour market over the summer, and highlighted the evolution of exports as a key indicator for considering the need for additional cuts, given uncertainty about the impact of U.S. tariff policy.

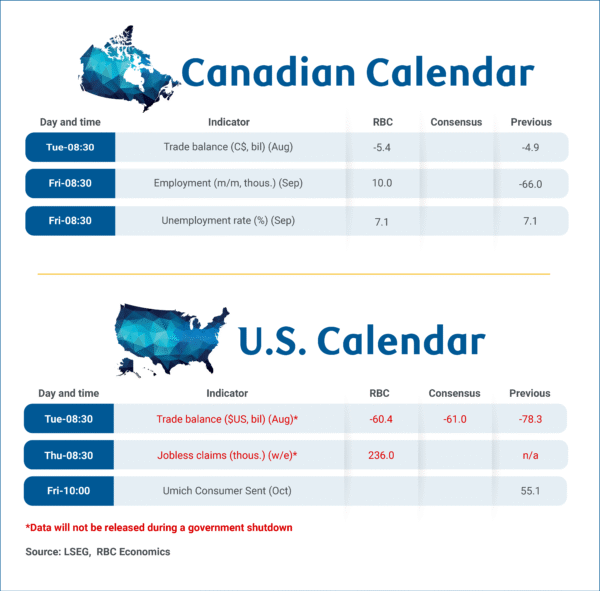

We expect labour market data to show signs of stabilizing in September with 10,000 jobs added, which would leave the unemployment rate unchanged at 7.1%. The labour market weakened significantly through July and August, but early data on hiring demand (indeed.com job openings), and business confidence are not pointing to more significant deterioration.

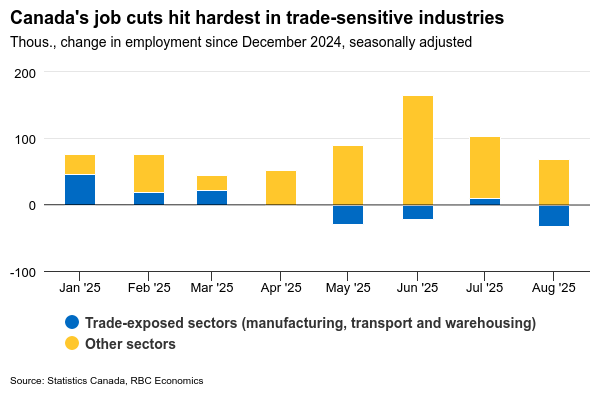

Beyond the headline, heavily trade exposed sectors, particularly manufacturing, are expected to remain under pressure. The numbers will be analyzed for further signs that weakness is (or not) spreading more broadly across the economy. As of August this year, Canadian employment is down 25,000 in the manufacturing sector, but still up 38,000 overall (and up 1% from a year ago).

The composition of jobs also matters. Any rebound that leans on part-time work would provide less reassurance about underlying strength in the market compared to gains in full-time positions. The increase in employment as of August this year is entirely a result of growth in part-time positions. Hours worked will also be in focus as a key signal for Q3 gross domestic product momentum.

Canada’s trade data to be released despite U.S. government shutdown

Meanwhile, tracking exports could become more difficult if the U.S. government shutdown continues to drag on. Statistics Canada relies on import data from the U.S. Census Bureau to create Canadian export estimates, and that will not be provided by the U.S. agency as long as the shutdown lasts.

For now, our understanding is the data for Canadian trade in August had already been collected, and will be released as scheduled on Tuesday. We expect the Canadian trade deficit to widen slightly to $5.4 billion, although in large part due to a 4.8% pullback in energy prices.

Other important detailed data from U.S. sources, for example, tariff revenues collected by country and product, will not be available until the U.S. Census Bureau is back on the job.

Week ahead data watch:

U.S. trade deficit likely narrowed to $60.4 billion, down from $78.3 billion in the previous month. According to the U.S. advance trade report for August, goods imports fell by 7%, fully reversing July’s gain, largely due to pullbacks in industrial supplies. Exports also declined, but to a lesser extent, dropping by 1.3%.